Grab Results Presentation Deck

Business Update

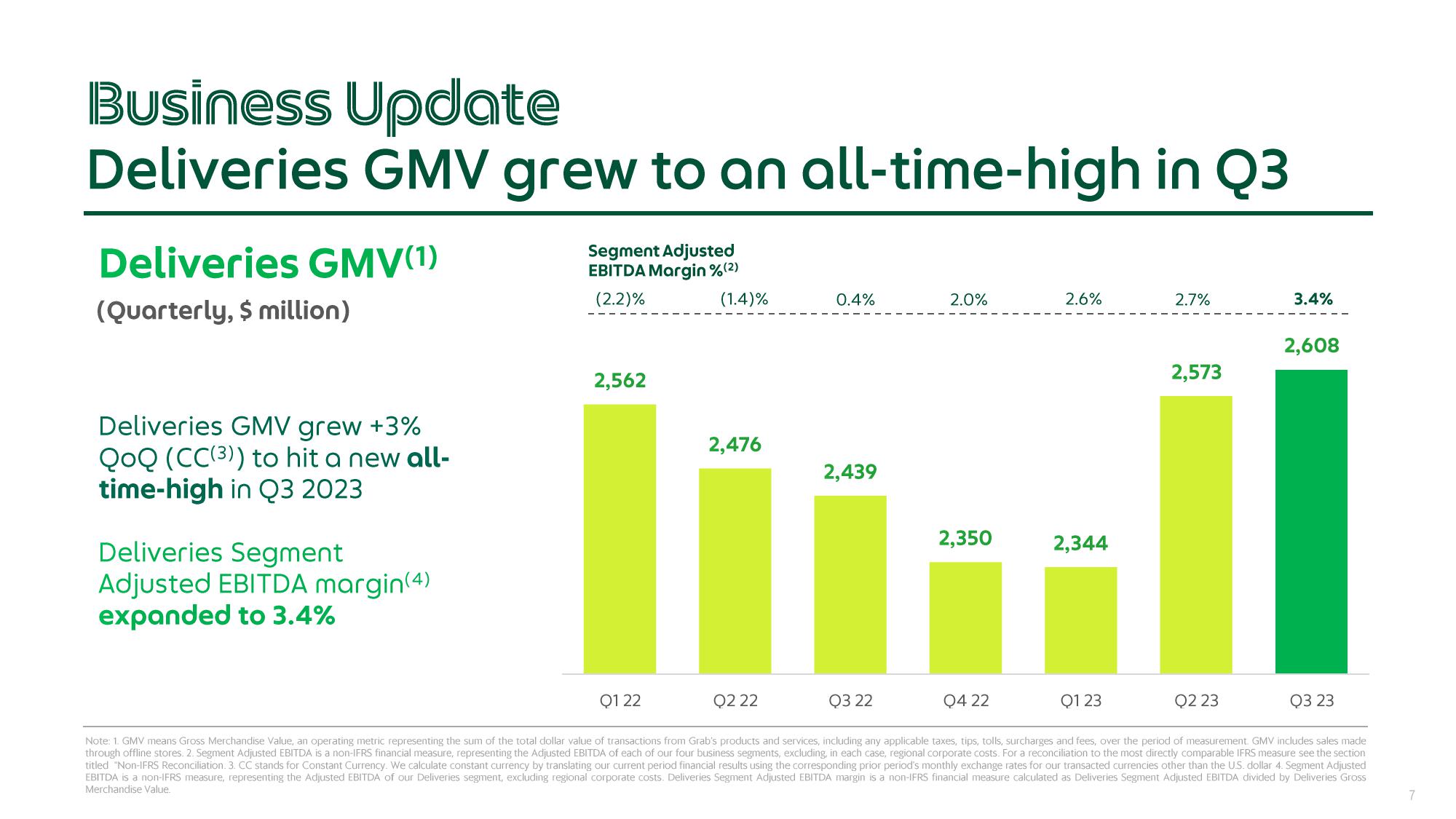

Deliveries GMV grew to an all-time-high in Q3

Deliveries GMV(¹)

(Quarterly, $ million)

Deliveries GMV grew +3%

QOQ (CC(3)) to hit a new all-

time-high in Q3 2023

Deliveries Segment

Adjusted EBITDA margin(4)

expanded to 3.4%

Segment Adjusted

EBITDA Margin % (2)

(2.2)%

2,562

Q1 22

(1.4)%

2,476

Q2 22

0.4%

2,439

2.0%

2,350

Q4 22

2.6%

2,344

Q1 23

2.7%

2,573

1

Q2 23

3.4%

2,608

Q3 22

Q3 23

Note: 1. GMV means Gross Merchandise Value, an operating metric representing the sum of the total dollar value of transactions from Grab's products and services, including any applicable taxes, tips, tolls, surcharges and fees, over the period of measurement. GMV includes sales made

through offline stores. 2. Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs. For a reconciliation to the most directly comparable IFRS measure see the section

titled "Non-IFRS Reconciliation. 3. CC stands for Constant Currency. We calculate constant currency by translating our current period financial results using the corresponding prior period's monthly exchange rates for our transacted currencies other than the U.S. dollar 4. Segment Adjusted

EBITDA is a non-IFRS measure, representing the Adjusted EBITDA of our Deliveries segment, excluding regional corporate costs. Deliveries Segment Adjusted EBITDA margin is a non-IFRS financial measure calculated as Deliveries Segment Adjusted EBITDA divided by Deliveries Gross

Merchandise Value.

7View entire presentation