Pershing Square Activist Presentation Deck

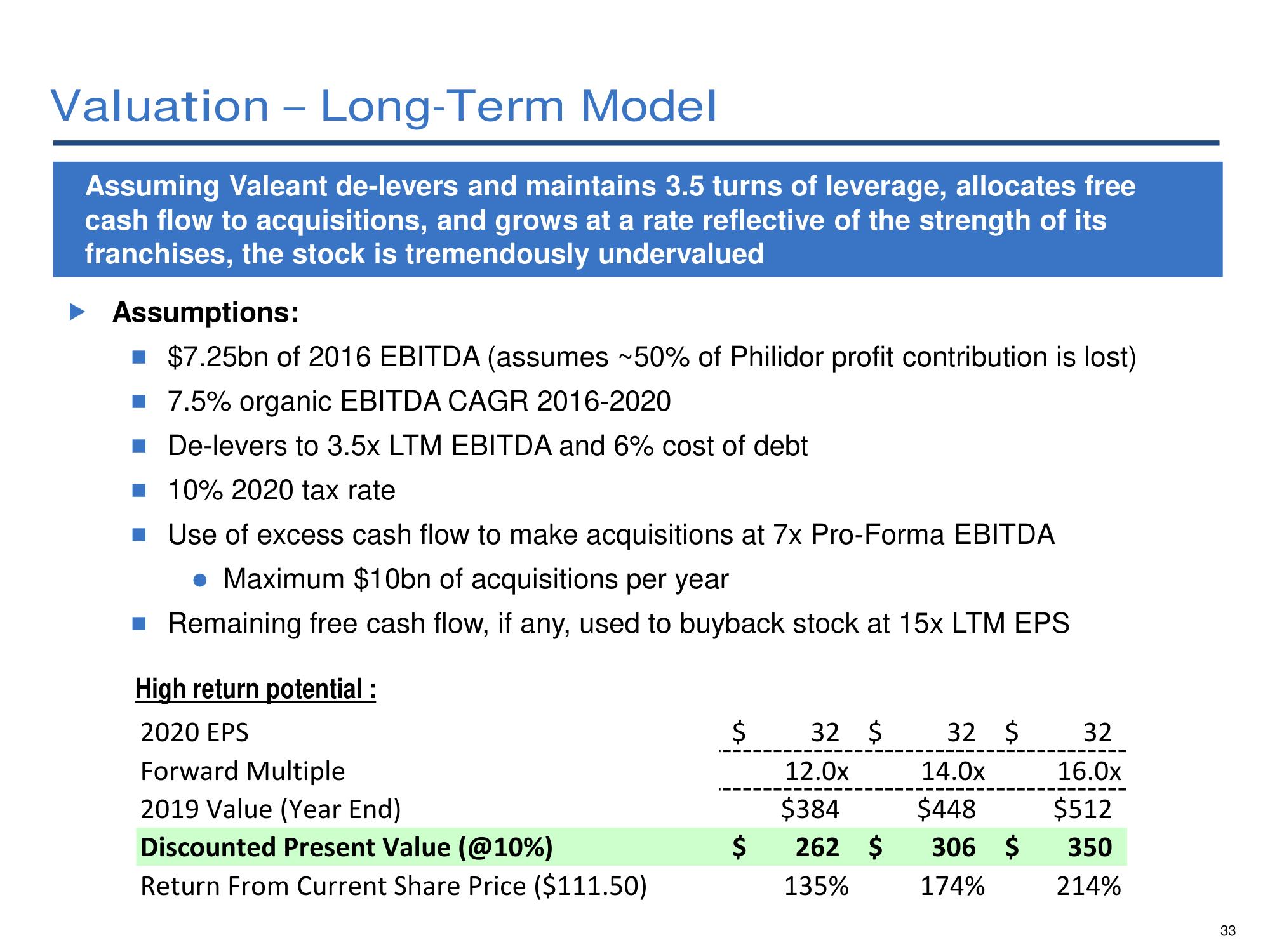

Valuation - Long-Term Model

Assuming Valeant de-levers and maintains 3.5 turns of leverage, allocates free

cash flow to acquisitions, and grows at a rate reflective of the strength of its

franchises, the stock is tremendously undervalued

▸ Assumptions:

$7.25bn of 2016 EBITDA (assumes ~50% of Philidor profit contribution is lost)

■ 7.5% organic EBITDA CAGR 2016-2020

■ De-levers to 3.5x LTM EBITDA and 6% cost of debt

■ 10% 2020 tax rate

■ Use of excess cash flow to make acquisitions at 7x Pro-Forma EBITDA

• Maximum $10bn of acquisitions per year

Remaining free cash flow, if any, used to buyback stock at 15x LTM EPS

High return potential :

2020 EPS

Forward Multiple

2019 Value (Year End)

Discounted Present Value (@10%)

Return From Current Share Price ($111.50)

$

$

32 $

12.0x

$384

262 Ś

135%

32 $

14.0x

$448

306 $

174%

32

16.0x

$512

350

214%

33View entire presentation