FiscalNote SPAC Presentation Deck

29

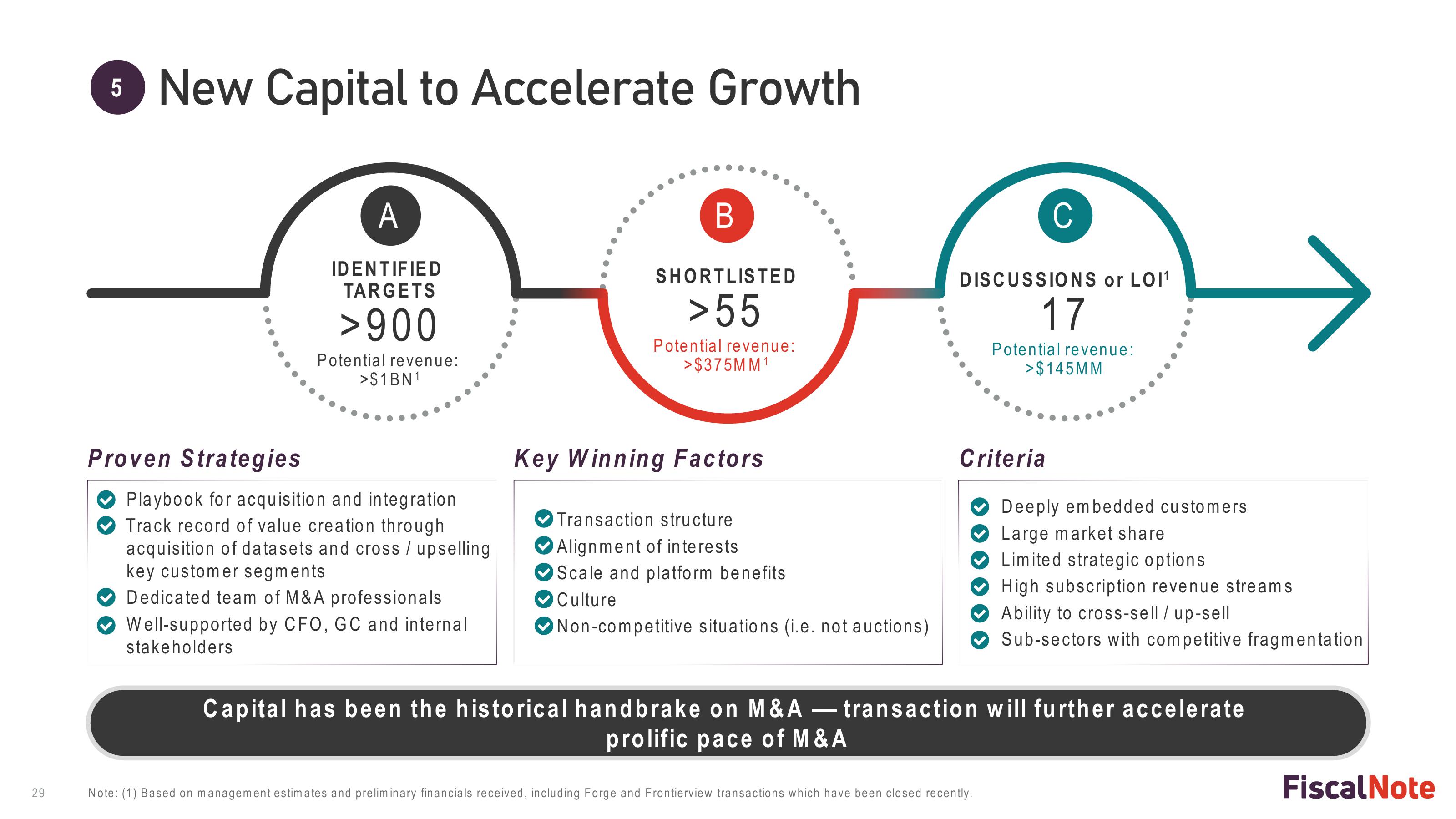

5 New Capital to Accelerate Growth

Proven Strategies

A

IDENTIFIED

TARGETS

>900

Potential revenue:

>$1BN¹

Playbook for acquisition and integration

Track record of value creation through

acquisition of datasets and cross / upselling

key customer segments

Dedicated team of M&A professionals

Well-supported by CFO, GC and internal.

stakeholders

B

SHORTLISTED

>55

Potential revenue:

>$375MM1

Key Winning Factors

Transaction structure

Alignment of interests

Scale and platform benefits

Culture

Non-competitive situations (i.e. not auctions)

DISCUSSIONS or LOI¹

17

Potential revenue:

>$145MM

Criteria

C

Note: (1) Based on management estimates and preliminary financials received, including Forge and Frontierview transactions which have been closed recently.

Deeply embedded customers

Large market share

Limited strategic options

High subscription revenue streams

Ability to cross-sell / up-sell

Sub-sectors with competitive fragmentation.

Capital has been the historical handbrake on M&A - transaction will further accelerate

prolific pace of M&A

Fiscal NoteView entire presentation