Pershing Square Activist Presentation Deck

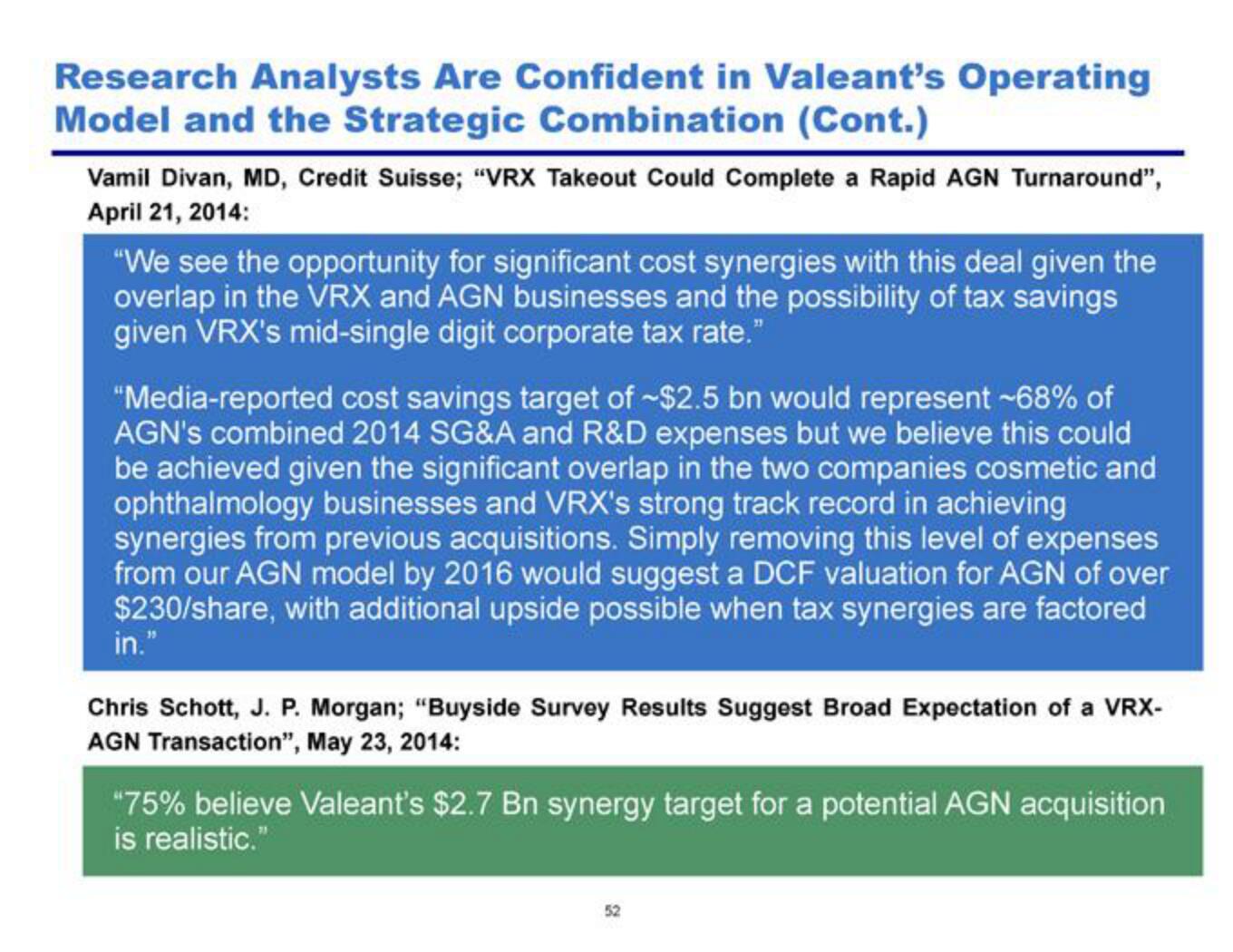

Research Analysts Are Confident in Valeant's Operating

Model and the Strategic Combination (Cont.)

Vamil Divan, MD, Credit Suisse; "VRX Takeout Could Complete a Rapid AGN Turnaround",

April 21, 2014:

"We see the opportunity for significant cost synergies with this deal given the

overlap in the VRX and AGN businesses and the possibility of tax savings

given VRX's mid-single digit corporate tax rate."

"Media-reported cost savings target of ~$2.5 bn would represent ~68% of

AGN's combined 2014 SG&A and R&D expenses but we believe this could

be achieved given the significant overlap in the two companies cosmetic and

ophthalmology businesses and VRX's strong track record in achieving

synergies from previous acquisitions. Simply removing this level of expenses

from our AGN model by 2016 would suggest a DCF valuation for AGN of over

$230/share, with additional upside possible when tax synergies are factored

in."

Chris Schott, J. P. Morgan; “Buyside Survey Results Suggest Broad Expectation of a VRX-

AGN Transaction", May 23, 2014:

"75% believe Valeant's $2.7 Bn synergy target for a potential AGN acquisition

is realistic."View entire presentation