Statement of Financial Condition

1₂.

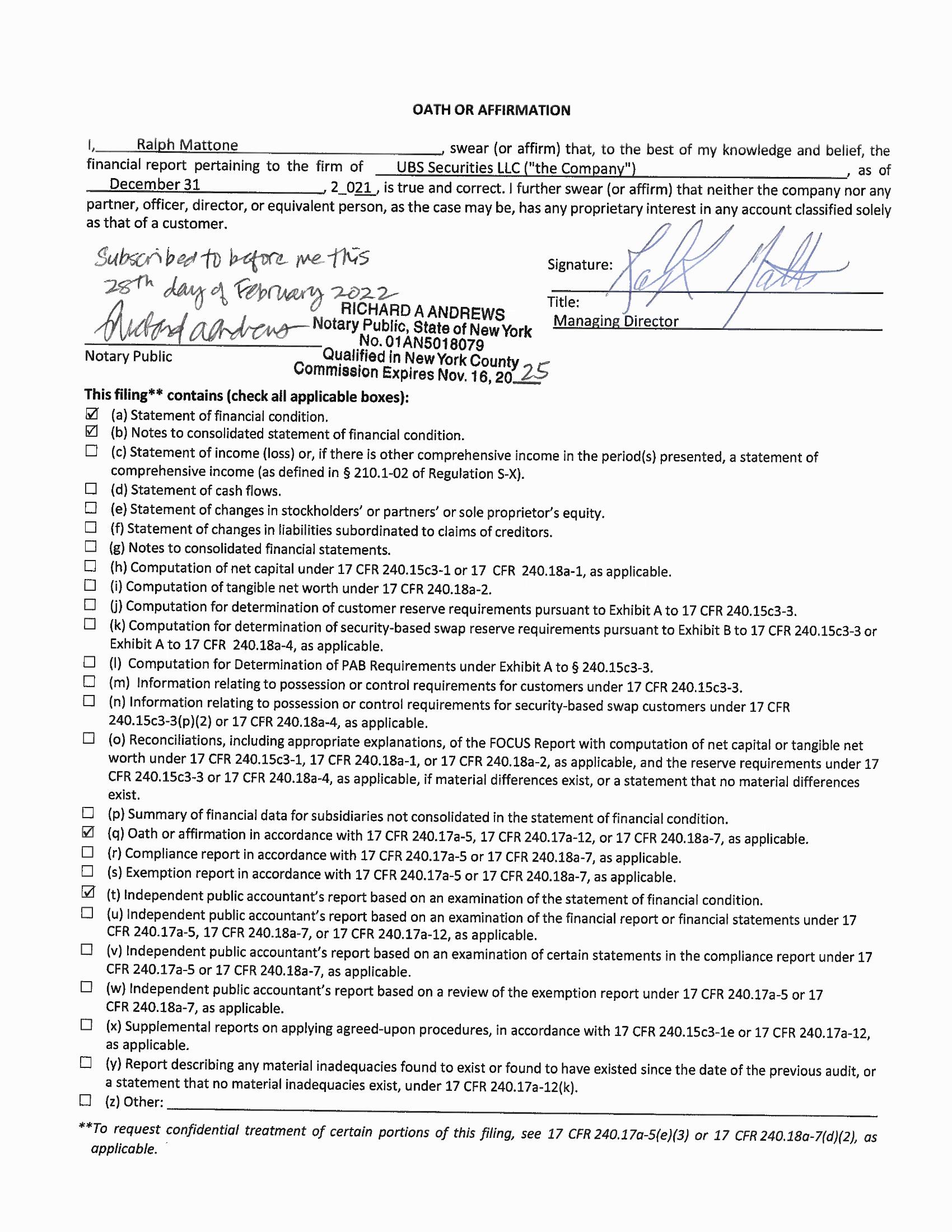

Ralph Mattone

financial report pertaining to the firm of

December 31

2_021, is true and correct. I further swear (or affirm) that neither the company nor any

partner, officer, director, or equivalent person, as the case may be, has any proprietary interest in any account classified solely

as that of a customer.

