Barclays Investment Banking Pitch Book

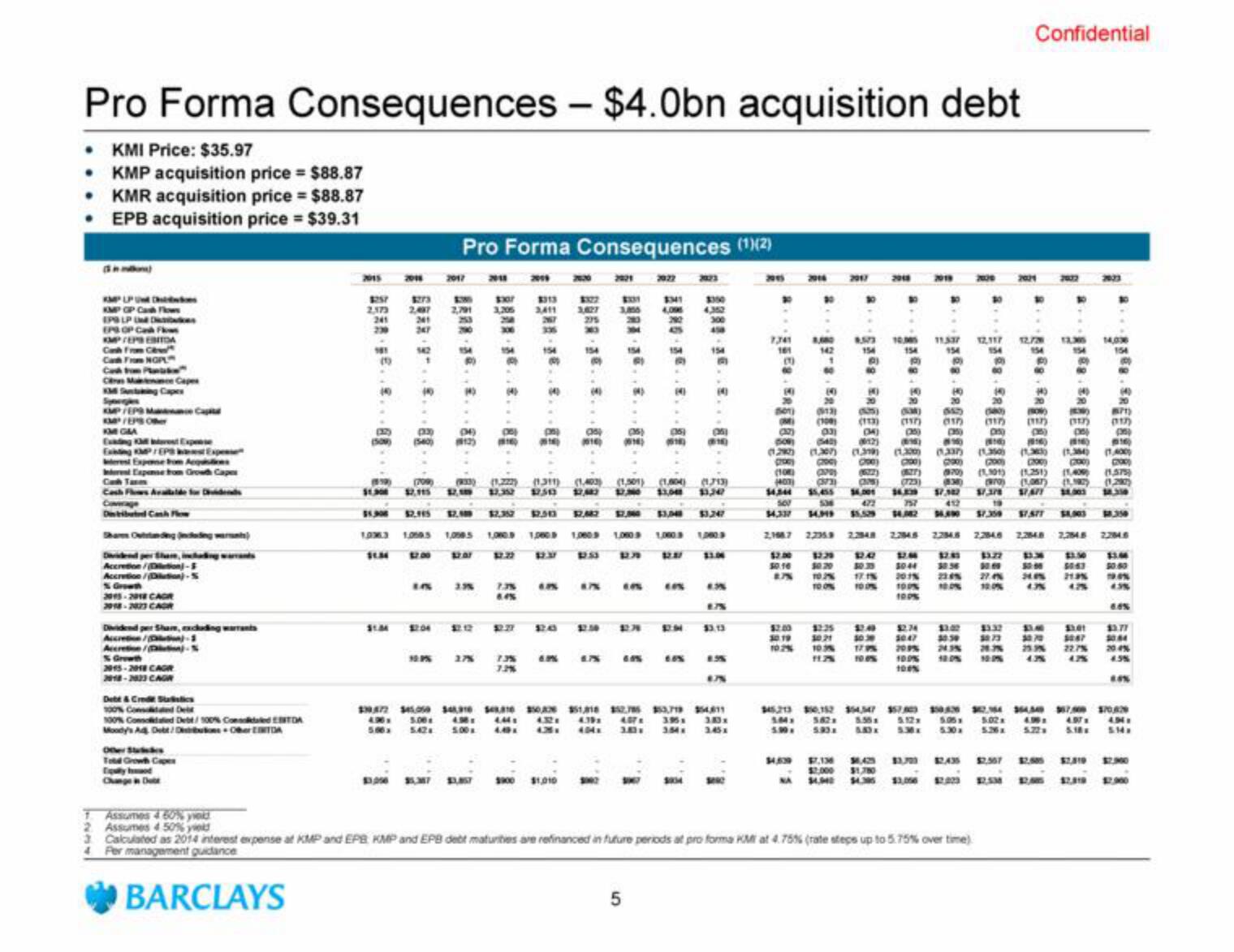

Pro Forma Consequences - $4.0bn acquisition debt

• KMI Price: $35.97

• KMP acquisition price = $88.87

• KMR acquisition price = $88.87

• EPB acquisition price = $39.31

KMP UP U kes

KMP GP Cash Flows

EPS LP

EPS OP Cash F

KMP/EPB EBITDA

Des

Cash From C

Cash From NGPL

Cash From P

C

KM Sting Capes

Menance Cape

Spoerges

KMP/EPS Man Capital

KM/EPS Or

KM GIA

Existing KP/EPS

Expense

rest Expone from Acquisitions

est Expense from Growth Caper

Cash Tar

Coverage

Distributed Cash Flow

Accretion/Dion-

Accretion/Dution)-5

% Growth

2015-2018 CAR

2018-2023 CAGR

Accretion/n)-1

Accretion/tin-

% Growth

2015-2018 CAGR

2018-2023 CAGN

Det & Credit Suistics

100% Consted De

100% Consoldated Debt/100% Conded TA

Moody's Ad Debt/sbons OberENTDA

Other Stud

To Grow Capes

Th

Change in D

Assumes 4 60% yold

Assumes 4 50% yield

2015

2,173

241

(509)

(819)

$1,300

10363

$1.34

Pro Forma Consequences (¹)(2)

9

2017

1773

2,487 2,791 3,205

201

247

300

R

2011

3.3%

$1.34 12:04 £2.12

2011

7.3%

3,411

267

336

7.2%

1,080.9 1,000 B 1,0609

6.P%

130472 $45.00 4310 5410 350

490x 5.00 4.98 LM:

500x 5.42 5.00

4.0

3322 2331

3,627 3,855

275

(933) (1,222) (1311) (1,403) (1,501) (1,004) (1793)

12,115 12,109 $7,352 1230 17,683 17,300 $1,000 11,307

$2.445 $2.500 $2,352 12.303

$3,247

1,000.9

1,000 5

113,056 $5,347 13.857 3900 $1,010

2021

$2,482

$7,040

1,000 9

2022

(16) (618)

$M1

4,096 4,352

CPS

5

435

$3,000

300

