OppFi Investor Presentation Deck

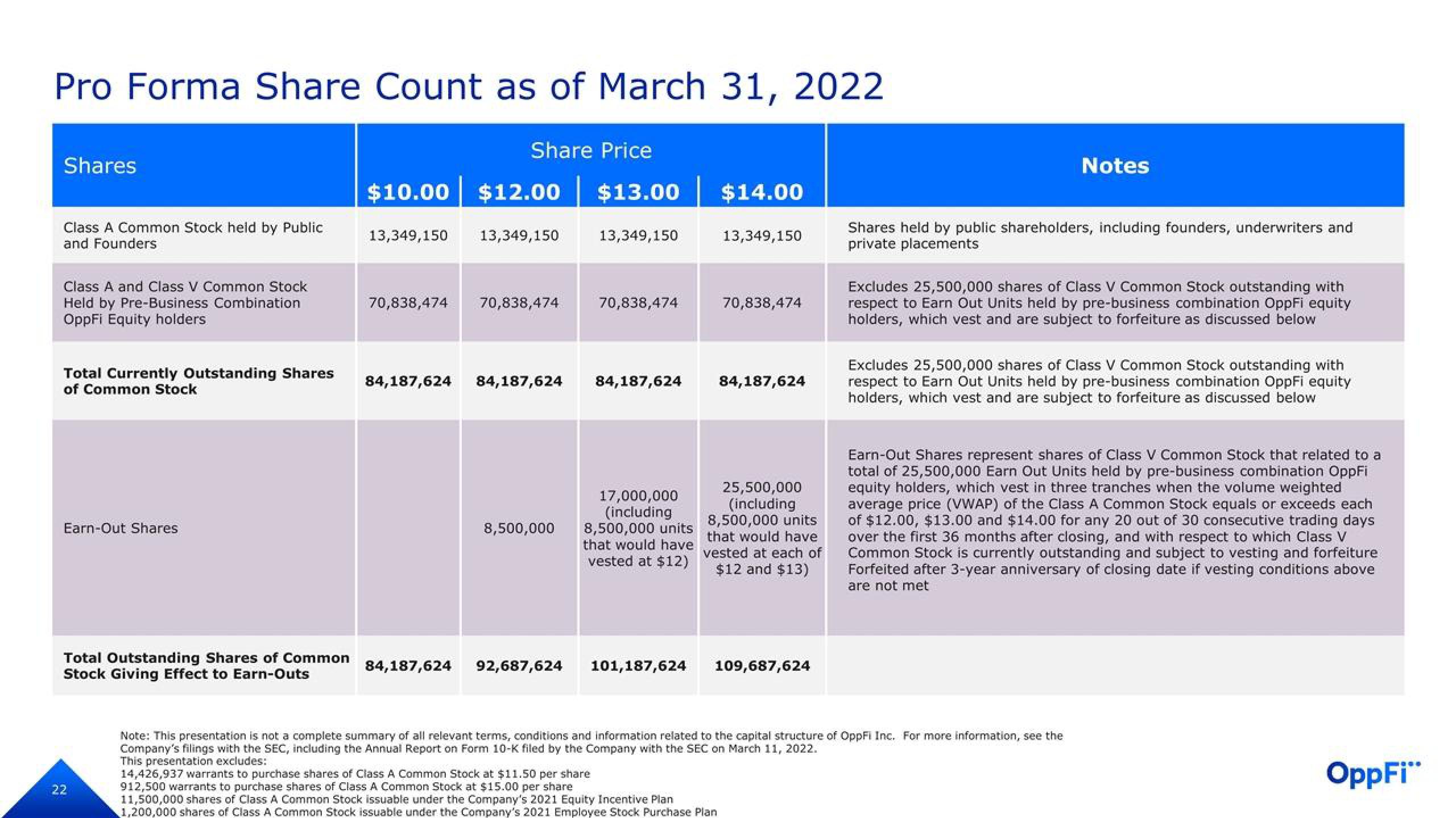

Pro Forma Share Count as of March 31, 2022

Shares

Class A Common Stock held by Public

and Founders

Class A and Class V Common Stock

Held by Pre-Business Combination

OppFi Equity holders

Total Currently Outstanding Shares

of Common Stock

Earn-Out Shares

Total Outstanding Shares of Common

Stock Giving Effect to Earn-Outs

22

Share Price

$10.00 $12.00 $13.00 $14.00

13,349,150 13,349,150

70,838,474 70,838,474

84,187,624

84,187,624

84,187,624

8,500,000

92,687,624

13,349,150

70,838,474

84,187,624

17,000,000

(including

8,500,000 units

that would have

vested at $12)

101,187,624

13,349,150

70,838,474

84,187,624

25,500,000

(including

8,500,000 units

that would have

vested at each of

$12 and $13)

109,687,624

Notes

Shares held by public shareholders, including founders, underwriters and

private placements

Excludes 25,500,000 shares of Class V Common Stock outstanding with

respect to Earn Out Units held by pre-business combination OppFi equity

holders, which vest and are subject to forfeiture as discussed below

Excludes 25,500,000 shares of Class V Common Stock outstanding with

respect to Earn Out Units held by pre-business combination OppFi equity

holders, which vest and are subject to forfeiture as discussed below

Earn-Out Shares represent shares of Class V Common Stock that related to a

total of 25,500,000 Earn Out Units held by pre-business combination OppFi

equity holders, which vest in three tranches when the volume weighted

average price (VWAP) of the Class A Common Stock equals or exceeds each

of $12.00, $13.00 and $14.00 for any 20 out of 30 consecutive trading days

over the first 36 months after closing, and with respect to which Class V

Common Stock is currently outstanding and subject to vesting and forfeiture

Forfeited after 3-year anniversary of closing date if vesting conditions above

are not met

Note: This presentation is not a complete summary of all relevant terms, conditions and information related to the capital structure of OppFi Inc. For more information, see the

Company's filings with the SEC, including the Annual Report on Form 10-K filed by the Company with the SEC on March 11, 2022.

This presentation excludes:

14,426,937 warrants to purchase shares of Class A Common Stock at $11.50 per share

912,500 warrants to purchase shares of Class A Common Stock at $15.00 per share

11,500,000 shares of Class A Common Stock issuable under the Company's 2021 Equity Incentive Plan

1,200,000 shares of Class A Common Stock issuable under the Company's 2021 Employee Stock Purchase Plan

OppFi"View entire presentation