OppFi SPAC Presentation Deck

14

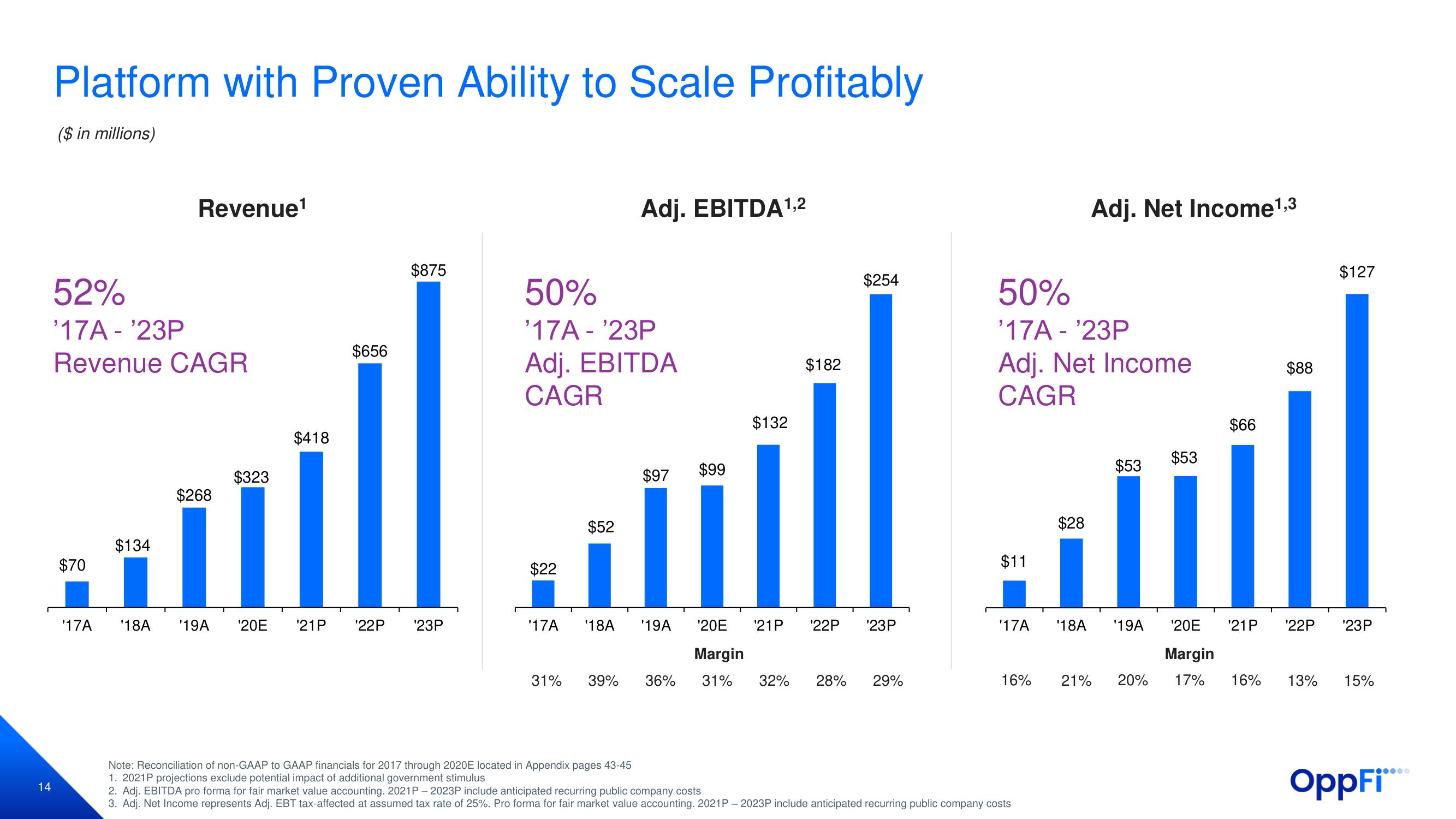

Platform with Proven Ability to Scale Profitably

($ in millions)

52%

'17A - ¹23P

Revenue CAGR

$70

'17A

Revenue¹

$134

$268

$323

$418

$656

$875

'18A '19A '20E '21P ¹22P '23P

50%

'17A - ¹23P

Adj. EBITDA

CAGR

$22

'17A

31%

Adj. EBITDA ¹,2

$52

$97

$99

39% 36%

$132

$182

$254

'18A '19A '20E '21P '22P

Margin

31% 32% 28% 29%

¹23P

50%

'17A - ¹23P

Adj. Net Income

CAGR

$11

Adj. Net Income ¹,3

$28

Note: Reconciliation of non-GAAP to GAAP financials for 2017 through 2020E located in Appendix pages 43-45

1. 2021P projections exclude potential impact of additional government stimulus

2. Adj. EBITDA pro forma for fair market value accounting. 2021P-2023P include anticipated recurring public company costs

3. Adj. Net Income represents Adj. EBT tax-affected at assumed tax rate of 25%. Pro forma for fair market value accounting. 2021P-2023P include anticipated recurring public company costs

$53

$53

$66

$88

$127

'17A '18A '19A '20E '21P ¹22P ¹23P

Margin

16% 21% 20% 17% 16% 13% 15%

OppFi****View entire presentation