Refl Hallo

Subscribed to before me this

28th

day of February 2022

Auctand aandens

Notary Public

00000000

OATH OR AFFIRMATION

□ロロ

This filing** contains (check all applicable boxes):

(a) Statement of financial condition.

(b) Notes to consolidated statement of financial condition.

□ □ □□

swear (or affirm) that, to the best of my knowledge and belief, the

UBS Securities LLC ("the Company")

as of

Signature:

Title:

Managing Director

RICHARD A ANDREWS

Notary Public, State of New York

No. 01 AN5018079

Qualified in New York County

Commission Expires Nov. 16, 20

25

(c) Statement of income (loss) or, if there is other comprehensive income in the period(s) presented, a statement of

comprehensive income (as defined in § 210.1-02 of Regulation S-X).

(d) Statement of cash flows.

(e) Statement of changes in stockholders' or partners' or sole proprietor's equity.

(f) Statement of changes in liabilities subordinated to claims of creditors.

(g) Notes to consolidated financial statements.

(h) Computation of net capital under 17 CFR 240.15c3-1 or 17 CFR 240.18a-1, as applicable.

Computation of tangible net worth under 17 CFR 240.18a-2.

(i)

(j)

Computation for determination of customer reserve requirements pursuant to Exhibit A to 17 CFR 240.15c3-3.

(k) Computation for determination of security-based swap reserve requirements pursuant to Exhibit B to 17 CFR 240.15c3-3 or

Exhibit A to 17 CFR 240.18a-4, as applicable.

(1) Computation for Determination of PAB Requirements under Exhibit A to § 240.15c3-3.

(m) Information relating to possession or control requirements for customers under 17 CFR 240.15c3-3.

(n) Information relating to possession or control requirements for security-based swap customers under 17 CFR

240.15c3-3(p)(2) or 17 CFR 240.18a-4, as applicable.

(o) Reconciliations, including appropriate explanations, of the FOCUS Report with computation of net capital or tangible net

worth under 17 CFR 240.15c3-1, 17 CFR 240.18a-1, or 17 CFR 240.18a-2, as applicable, and the reserve requirements under 17

CFR 240.15c3-3 or 17 CFR 240.18a-4, as applicable, if material differences exist, or a statement that no material differences

exist.

(p) Summary of financial data for subsidiaries not consolidated in the statement of financial condition.

(q) Oath or affirmation in accordance with 17 CFR 240.17a-5, 17 CFR 240.17a-12, or 17 CFR 240.18a-7, as applicable.

(r) Compliance report in accordance with 17 CFR 240.17a-5 or 17 CFR 240.18a-7, as applicable.

(s) Exemption report in accordance with 17 CFR 240.17a-5 or 17 CFR 240.18a-7, as applicable.

(t) Independent public accountant's report based on an examination of the statement of financial condition.

(u) Independent public accountant's report based on an examination of the financial report or financial statements under 17

CFR 240.17a-5, 17 CFR 240.18a-7, or 17 CFR 240.17a-12, as applicable.

(v) Independent public accountant's report based on an examination of certain statements in the compliance report under 17

CFR 240.17a-5 or 17 CFR 240.18a-7, as applicable.

(w) Independent public accountant's report based on a review of the exemption report under 17 CFR 240.17a-5 or 17

CFR 240.18a-7, as applicable.

(x) Supplemental reports on applying agreed-upon procedures, in accordance with 17 CFR 240.15c3-1e or 17 CFR 240.17a-12,

as applicable.

(y) Report describing any material inadequacies found to exist or found to have existed since the date of the previous audit, or

a statement that no material inadequacies exist, under 17 CFR 240.17a-12(k).

(z) Other:

**To request confidential treatment of certain portions of this filing, see 17 CFR 240.17a-5(e)(3) or 17 CFR 240.18a-7(d)(2), as

applicable.View entire presentation