40th Annual J.P. Morgan Healthcare Conference Presentation

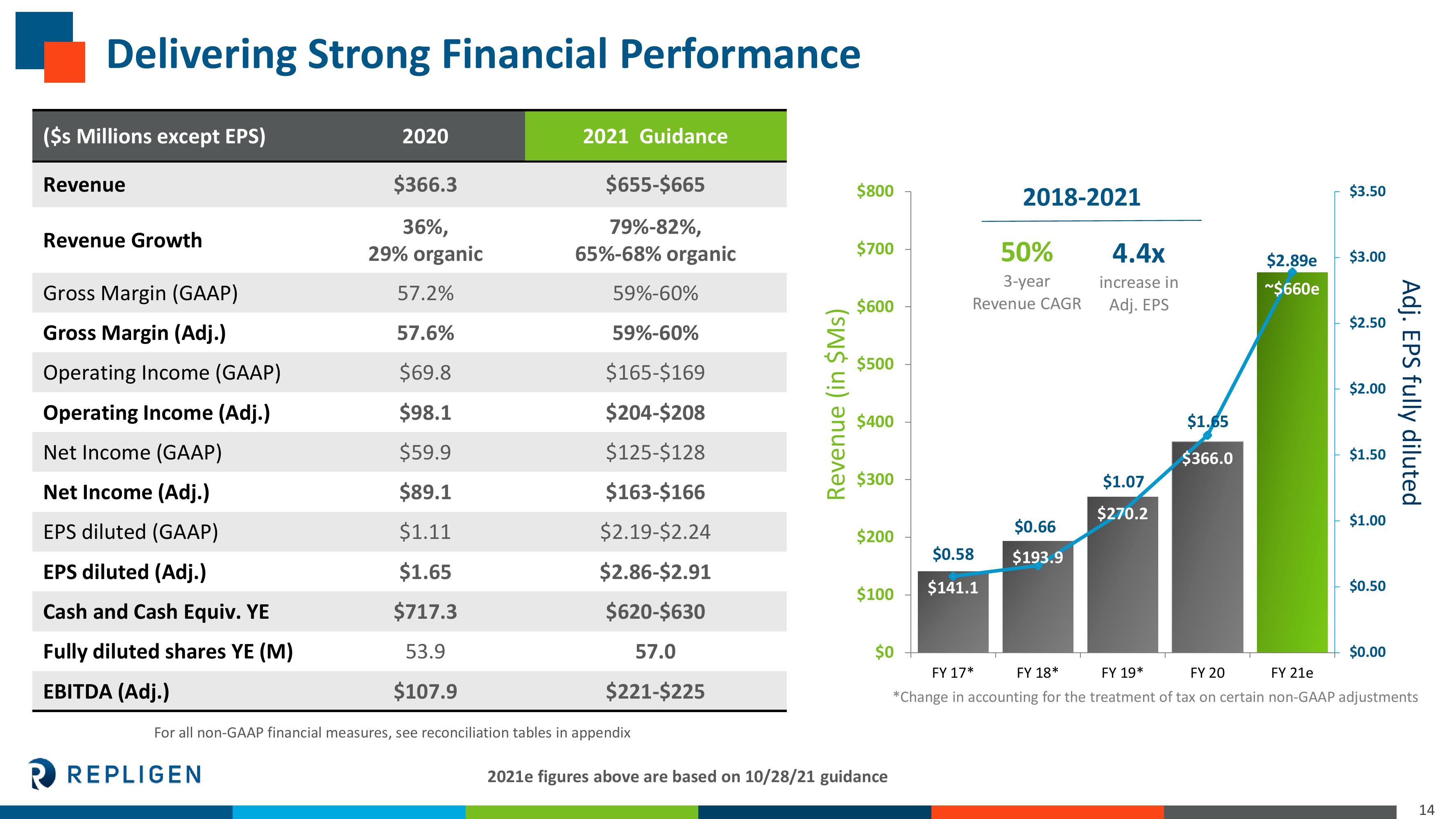

Delivering Strong Financial Performance

($s Millions except EPS)

Revenue

Revenue Growth

Gross Margin (GAAP)

Gross Margin (Adj.)

$366.3

36%,

29% organic

57.2%

57.6%

$69.8

$98.1

$59.9

$89.1

$1.11

$1.65

$717.3

53.9

$107.9

For all non-GAAP financial measures, see reconciliation tables in appendix

Operating Income (GAAP)

Operating Income (Adj.)

Net Income (GAAP)

Net Income (Adj.)

EPS diluted (GAAP)

EPS diluted (Adj.)

Cash and Cash Equiv. YE

Fully diluted shares YE (M)

EBITDA (Adj.)

2020

R REPLIGEN

2021 Guidance

$655-$665

79%-82%,

65%-68% organic

59%-60%

59%-60%

$165-$169

$204-$208

$125-$128

$163-$166

$2.19-$2.24

$2.86-$2.91

$620-$630

57.0

$221-$225

Revenue (in $Ms)

$800

$700

$600

$500

$400

$300

$200

$100

$0

2021e figures above are based on 10/28/21 guidance

2018-2021

50%

3-year

Revenue CAGR

$0.58

$141.1

$0.66

$193.9

4.4x

increase in

Adj. EPS

$1.07

$270.2

$1.65

$366.0

$2.89e

~$660e

$3.50

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50

$0.00

Adj. EPS fully diluted

FY 19*

FY 20

FY 17*

FY 18*

FY 21e

*Change in accounting for the treatment of tax on certain non-GAAP adjustments

14View entire presentation