Allwyn SPAC

Transaction summary

●

R

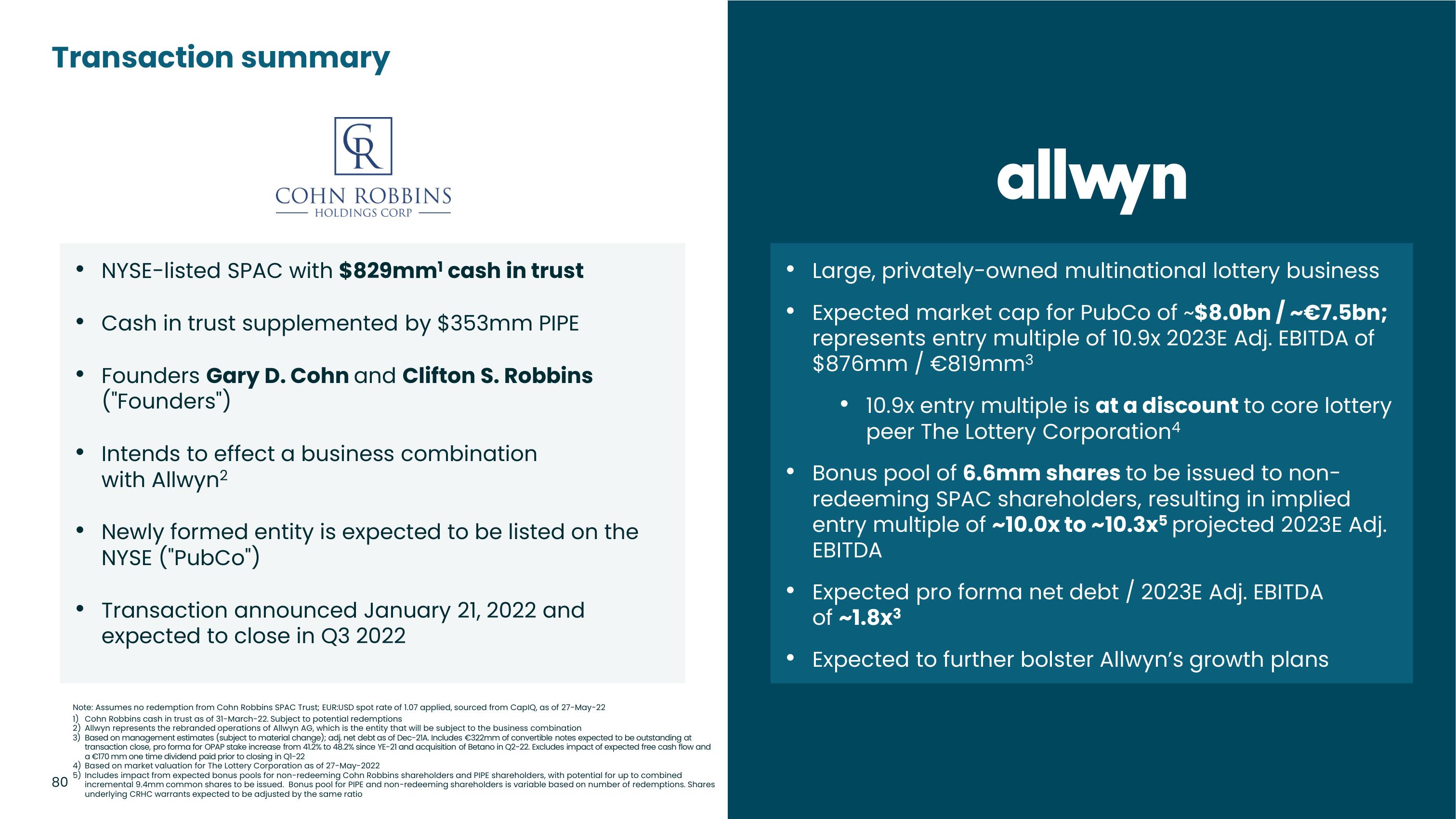

NYSE-listed SPAC with $829mm¹ cash in trust

• Cash in trust supplemented by $353mm PIPE

• Founders Gary D. Cohn and Clifton S. Robbins

("Founders")

COHN ROBBINS

HOLDINGS CORP

●

• Intends to effect a business combination

●

with Allwyn²

Newly formed entity is expected to be listed on the

NYSE ("PubCo")

• Transaction announced January 21, 2022 and

expected to close in Q3 2022

Note: Assumes no redemption from Cohn Robbins SPAC Trust; EUR:USD spot rate of 1.07 applied, sourced from CapIQ, as of 27-May-22

1) Cohn Robbins cash in trust as of 31-March-22. Subject to potential redemptions

2) Allwyn represents the rebranded operations of Allwyn AG, which is the entity that will be subject to the business combination

3) Based on management estimates (subject to material change); adj. net debt as of Dec-21A. Includes €322mm of convertible notes expected to be outstanding at

transaction close, pro forma for OPAP stake increase from 41.2% to 48.2% since YE-21 and acquisition of Betano in Q2-22. Excludes impact of expected free cash flow and

a €170 mm one time dividend paid prior to closing in Q1-22

Based on market valuation for The Lottery Corporation as of 27-May-2022

80

5) Includes impact from expected bonus pools for non-redeeming Cohn Robbins shareholders and PIPE shareholders, with potential for up to combined

incremental 9.4mm common shares to be issued. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions. Shares

underlying CRHC warrants expected to be adjusted by the same ratio

allwyn

Large, privately-owned multinational lottery business

Expected market cap for PubCo of ~$8.0bn /~€7.5bn;

represents entry multiple of 10.9x 2023E Adj. EBITDA of

$876mm / €819mm³

10.9x entry multiple is at a discount to core lottery

peer The Lottery Corporation4

Bonus pool of 6.6mm shares to be issued to non-

redeeming SPAC shareholders, resulting in implied

entry multiple of ~10.0x to ~10.3x5 projected 2023E Adj.

EBITDA

Expected pro forma net debt / 2023E Adj. EBITDA

of ~1.8x³

Expected to further bolster Allwyn's growth plansView entire presentation