jetBlue Results Presentation Deck

BALANCED APPROACH TO MULTI-YEAR DELEVERAGING EFFORT

●

●

jetBlue

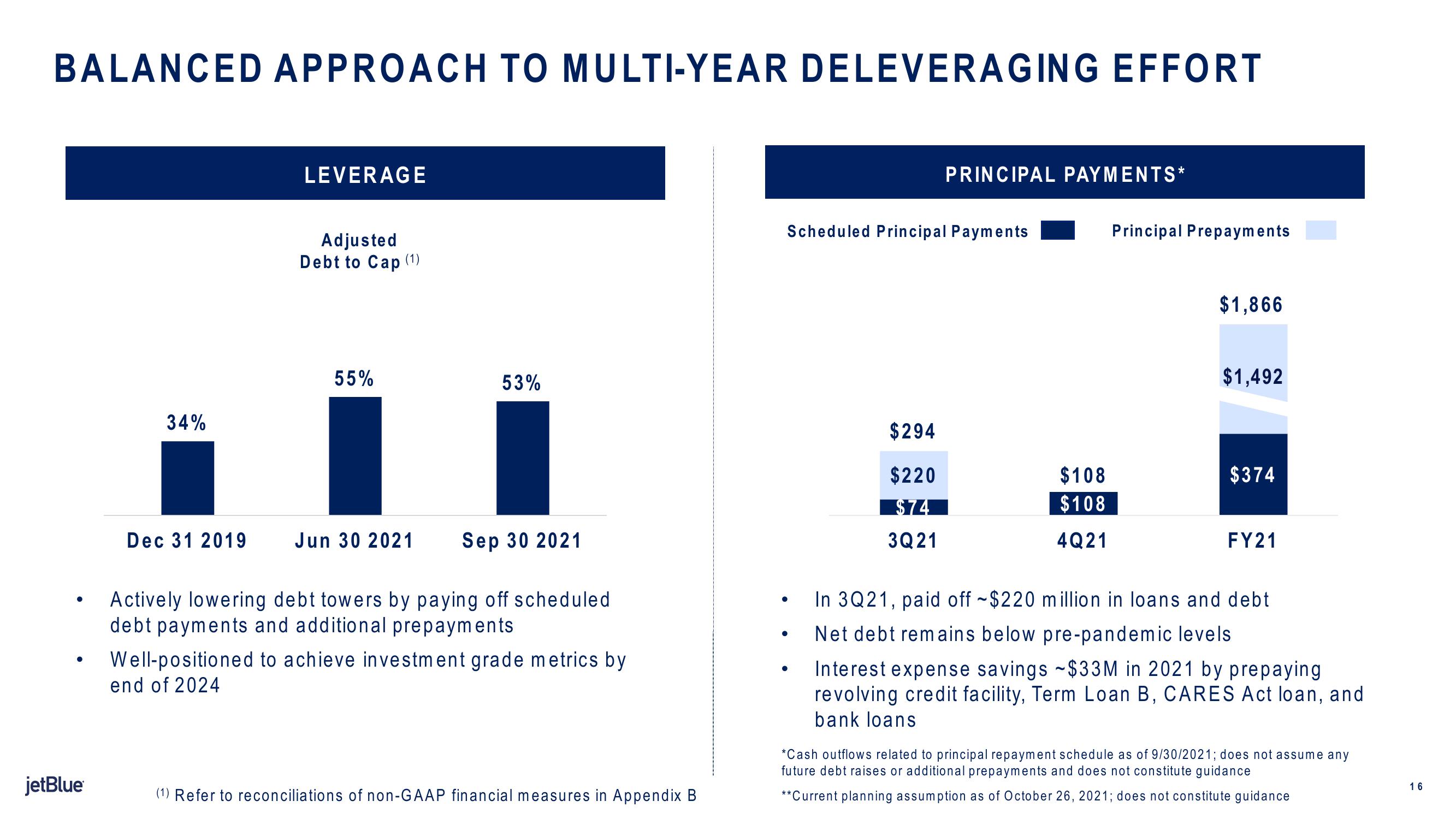

34%

LEVERAGE

Dec 31 2019

Adjusted

Debt to Cap (1)

55%

53%

Jun 30 2021 Sep 30 2021

Actively lowering debt towers by paying off scheduled

debt payments and additional prepayments

Well-positioned to achieve investment grade metrics by

end of 2024

(1) Refer to reconciliations of non-GAAP financial measures in Appendix B

PRINCIPAL PAYMENTS*

Scheduled Principal Payments

$294

$220

$74

3Q21

$108

$108

4Q21

Principal Prepayments

$1,866

$1,492

$374

FY21

In 3Q21, paid off ~$220 million in loans and debt

Net debt remains below pre-pandemic levels

Interest expense savings -$33M in 2021 by prepaying

revolving credit facility, Term Loan B, CARES Act loan, and

bank loans

*Cash outflows related to principal repayment schedule as of 9/30/2021; does not assume any

future debt raises or additional prepayments and does not constitute guidance

**Current planning assumption as of October 26, 2021; does not constitute guidance

16View entire presentation