LegalZoom.com Results Presentation Deck

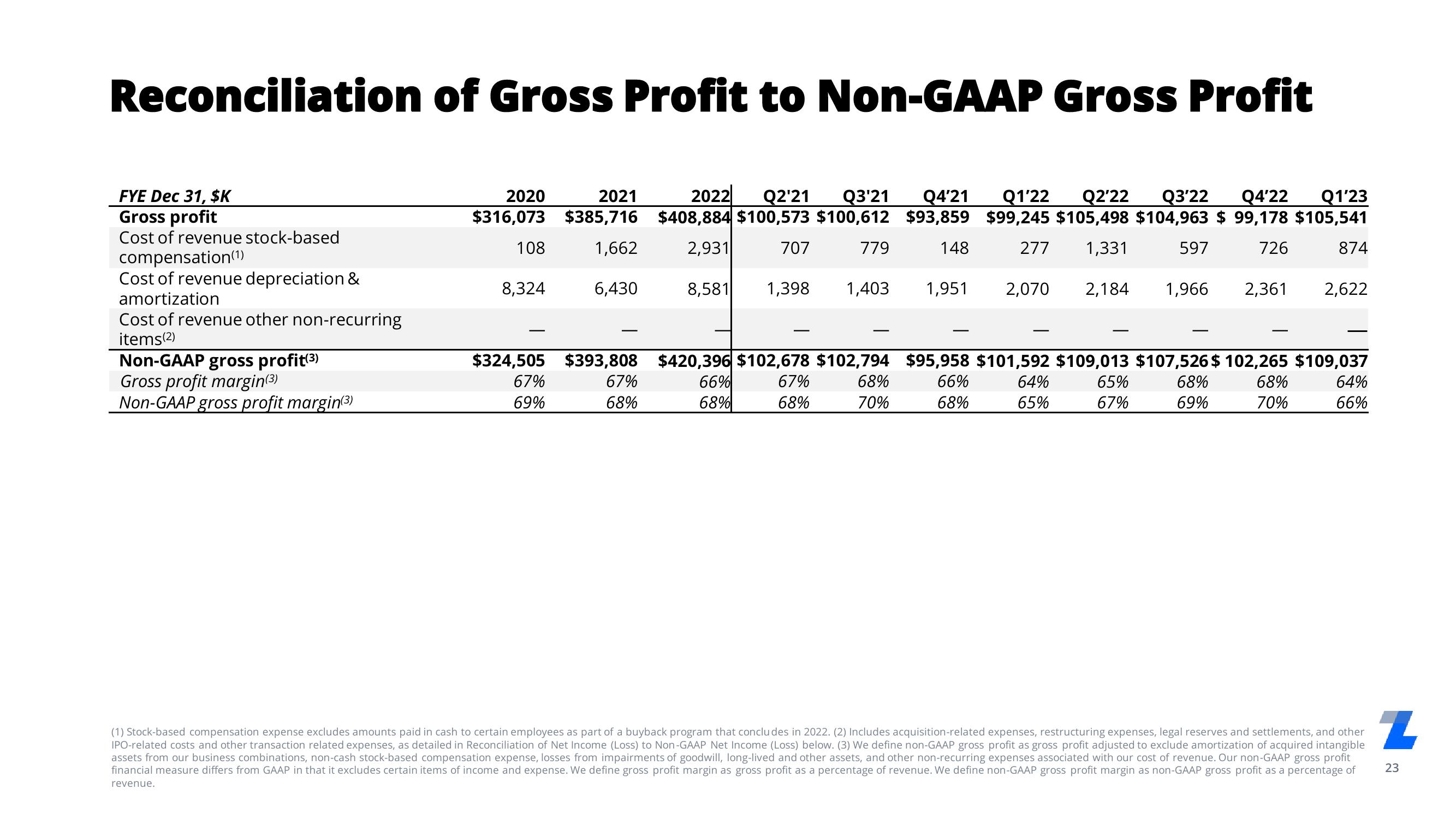

Reconciliation of Gross Profit to Non-GAAP Gross Profit

FYE Dec 31, $K

Gross profit

Cost of revenue stock-based

compensation (¹)

Cost of revenue depreciation &

amortization

Cost of revenue other non-recurring

items (2)

Non-GAAP gross profit(³)

Gross profit margin(3)

Non-GAAP gross profit margin(3)

2020

2021

2022 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23

$316,073 $385,716 $408,884 $100,573 $100,612 $93,859 $99,245 $105,498 $104,963 $ 99,178 $105,541

108

707

779

148

277 1,331

597

726

874

1,662

6,430

2,931

8,581 1,398 1,403 1,951 2,070

8,324

67%

69%

$324,505 $393,808 $420,396 $102,678 $102,794 $95,958 $101,592 $109,013 $107,526 $ 102,265 $109,037

66%

68%

68%

70%

67%

68%

66%

68%

67%

68%

68%

70%

2,184 1,966

64%

65%

65%

67%

2,361 2,622

68%

69%

64%

66%

(1) Stock-based compensation expense excludes amounts paid in cash to certain employees as part of a buyback program that concludes in 2022. (2) Includes acquisition-related expenses, restructuring expenses, legal reserves and settlements, and other

IPO-related costs and other transaction related expenses, as detailed in Reconciliation of Net Income (Loss) to Non-GAAP Net Income (Loss) below. (3) We define non-GAAP gross profit as gross profit adjusted to exclude amortization of acquired intangible

assets from our business combinations, non-cash stock-based compensation expense, losses from impairments of goodwill, long-lived and other assets, and other non-recurring expenses associated with our cost of revenue. Our non-GAAP gross profit

financial measure differs from GAAP in that it excludes certain items of income and expense. We define gross profit margin as gross profit as a percentage of revenue. We define non-GAAP gross profit margin as non-GAAP gross profit as a percentage of

revenue.

Z

23View entire presentation