LegalZoom.com Results Presentation Deck

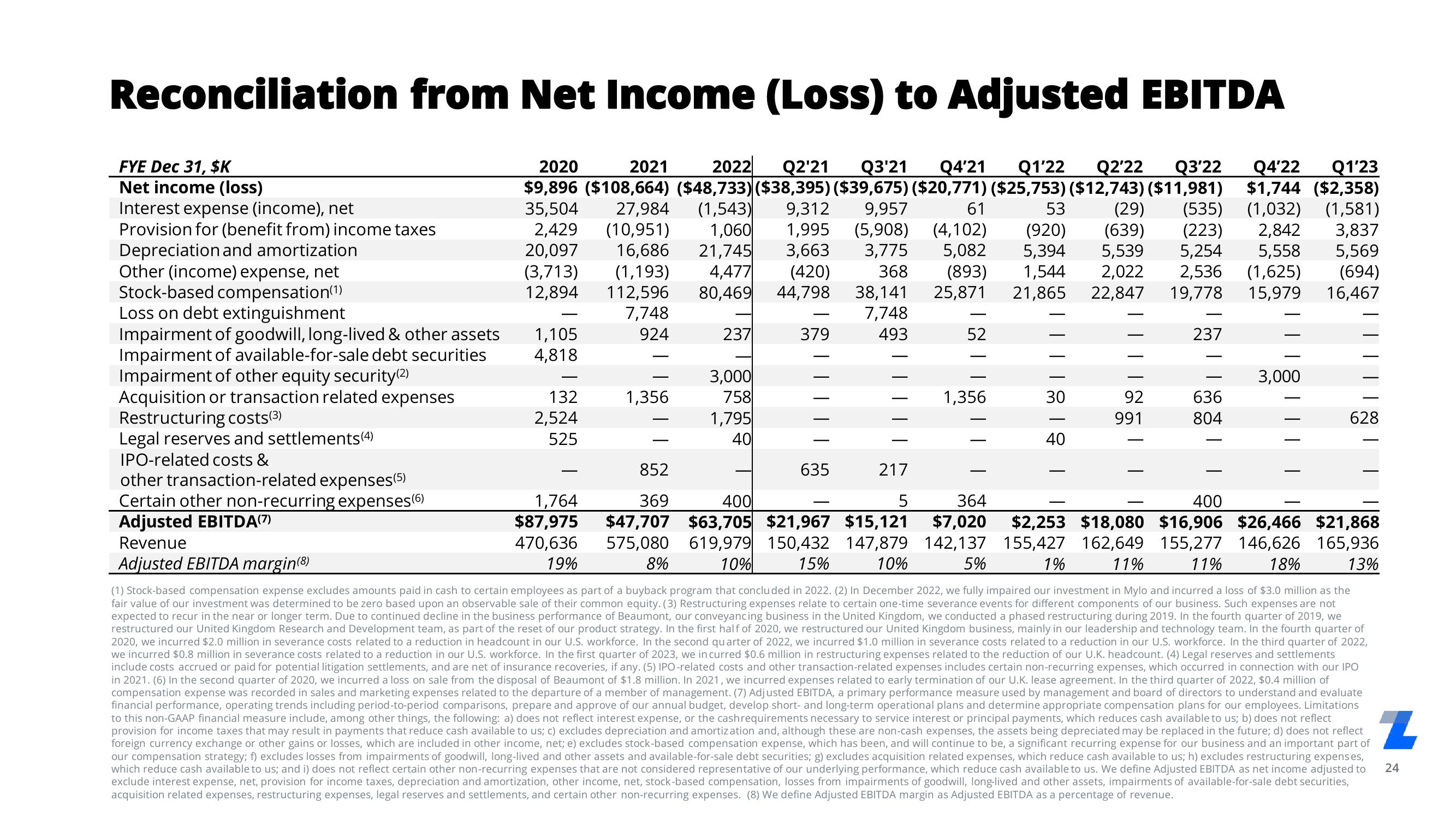

Reconciliation from Net Income (Loss) to Adjusted EBITDA

2020

2021 2022 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23

$9,896 ($108,664) ($48,733) ($38,395) ($39,675) ($20,771) ($25,753) ($12,743) ($11,981) $1,744 ($2,358)

35,504 27,984 (1,543) 9,312 9,957

61

53 (29) (535) (1,032) (1,581)

2,429 (10,951) 1,060 1,995 (5,908) (4,102) (920) (639) (223) 2,842 3,837

20,097 16,686 21,745 3,663 3,775 5,082 5,394 5,539 5,254 5,558 5,569

(1,193) 4,477 (420) 368 (893) 1,544 2,022 2,536 (1,625) (694)

