BlockFi Investor Conference Presentation Deck

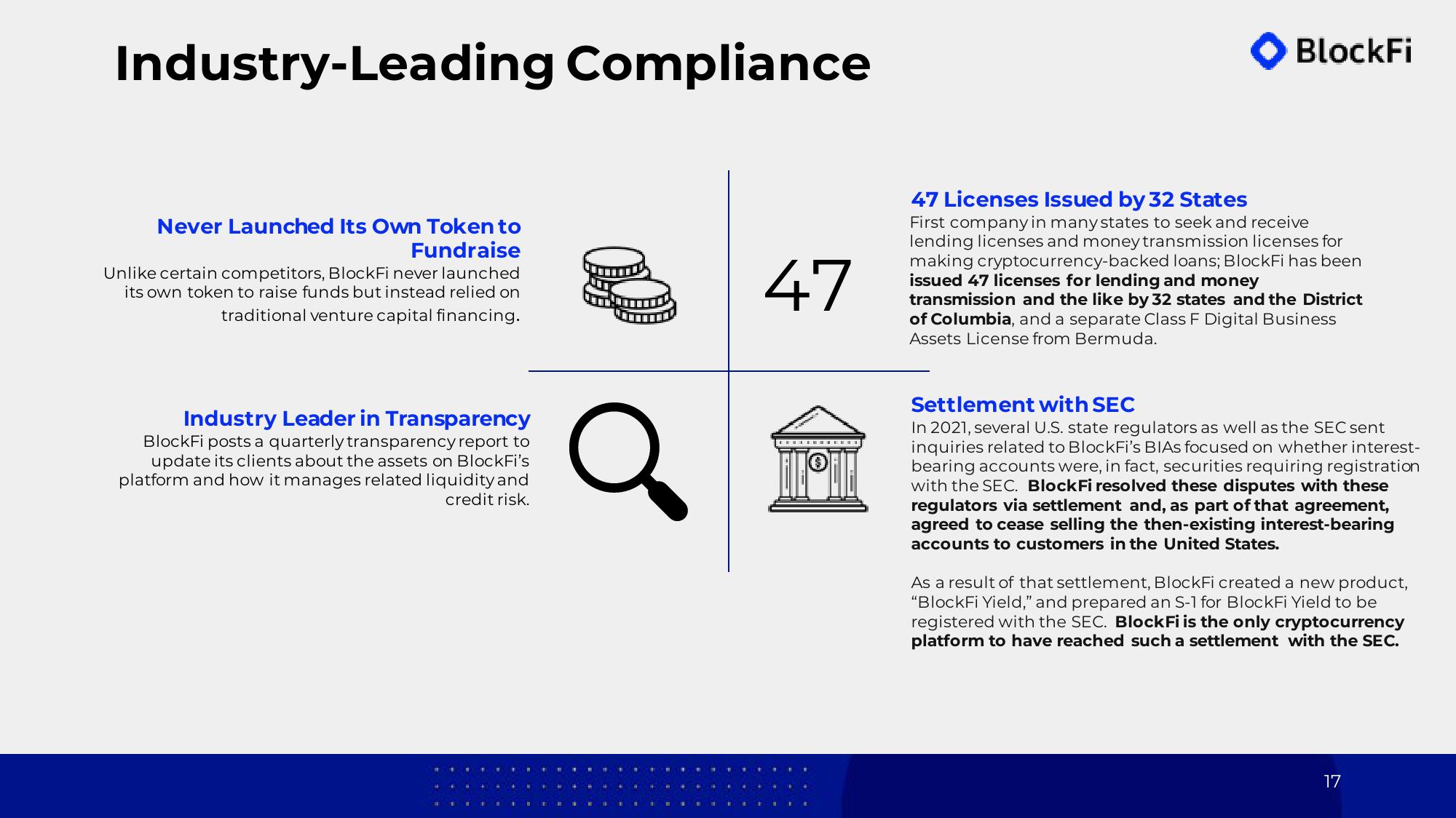

Industry-Leading Compliance

Never Launched Its Own Token to

Fundraise

Unlike certain competitors, BlockFi never launched

its own token to raise funds but instead relied on

traditional venture capital financing.

Industry Leader in Transparency

BlockFi posts a quarterly transparency report to

update its clients about the assets on BlockFi's

platform and how it manages related liquidity and

credit risk.

47

BlockFi

47 Licenses Issued by 32 States

First company in many states to seek and receive

lending licenses and money transmission licenses for

making cryptocurrency-backed loans; BlockFi has been

issued 47 licenses for lending and money

transmission and the like by 32 states and the District

of Columbia, and a separate Class F Digital Business

Assets License from Bermuda.

Settlement with SEC

In 2021, several U.S. state regulators as well as the SEC sent

inquiries related to BlockFi's BIAs focused on whether interest-

bearing accounts were, in fact, securities requiring registration

with the SEC. BlockFi resolved these disputes with these

regulators via settlement and, as part of that agreement,

agreed to cease selling the then-existing interest-bearing

accounts to customers in the United States.

As a result of that settlement, BlockFi created a new product,

"BlockFi Yield," and prepared an S-1 for BlockFi Yield to be

registered with the SEC. BlockFi is the only cryptocurrency

platform to have reached such a settlement with the SEC.

17View entire presentation