Grab Results Presentation Deck

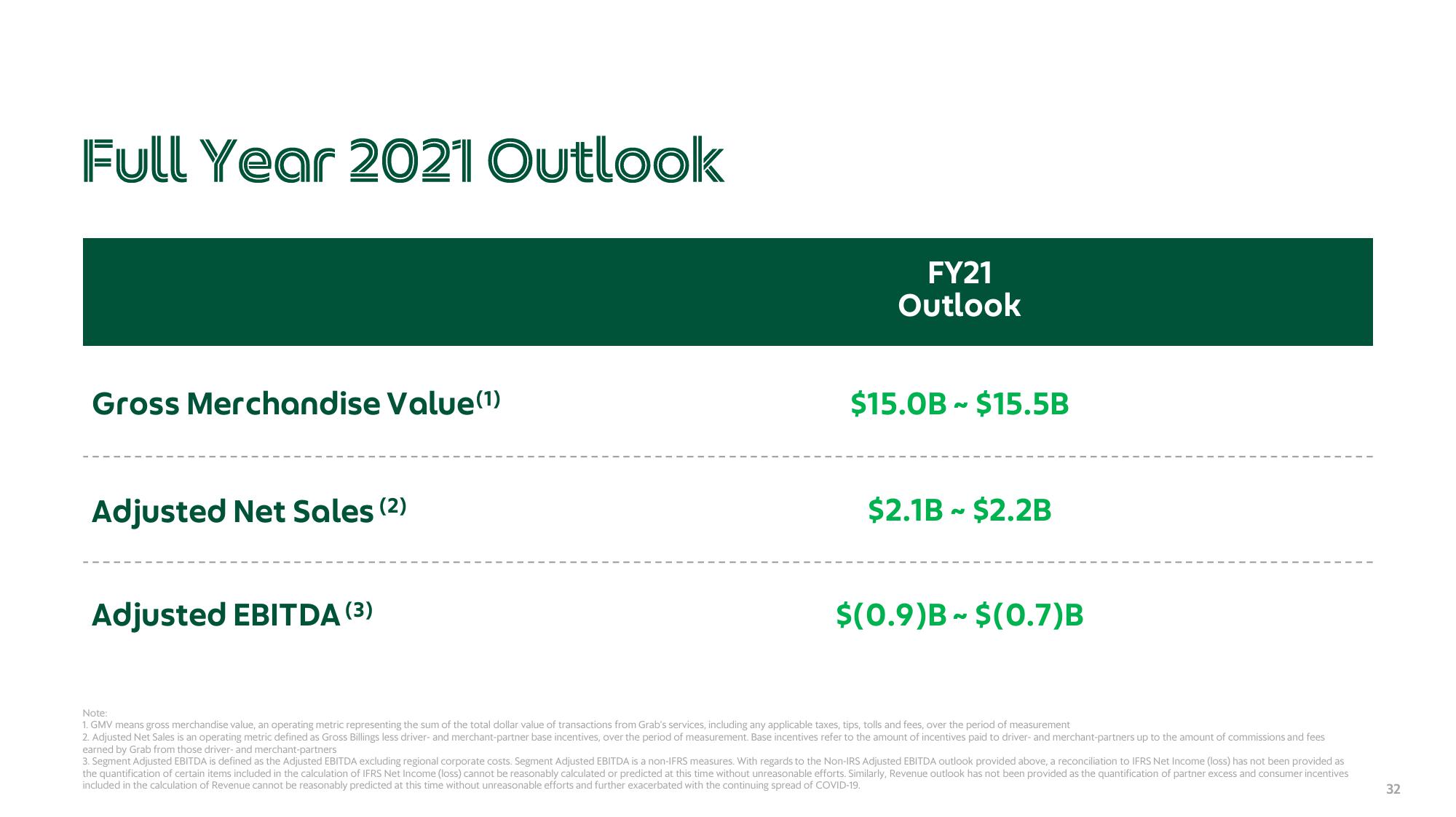

Full Year 2021 Outlook

Gross Merchandise Value(1)

Adjusted Net Sales (2)

Adjusted EBITDA (3)

FY21

Outlook

$15.0B - $15.5B

$2.1B $2.2B

N

$(0.9)B- $(0.7)B

Note:

1. GMV means gross merchandise value, an operating metric representing the sum of the total dollar value of transactions from Grab's services, including any applicable taxes, tips, tolls and fees, over the period of measurement

2. Adjusted Net Sales is an operating metric defined as Gross Billings less driver- and merchant-partner base incentives, over the period of measurement. Base incentives refer to the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees

earned by Grab from those driver- and merchant-partners

3. Segment Adjusted EBITDA is defined as the Adjusted EBITDA excluding regional corporate costs. Segment Adjusted EBITDA is a non-IFRS measures. With regards to the Non-IRS Adjusted EBITDA outlook provided above, a reconciliation to IFRS Net Income (loss) has not been provided as

the quantification of certain items included in the calculation of IFRS Net Income (loss) cannot be reasonably calculated or predicted at this time without unreasonable efforts. Similarly, Revenue outlook has not been provided as the quantification of partner excess and consumer incentives

included in the calculation of Revenue cannot be reasonably predicted at this time without unreasonable efforts and further exacerbated with the continuing spread of COVID-19.

32View entire presentation