44,798 38,141 25,871 21,865 22,847 19,778 15,979 16,467

7,748

493

(3,713)

12,894

112,596

80,469

7,748

924

FYE Dec 31, $K

Net income (loss)

Interest expense (income), net

Provision for (benefit from) income taxes

Depreciation and amortization

Other (income) expense, net

Stock-based compensation(¹)

Loss on debt extinguishment

Impairment of goodwill, long-lived & other assets

Impairment of available-for-sale debt securities

Impairment of other equity security (2)

Acquisition or transaction related expenses

Restructuring costs (3)

Legal reserves and settlements (4)

IPO-related costs &

other transaction-related expenses(5)

Certain other non-recurring expenses(6)

Adjusted EBITDA(7)

Revenue

1,105

4,818

132

2,524

525

1,764

$87,975

470,636

19%

-

1,356

237

3,000

758

1,795

40

379

852

217

400

5

369

$47,707 $63,705 $21,967 $15,121

575,080

8%

635

-

52

1,356

1

| 8 | 8 | | |

30

40

92

991

-

237

636

804

3,000

628

364

400

$7,020 $2,253 $18,080 $16,906 $26,466 $21,868

619,979 150,432 147,879 142,137 155,427 162,649 155,277 146,626 165,936

10%

15%

10%

5%

1%

11% 11%

18%

13%

Adjusted EBITDA margin(8)

(1) Stock-based compensation expense excludes amounts paid in cash to certain employees as part of a buyback program that concluded in 2022. (2) In December 2022, we fully impaired our investment in Mylo and incurred a loss of $3.0 million as the

fair value of our investment was determined to be zero based upon an observable sale of their common equity. (3) Restructuring expenses relate to certain one-time severance events for different components of our business. Such expenses are not

expected to recur in the near or longer term. Due to continued decline in the business performance of Beaumont, our conveyancing business in the United Kingdom, we conducted a phased restructuring during 2019. In the fourth quarter of 2019, we

restructured our United Kingdom Research and Development team, as part of the reset of our product strategy. In the first half of 2020, we restructured our United Kingdom business, mainly in our leadership and technology team. In the fourth quarter of

2020, we incurred $2.0 million in severance costs related to a reduction in headcount in our U.S. workforce. In the second quarter of 2022, we incurred $1.0 million in severance costs related to a reduction in our U.S. workforce. In the third quarter of 2022,

we incurred $0.8 million in severance costs related to a reduction in our U.S. workforce. In the first quarter of 2023, we in curred $0.6 million in restructuring expenses related to the reduction of our U.K. headcount. (4) Legal reserves and settlements

include costs accrued or paid for potential litigation settlements, and are net of insurance recoveries, if any. (5) IPO-related costs and other transaction-related expenses includes certain non-recurring expenses, which occurred in connection with our IPO

in 2021. (6) In the second quarter of 2020, we incurred a loss on sale from the disposal of Beaumont of $1.8 million. In 2021, we incurred expenses related to early termination of our U.K. lease agreement. In the third quarter of 2022, $0.4 million of

compensation expense was recorded in sales and marketing expenses related to the departure of a member of management. (7) Adjusted EBITDA, a primary performance measure used by management and board of directors to understand and evaluate

financial performance, operating trends including period-to-period comparisons, prepare and approve of our annual budget, develop short- and long-term operational plans and determine appropriate compensation plans for our employees. Limitations

to this non-GAAP financial measure include, among other things, the following: a) does not reflect interest expense, or the cash requirements necessary to service interest or principal payments, which reduces cash available to us; b) does not reflect

provision for income taxes that may result in payments that reduce cash available to us; c) excludes depreciation and amortization and, although these are non-cash expenses, the assets being depreciated may be replaced in the future; d) does not reflect

foreign currency exchange or other gains or losses, which are included in other income, net; e) excludes stock-based compensation expense, which has been, and will continue to be, a significant recurring expense for our business and an important part of

our compensation strategy; f) excludes losses from impairments of goodwill, long-lived and other assets and available-for-sale debt securities; g) excludes acquisition related expenses, which reduce cash available to us; h) excludes restructuring expenses,

which reduce cash available to us; and i) does not reflect certain other non-recurring expenses that are not considered representative of our underlying performance, which reduce cash available to us. We define Adjusted EBITDA as net income adjusted to

exclude interest expense, net, provision for income taxes, depreciation and amortization, other income, net, stock-based compensation, losses from impairments of goodwill, long-lived and other assets, impairments of available-for-sale debt securities,

acquisition related expenses, restructuring expenses, legal reserves and settlements, and certain other non-recurring expenses. (8) We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of revenue.

Z

24View entire presentation