BlackRock Results Presentation Deck

Operating Income

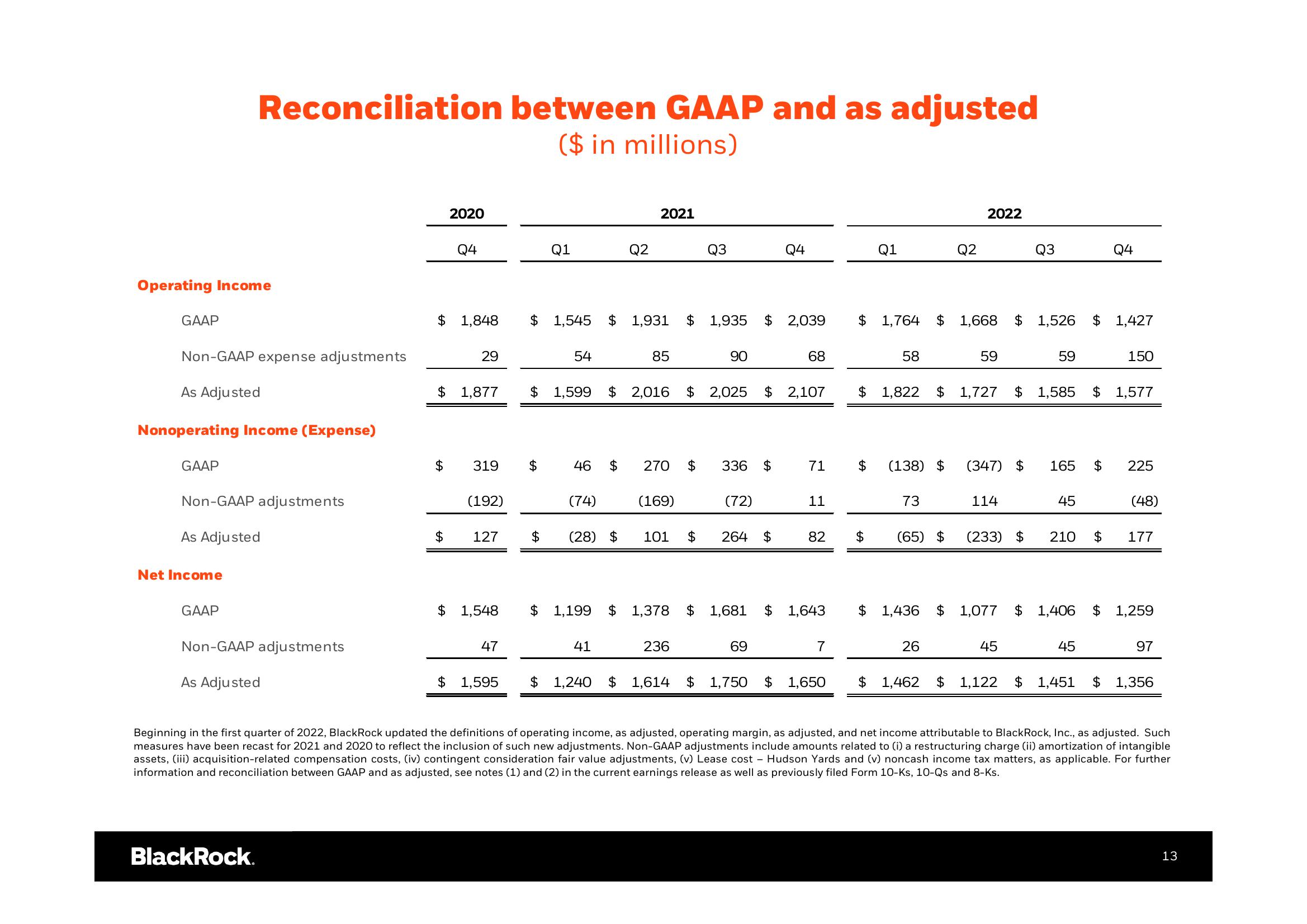

GAAP

Non-GAAP expense adjustments

Reconciliation between GAAP and as adjusted

($ in millions)

As Adjusted

Nonoperating Income (Expense)

GAAP

Non-GAAP adjustments

As Adjusted

Net Income

GAAP

Non-GAAP adjustments

As Adjusted

BlackRock.

2020

$ 1,848

$

Q4

$

29

319

$ 1,877 $ 1,599

(192)

127

$ 1,548

47

$

$ 1,595

$

Q1

$

1,545

54

(74)

$ 1,199

Q2

(28) $

41

2021

$1,931 $ 1,935 $ 2,039

85

46 $ 270 $ 336 $

$ 2,016 $ 2,025

Q3

(169)

90

$1,378 $

236

(72)

101 $ 264 $

Q4

$ 2,107

69

68

71

11

82

1,681 $ 1,643

7

$ 1,240 $ 1,614 $ 1,750 $ 1,650

Q1

$ 1,764

58

$ (138) $

73

$ (65) $

$ 1,436

Q2

$ 1,668 $

26

2022

$ 1,822 $ 1,727 $ 1,585

59

(347) $

114

(233) $

Q3

1,526

45

59

165

45

210

$ 1,077 $ 1,406

45

$

$

Q4

LA

1,427

$ 1,577

150

225

(48)

177

$ 1,259

97

$ 1,462 $ 1,122 $ 1,451 $ 1,356

Beginning in the first quarter of 2022, BlackRock updated the definitions of operating income, as adjusted, operating margin, as adjusted, and net income attributable to BlackRock, Inc., as adjusted. Such

measures have been recast for 2021 and 2020 to reflect the inclusion of such new adjustments. Non-GAAP adjustments include amounts related to (i) a restructuring charge (ii) amortization of intangible

assets, (iii) acquisition-related compensation costs, (iv) contingent consideration fair value adjustments, (v) Lease cost - Hudson Yards and (v) noncash income tax matters, as applicable. For further

information and reconciliation between GAAP and as adjusted, see notes (1) and (2) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks.

13View entire presentation