Pershing Square Activist Presentation Deck

Wendy's OpCo: Almost No Profitability

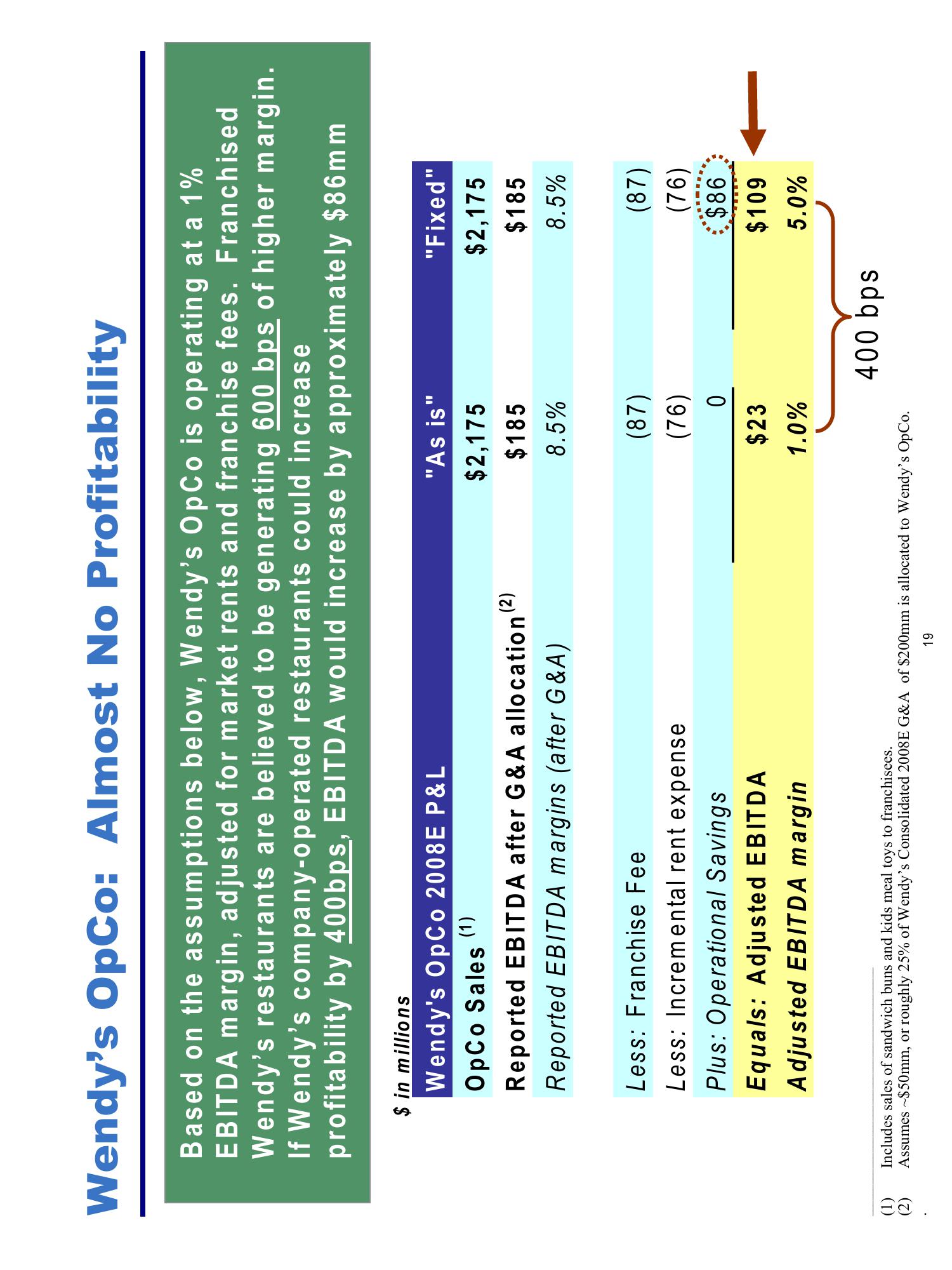

Based on the assumptions below, Wendy's OpCo is operating at a 1%

EBITDA margin, adjusted for market rents and franchise fees. Franchised

Wendy's restaurants are believed to be generating 600 bps of higher margin.

If Wendy's company-operated restaurants could increase

profitability by 400bps, EBITDA would increase by approximately $86mm

(1)

$ in millions

Wendy's OpCo 2008E P&L

OpCo Sales (1)

Reported EBITDA after G&A allocation (²)

Reported EBITDA margins (after G&A)

Less: Franchise Fee

Less: Incremental rent expense

Plus: Operational Savings

Equals: Adjusted EBITDA

Adjusted EBITDA margin

"As is"

$2,175

$185

8.5%

(87)

(76)

0

$23

1.0%

Includes sales of sandwich buns and kids meal toys to franchisees.

Assumes ~$50mm, or roughly 25% of Wendy's Consolidated 2008E G&A of $200mm is allocated to Wendy's OpCo.

19

400 bps

"Fixed"

$2,175

$185

8.5%

(87)

(76)

$86

$109

5.0%View entire presentation