jetBlue Results Presentation Deck

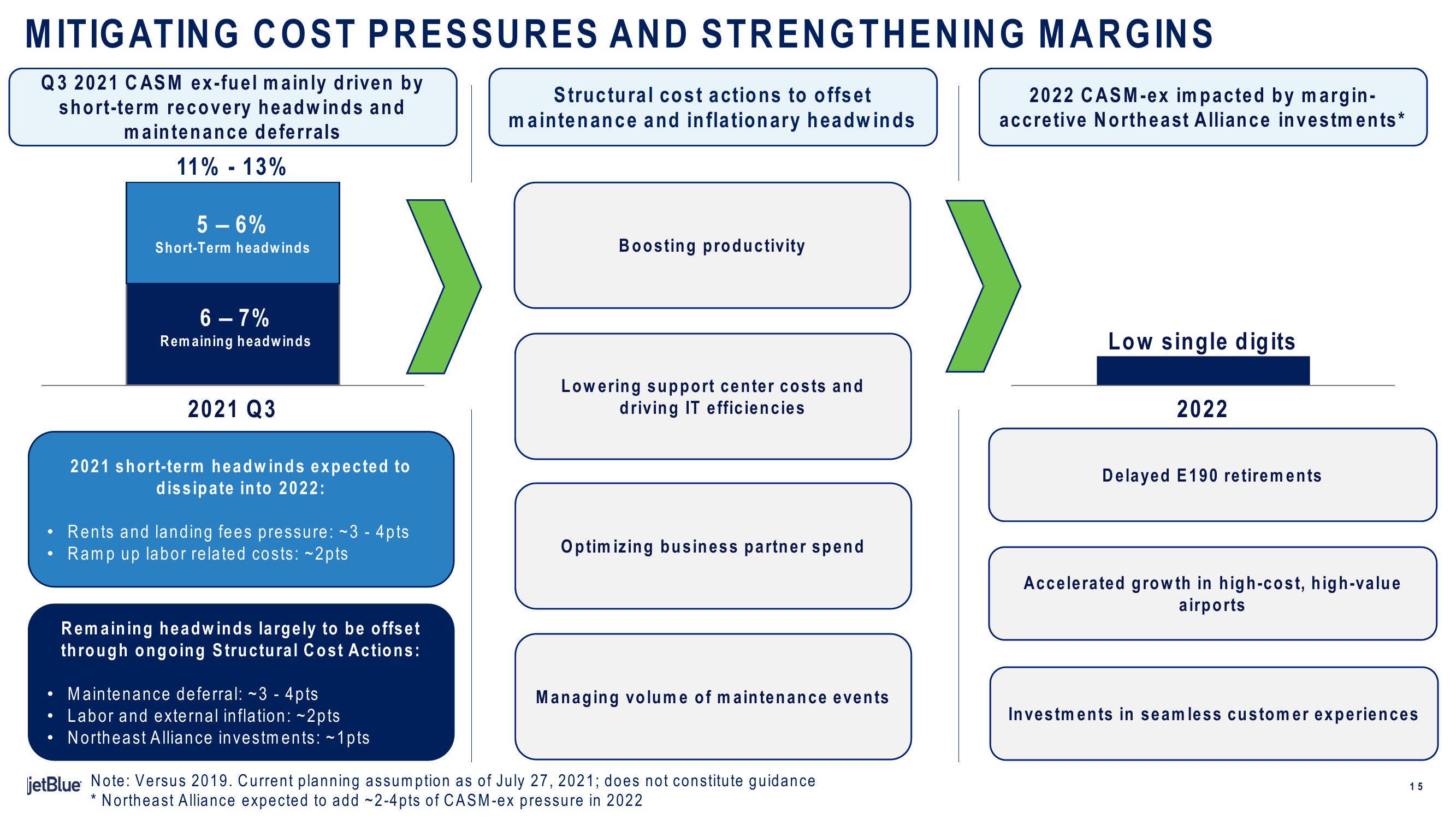

MITIGATING COST PRESSURES AND STRENGTHENING MARGINS

Q3 2021 CASM ex-fuel mainly driven by

short-term recovery headwinds and

maintenance deferrals

11% -13%

●

●

5-6%

Short-Term headwinds

6 - 7%

Remaining headwinds

2021 Q3

}

2021 short-term headwinds expected to

dissipate into 2022:

Rents and landing fees pressure: ~3 - 4pts

Ramp up labor related costs: ~2pts

Remaining headwinds largely to be offset

through ongoing Structural Cost Actions:

Maintenance deferral: ~3 - 4pts

Labor and external inflation: ~2pts

Northeast Alliance investments: -1pts

Structural cost actions to offset

maintenance and inflationary headwinds

Boosting productivity

Lowering support center costs and

driving IT efficiencies

Optimizing business partner spend

Managing volume of maintenance events

jetBlue Note: Versus 2019. Current planning assumption as of July 27, 2021; does not constitute guidance

Northeast Alliance expected to add ~2-4pts of CASM-ex pressure in 2022

2022 CASM-ex impacted by margin-

accretive Northeast Alliance investments*

Low single digits

2022

Delayed E190 retirements

Accelerated growth in high-cost, high-value

airports

Investments in seamless customer experiences

15View entire presentation