Pershing Square Activist Presentation Deck

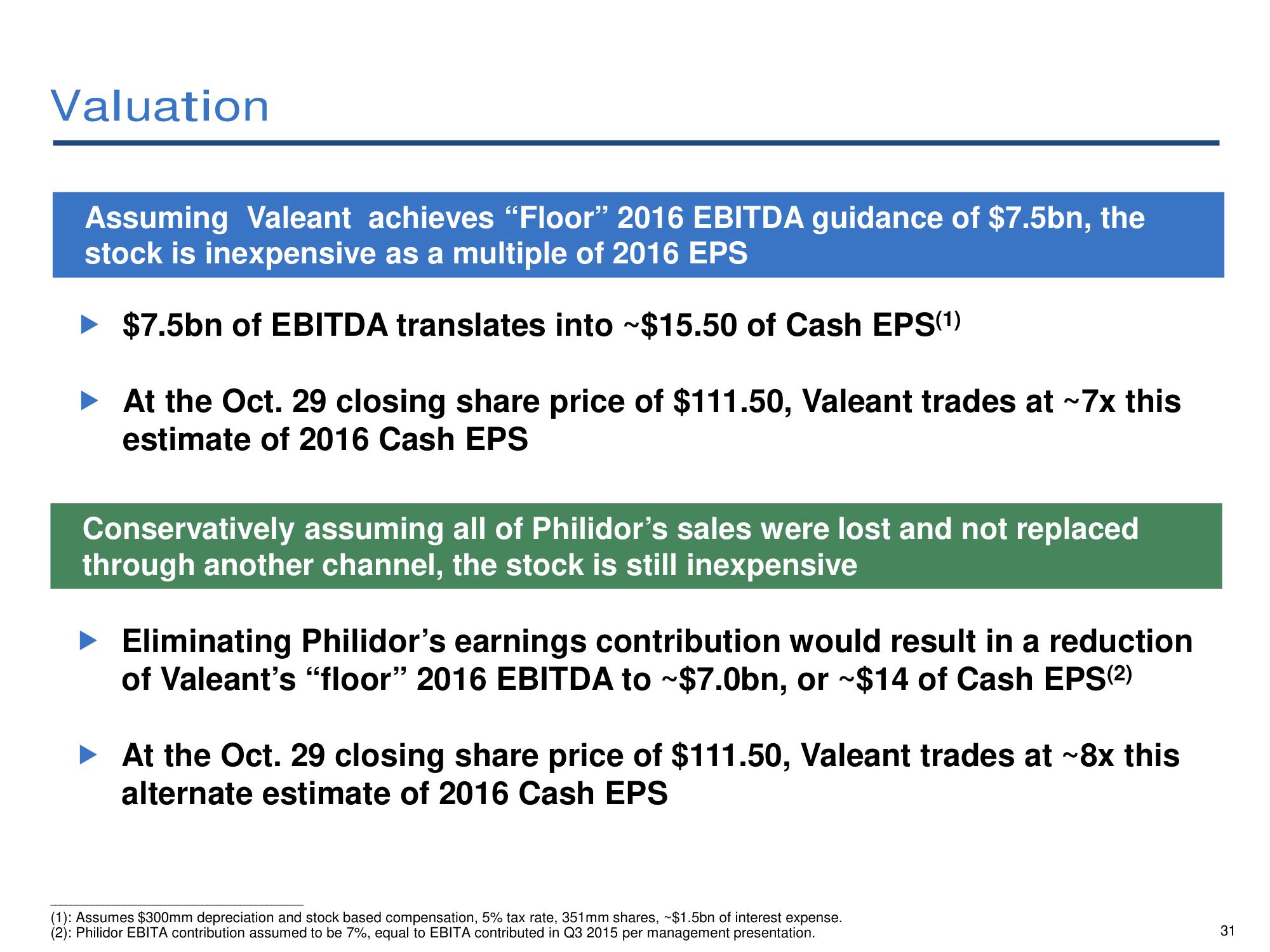

Valuation

Assuming Valeant achieves "Floor" 2016 EBITDA guidance of $7.5bn, the

stock is inexpensive as a multiple of 2016 EPS

$7.5bn of EBITDA translates into ~$15.50 of Cash EPS(1)

► At the Oct. 29 closing share price of $111.50, Valeant trades at ~7x this

estimate of 2016 Cash EPS

Conservatively assuming all of Philidor's sales were lost and not replaced

through another channel, the stock is still inexpensive

▸ Eliminating Philidor's earnings contribution would result in a reduction

of Valeant's "floor" 2016 EBITDA to ~$7.0bn, or ~$14 of Cash EPS(²)

▸ At the Oct. 29 closing share price of $111.50, Valeant trades at ~8x this

alternate estimate of 2016 Cash EPS

(1): Assumes $300mm depreciation and stock based compensation, 5% tax rate, 351mm shares, ~$1.5bn of interest expense.

(2): Philidor EBITA contribution assumed to be 7%, equal to EBITA contributed in Q3 2015 per management presentation.

31View entire presentation