Kore Results Presentation Deck

KORE

C

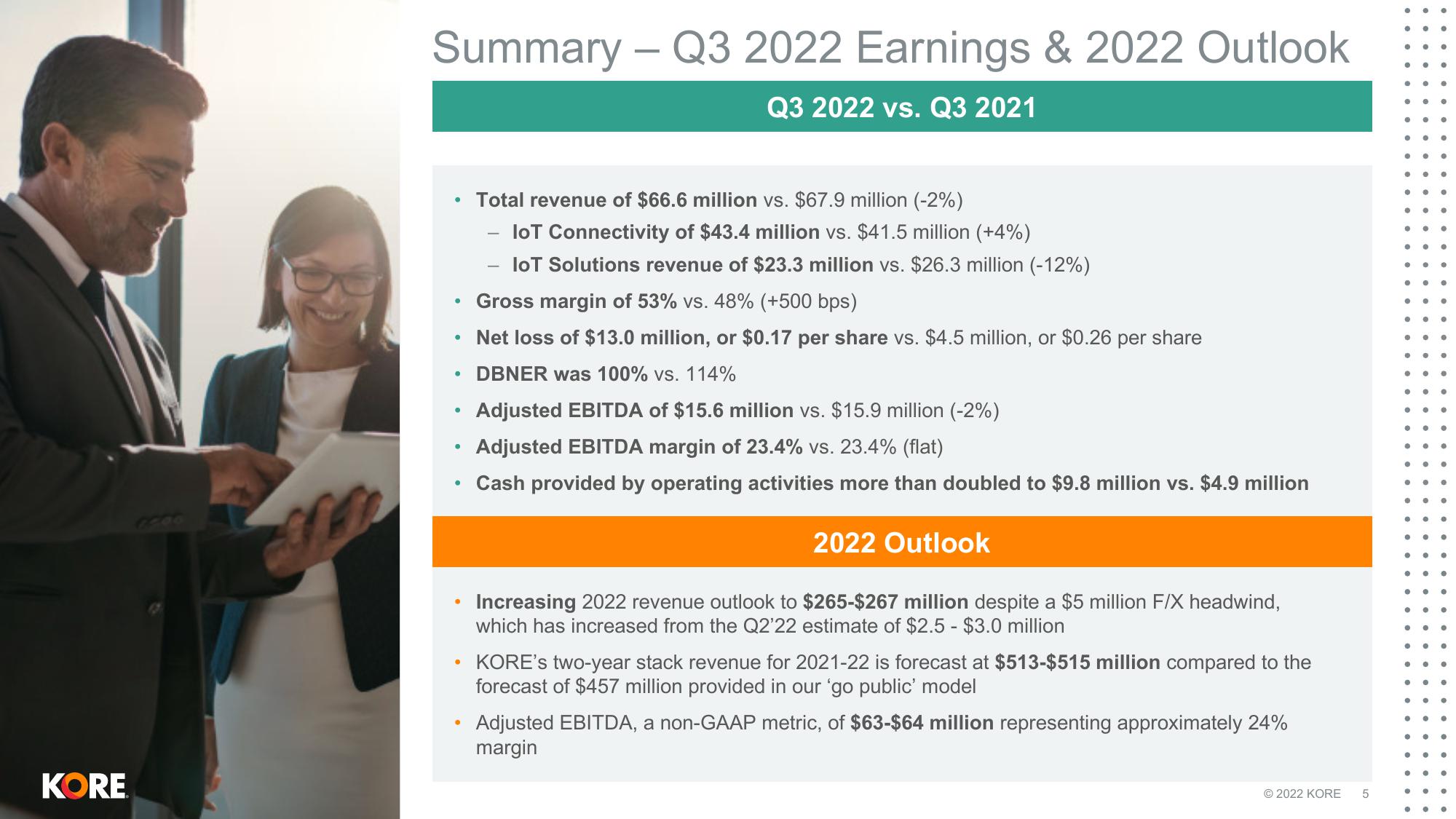

Summary - Q3 2022 Earnings & 2022 Outlook

Q3 2022 vs. Q3 2021

.

●

Gross margin of 53% vs. 48% (+500 bps)

Net loss of $13.0 million, or $0.17 per share vs. $4.5 million, or $0.26 per share

• DBNER was 100% vs. 114%

●

●

●

●

●

Total revenue of $66.6 million vs. $67.9 million (-2%)

IoT Connectivity of $43.4 million vs. $41.5 million (+4%)

IoT Solutions revenue of $23.3 million vs. $26.3 million (-12%)

●

Adjusted EBITDA of $15.6 million vs. $15.9 million (-2%)

Adjusted EBITDA margin of 23.4% vs. 23.4% (flat)

Cash provided by operating activities more than doubled to $9.8 million vs. $4.9 million

2022 Outlook

Increasing 2022 revenue outlook to $265-$267 million despite a $5 million F/X headwind,

which has increased from the Q2'22 estimate of $2.5 - $3.0 million

KORE's two-year stack revenue for 2021-22 is forecast at $513-$515 million compared to the

forecast of $457 million provided in our 'go public' model

Adjusted EBITDA, a non-GAAP metric, of $63-$64 million representing approximately 24%

margin

© 2022 KORE

5

..

..

●

.

●● ●

●

●

●

0

●

● ●

●

●

●

0

•

●

●

0

●View entire presentation