BlackRock Investor Conference Presentation Deck

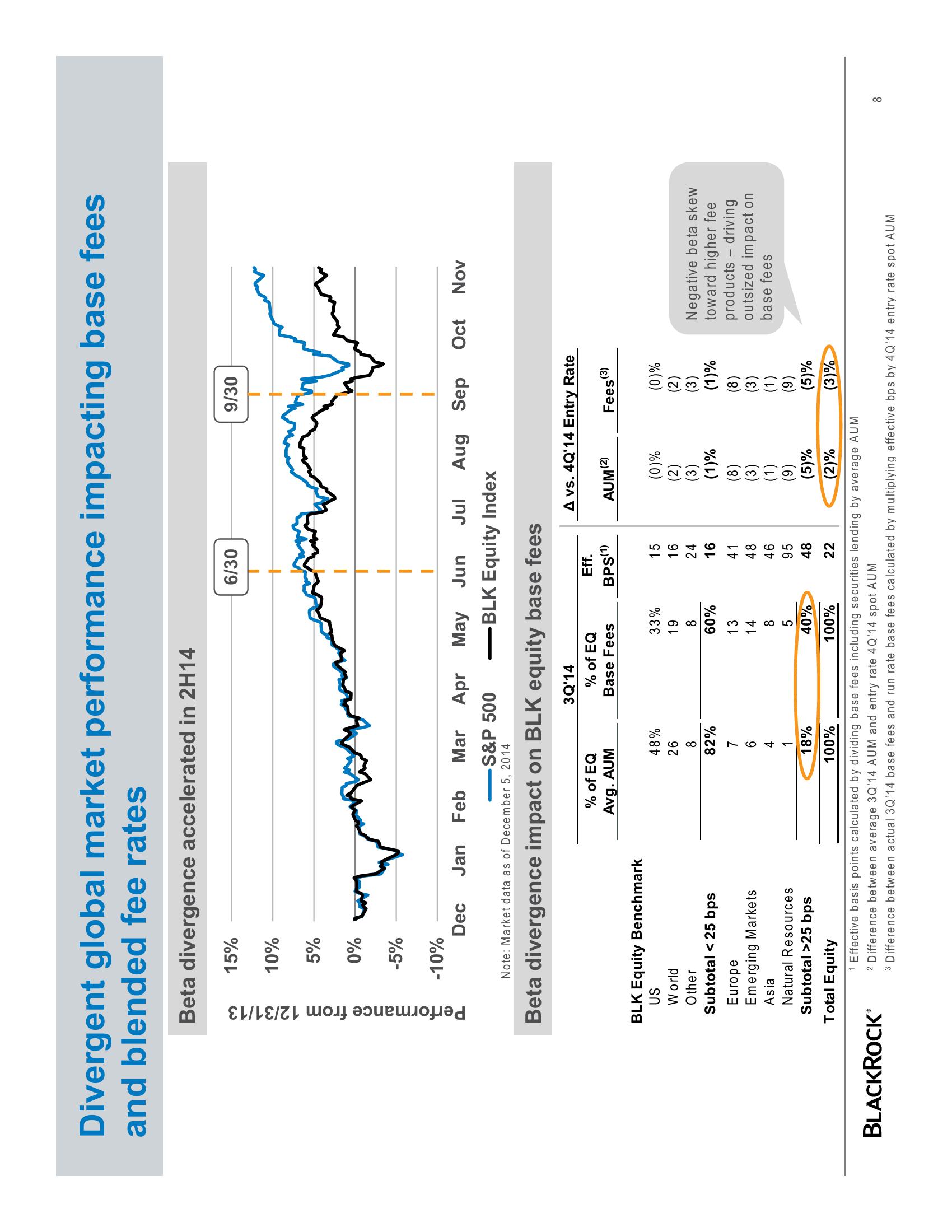

Divergent global market performance impacting base fees

and blended fee rates

Beta divergence accelerated in 2H14

Performance from 12/31/13

15%

10%

5%

0%

BLACKROCK®

-5%

-10%

BLK Equity Benchmark

US

World

Other

Subtotal < 25 bps

Dec Jan Feb

Mar Apr May Jun Jul Aug Sep Oct Nov

-BLK Equity dex

-S&P

Note: Market data as of December 5, 2014

Beta divergence impact on BLK equity base fees

Europe

Emerging Markets

Asia

Natural Resources

Subtotal >25 bps

MA

wman

% of EQ

Avg. AUM

48%

26

8

82%

7

6

4

1

18%

100%

3Q'14

% of EQ

Base Fees

33%

19

8

60%

13

14

6/30

8

5

40%

100%

Eff.

BPS(1)

15

16

24

16

41

48

46

95

48

22

A vs. 4Q'14 Entry Rate

AUM

(2)

9/30

(0)%

(2)

(3)

(1)%

(8)

(3)

(1)

(9)

(5)%

(2)%

(3)

Fees

(0)%

(2)

(3)

(1)%

(8)

(3)

(1)

(9)

(5)%

(3)%

Negative beta skew

toward higher fee

products - driving

outsized impact on

base fees

Total Equity

1 Effective basis points calculated by dividing base fees including securities lending by average AUM

2 Difference between average 3Q'14 AUM and entry rate 4Q'14 spot AUM

3 Difference between actual 3Q'14 base fees and run rate base fees calculated by multiplying effective bps by 4Q'14 entry rate spot AUM

8View entire presentation