OpenText Investor Presentation Deck

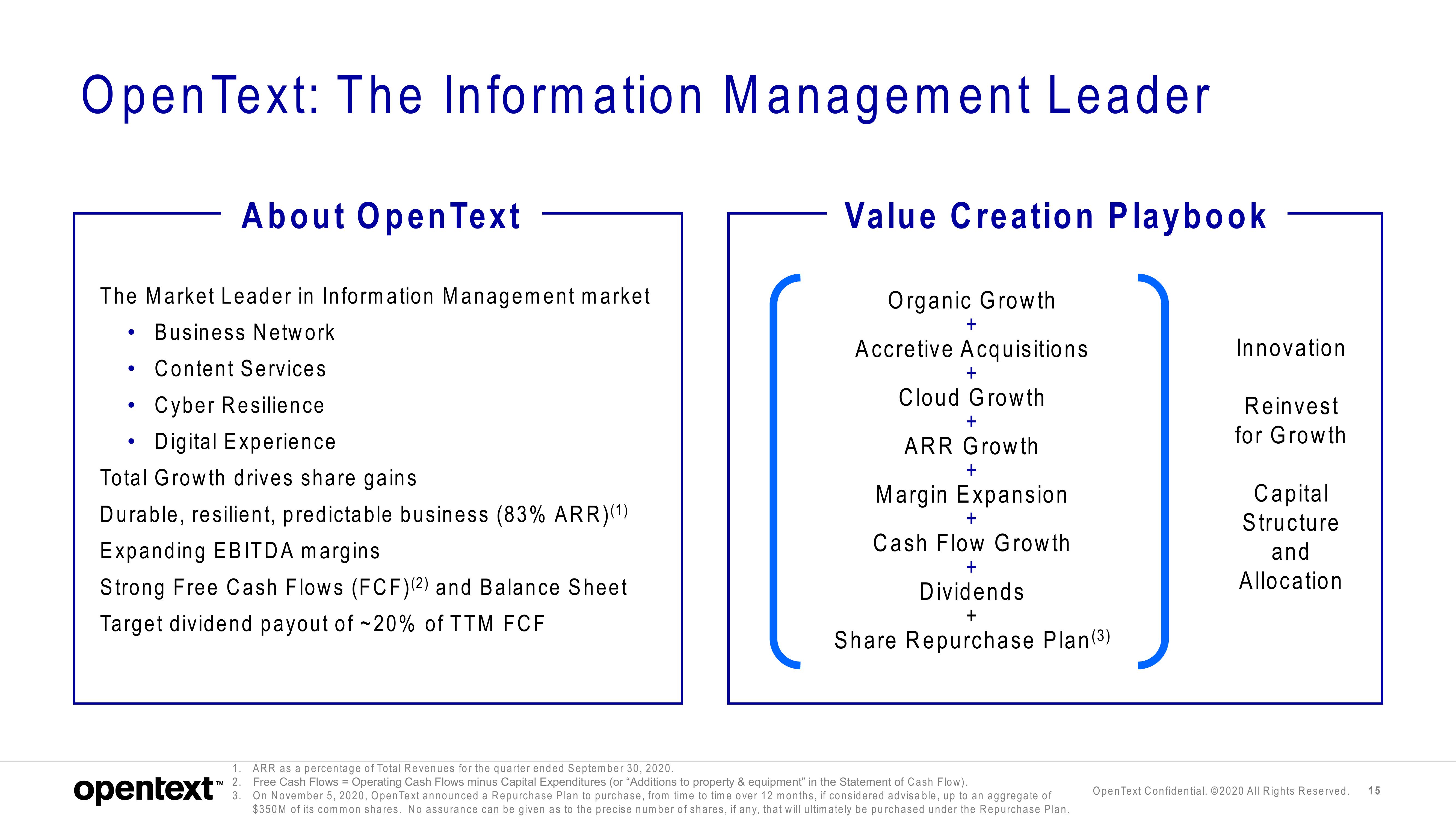

Open Text: The Information Management Leader

The Market Leader in Information Management market

Business Network

Content Services

●

• Cyber Resilience

• Digital Experience

Total Growth drives share gains

Durable, resilient, predictable business (83% ARR) (¹)

Expanding EBITDA margins

Strong Free Cash Flows (FCF) (2) and Balance Sheet

Target dividend payout of ~20% of TTM FCF

●

●

About Open Text

opentext

1

TM 2.

3

Value Creation Playbook

Organic Growth

Accretive Acquisitions

+

+

Cloud Growth

+

ARR Growth

+

Margin Expansion

+

Cash Flow Growth

+

Dividends

+

Share Repurchase Plan (3)

ARR as a percentage of Total Revenues for the quarter ended September 30, 2020.

Free Cash Flows = Operating Cash Flows minus Capital Expenditures (or "Additions to property & equipment" in the Statement of Cash Flow).

On November 5, 2020, Open Text announced a Repurchase Plan to purchase, from time to time over 12 months, if considered advisable, up to an aggregate of

$350M of its common shares. No assurance can be given as to the precise number of shares, if any, that will ultimately be purchased under the Repurchase Plan.

Innovation

Reinvest

for Growth

Capital

Structure

and

Allocation

Open Text Confidential. ©2020 All Rights Reserved.

15View entire presentation