Azerion SPAC Presentation Deck

M&A track record

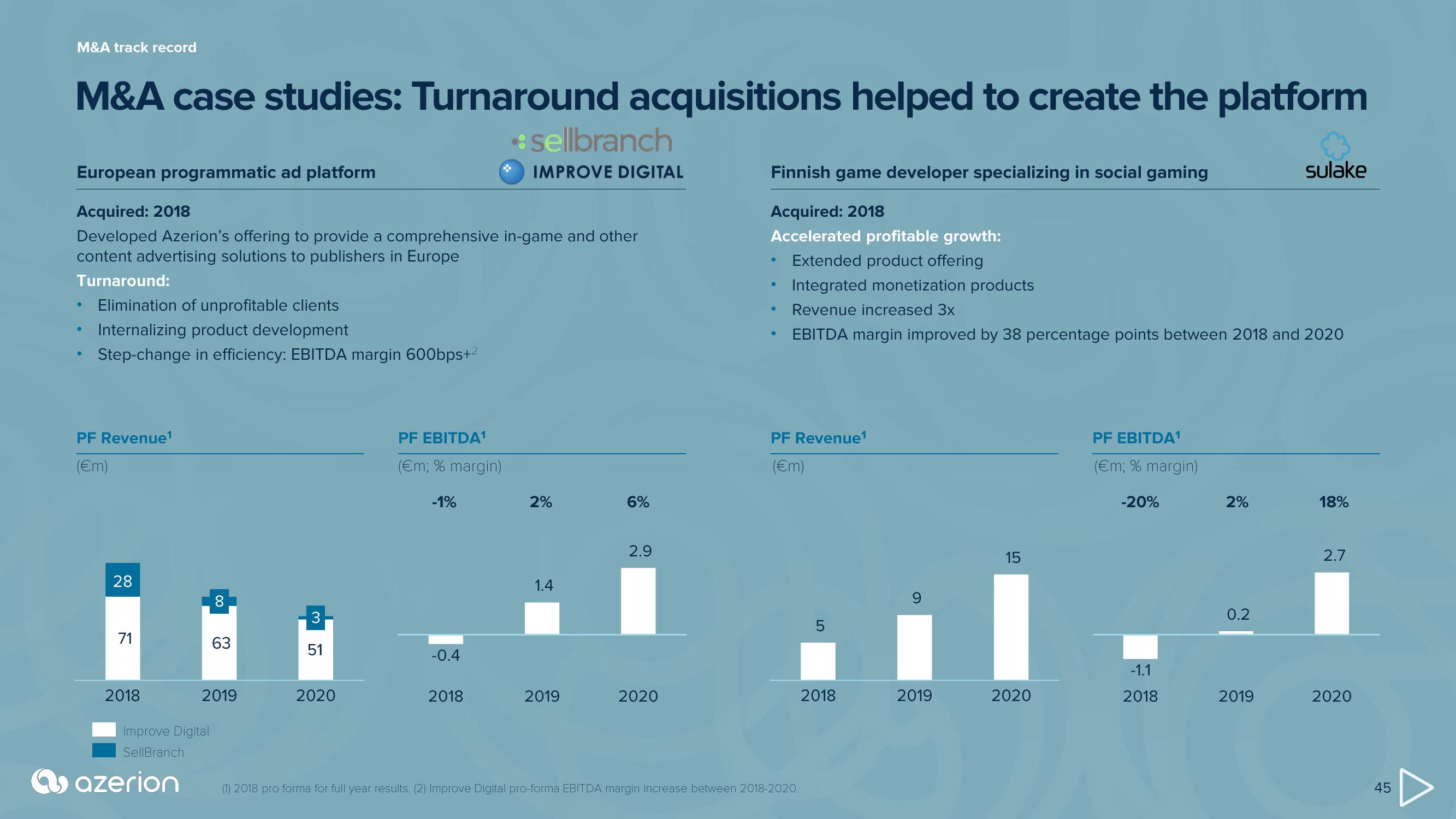

M&A case studies: Turnaround acquisitions helped to create the platform

European programmatic ad platform

Acquired: 2018

Developed Azerion's offering to provide a comprehensive in-game and other

content advertising solutions to publishers in Europe

Turnaround:

Elimination of unprofitable clients

Internalizing product development

Step-change in efficiency: EBITDA margin 600bps+²

0

●

PF Revenue¹

(€m)

28

71

2018

Improve Digital

SellBranch

azerion

8

63

2019

3

51

2020

PF EBITDA¹

(€m; % margin)

-1%

-0.4

sellbranch

IMPROVE DIGITAL

2018

2%

1.4

2019

6%

2.9

2020

Finnish game developer specializing in social gaming

Acquired: 2018

Accelerated profitable growth:

Extended product offering

Integrated monetization products

Revenue increased 3x

EBITDA margin improved by 38 percentage points between 2018 and 2020

●

●

●

PF Revenue¹

(€m)

(1) 2018 pro forma for full year results. (2) Improve Digital pro-forma EBITDA margin increase between 2018-2020.

5

2018

9

2019

15

2020

PF EBITDA¹

(€m; % margin)

-20%

-1.1

2018

2%

0.2

sulake

2019

18%

2.7

2020

45View entire presentation