jetBlue Results Presentation Deck

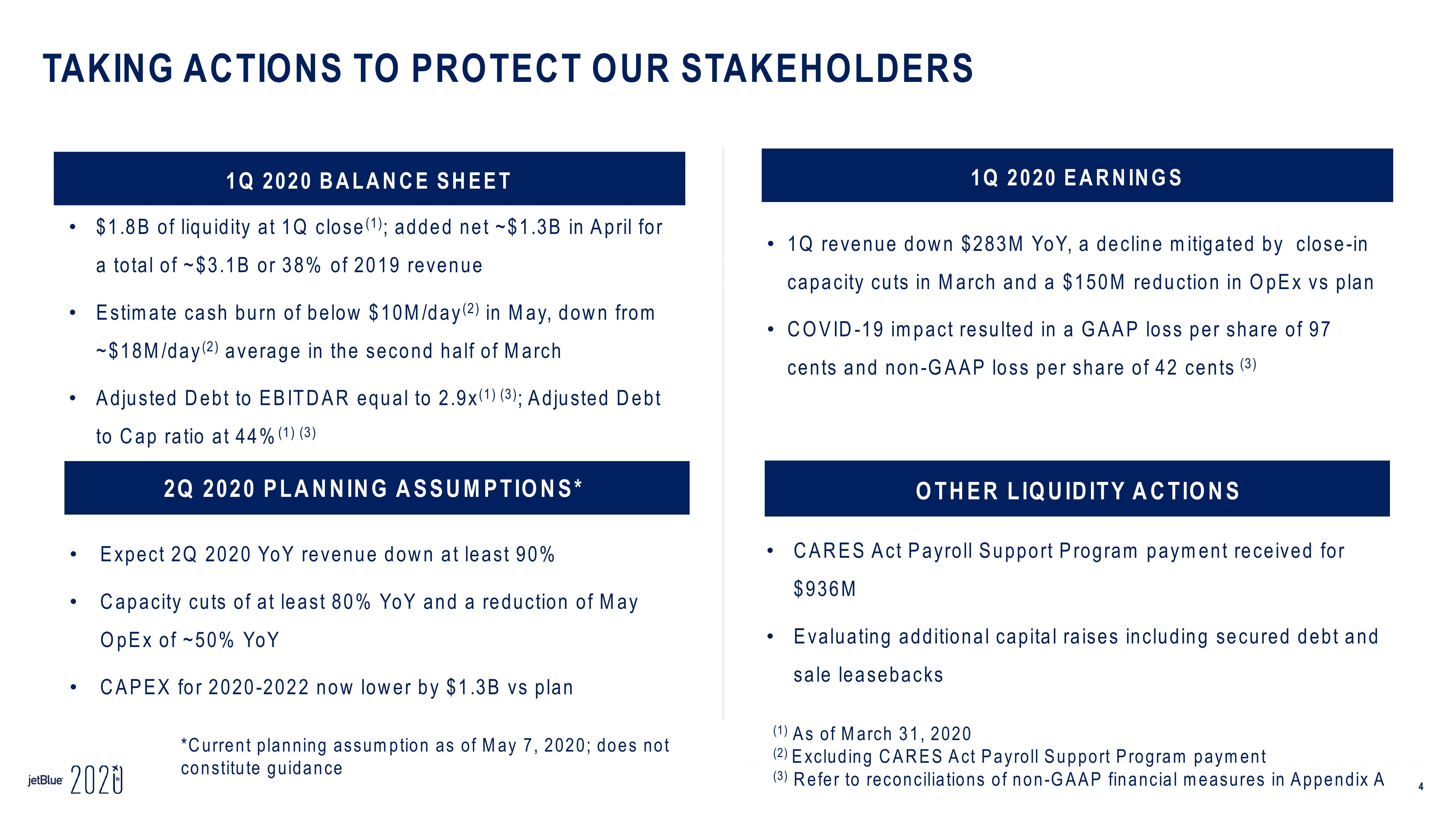

TAKING ACTIONS TO PROTECT OUR STAKEHOLDERS

●

●

●

●

●

1Q 2020 BALANCE SHEET

$1.8B of liquidity at 1Q close (¹); added net ~$1.3B in April for

a total of $3.1B or 38% of 2019 revenue

Estimate cash burn of below $10M/day (2) in May, down from

-$18M/day (2) average in the second half of March

Adjusted Debt to EBITDAR equal to 2.9x(1) (3); Adjusted Debt

to Cap ratio at 44% (1) (3)

2Q 2020 PLANNING ASSUMPTIONS*

Expect 2Q 2020 YoY revenue down at least 90%

Capacity cuts of at least 80% YoY and a reduction of May

OpEx of -50% YoY

CAPEX for 2020-2022 now lower by $1.3B vs plan

jetBlue 2020

*Current planning assumption as of May 7, 2020; does not

constitute guidance

●

1Q 2020 EARNINGS

• COVID-19 impact resulted in a GAAP loss per share of 97

cents and non-GAAP loss per share of 42 cents (³)

●

1Q revenue down $283M YoY, a decline mitigated by close-in

capacity cuts in March and a $150M reduction in OpEx vs plan

OTHER LIQUIDITY ACTIONS

CARES Act Payroll Support Program payment received for

$936M

Evaluating additional capital raises including secured debt and

sale leasebacks

(1) As of March 31, 2020

(2) Excluding CARES Act Payroll Support Program payment

(3) Refer to reconciliations of non-GAAP financial measures in Appendix A

4View entire presentation