Yellow Corporation Investor Conference Presentation Deck

Free Cash Flow

($ in millions)

Adjusted EBITDA

Total restructuring professional fees

Cash paid for interest

Cash paid for letter of credit fees

Working capital cash flows excluding income tax, net

Net cash provided by (used in) operating activities before income taxes

Cash received from income taxes, net

Net cash provided by (used in) operating activities

Acquisition of property and equipment

Free cash flow (deficit)

Total restructuring professional fees

Adjusted free cash flow (deficit)

$

2012

77.0

(28.9)

(9.4)

(14.3)

24.4

(2.3)

22.1

(18.3)

3.8

3.8

Three months

2011

41.3

(4.3)

(22.7)

(9.5)

$

27.3

32.1

(5.2)

26.9

Change

$ 35.7

4.3

(6.2)

0.1

(35.5)

(8.6)

4.3

(4.3) $

(41.6)

(7.7)

2.9

(4.8)

17.2

12.4

(4.3)

8.1

Twelve months

2012

241.2 $

(3.0)

(120.5)

(38.0)

(111.5)

(31.8)

5.9

(25.9)

(66.4)

(92.3)

3.0

(89.3)

$

2011

159.2 $

(44.0)

(67.5)

(16.7)

(50.5)

(19.5)

(6.5)

(26.0)

(71.6)

(97.6)

44.0

(53.6) $

Change

82.0

41.0

(53.0)

(21.3)

(61.0)

(12.3)

12.4

0.1

5.2

5.3

(41.0)

(35.7)

YRC Worldwide

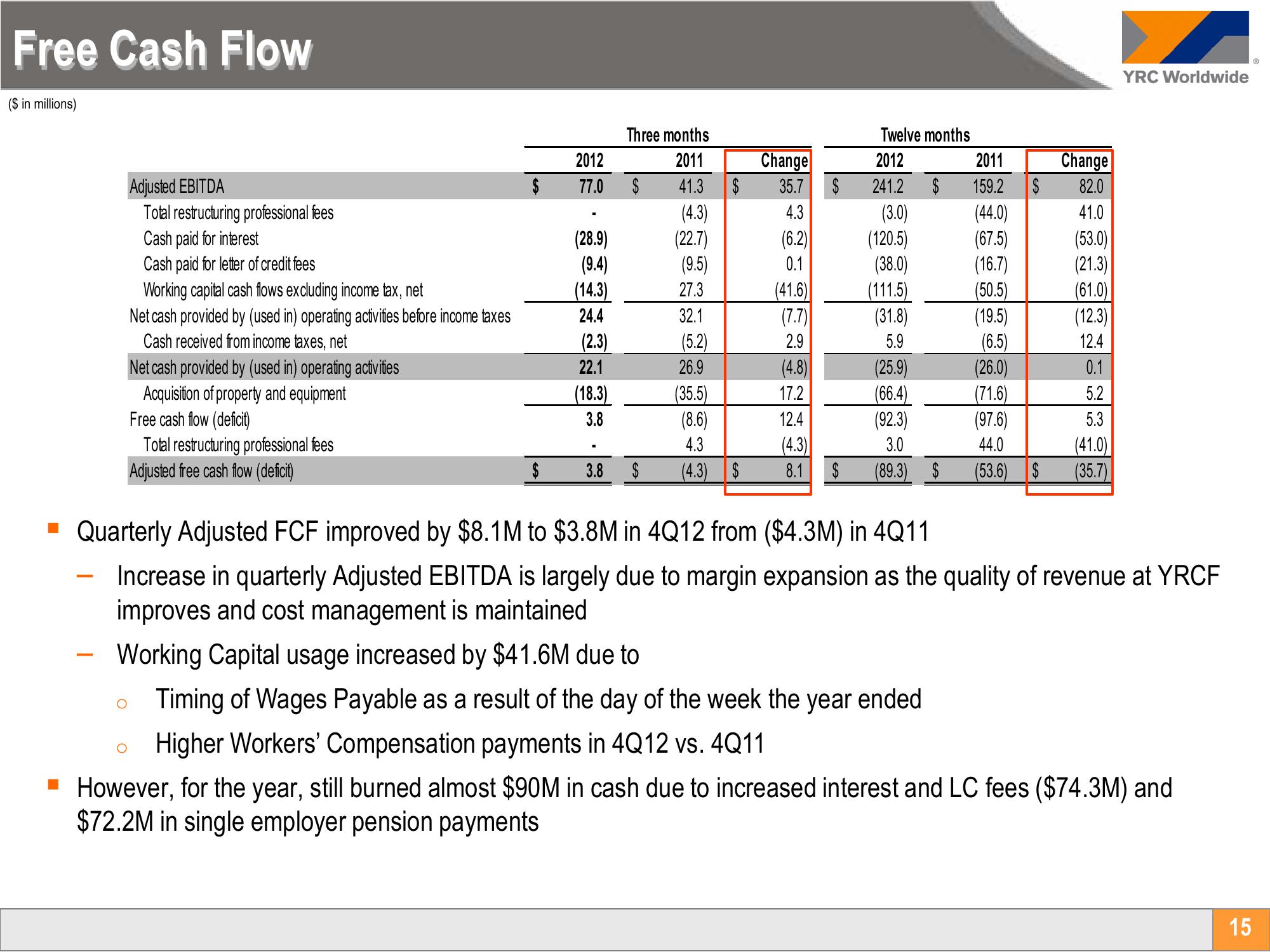

▪ Quarterly Adjusted FCF improved by $8.1M to $3.8M in 4Q12 from ($4.3M) in 4Q11

Increase in quarterly Adjusted EBITDA is largely due to margin expansion as the quality of revenue at YRCF

improves and cost management is maintained

Working Capital usage increased by $41.6M due to

o Timing of Wages Payable as a result of the day of the week the year ended

Higher Workers' Compensation payments in 4Q12 vs. 4Q11

▪ However, for the year, still burned almost $90M in cash due to increased interest and LC fees ($74.3M) and

$72.2M in single employer pension payments

15View entire presentation