450

1,000 B

(16)

43%

$3.13

8.5%

351318 $52,785 $53,719 $54811

4.39x 40TA 395 183x

404x 3.83

354x

7,341 8,080 8.573

161

501)

OM

1

(32)

DOR

2017

80

140

2018

10,005

2019

(0)

$

$4,59 1.13

$2,000 $1,780

$4.395

$4.40

(4)

BPT)

(117) (117) (117)

(15)

crasy

(108)

(540) (012) (695) 8160 1816 816)

(1,307) (1319) (1.300) (1.2335)

(136) (1,36)

(200) 200) (700) (290) (200) (2000) (200) GOO

(329) (622) OSNEP) (1970) (1,901) (1,251) (1,400) (1,575)

(403) (373) (325) (723) (830) (wo) (1,067)

(122)

14,244 $5,455 34,001

$7,382 57.378 STAFF

500

422

757

$4,337 14.39 $5.529 14,42

2,198.7 2.235.9 2.2948 2.254.5

18.310

19

$4,400 $7.359 SISTT $4,003

22846 2,284.8 2,284.5

20

(913) (5635) (M) (42)

(100) (113) (117) (17)

11.337 12,117 12.778 13365

22348

50.16 $0.20 30.35 30.44 30.56

5 TO2% 17.1% 20.1% 224%

100% 100%

100%

1

345,213 $50.152 354,547 $57.00 50.53

1.84 582 5.55 512x 5.05

5.90 5.93 583x 530x 530x

Calculated as 2014 interest expense at KMP and EPB, KMP and EPB debt maturities are refinanced in future periods at pro forma KM at 4.75% (rate steps up to 5.75% over time)

Per management guidance

BARCLAYS

Confidential

a

(180)

$2.74

12:35

11.01

30.19 10.21 10.30 30.47 30.50 30.73 30.70 5047

10.2% 10.3% 17.95 20.9% 243% 28.3% 25.3% 22.7%

11.7%

10.0% 12.05

100%

(4)

14,036

000

354.540 367.50

5.02

4.97

526x 5.22 5.1

$8,350

$1.50

$1.M

30.6 5000 5063 50.60

27.4% 24.05 2135

(

475

2284.6

4.3%

6.4%

$3.77

30.64

20.4%

4.3%

80%

$70.829

494

SM

$2,900View entire presentation