Allwyn SPAC

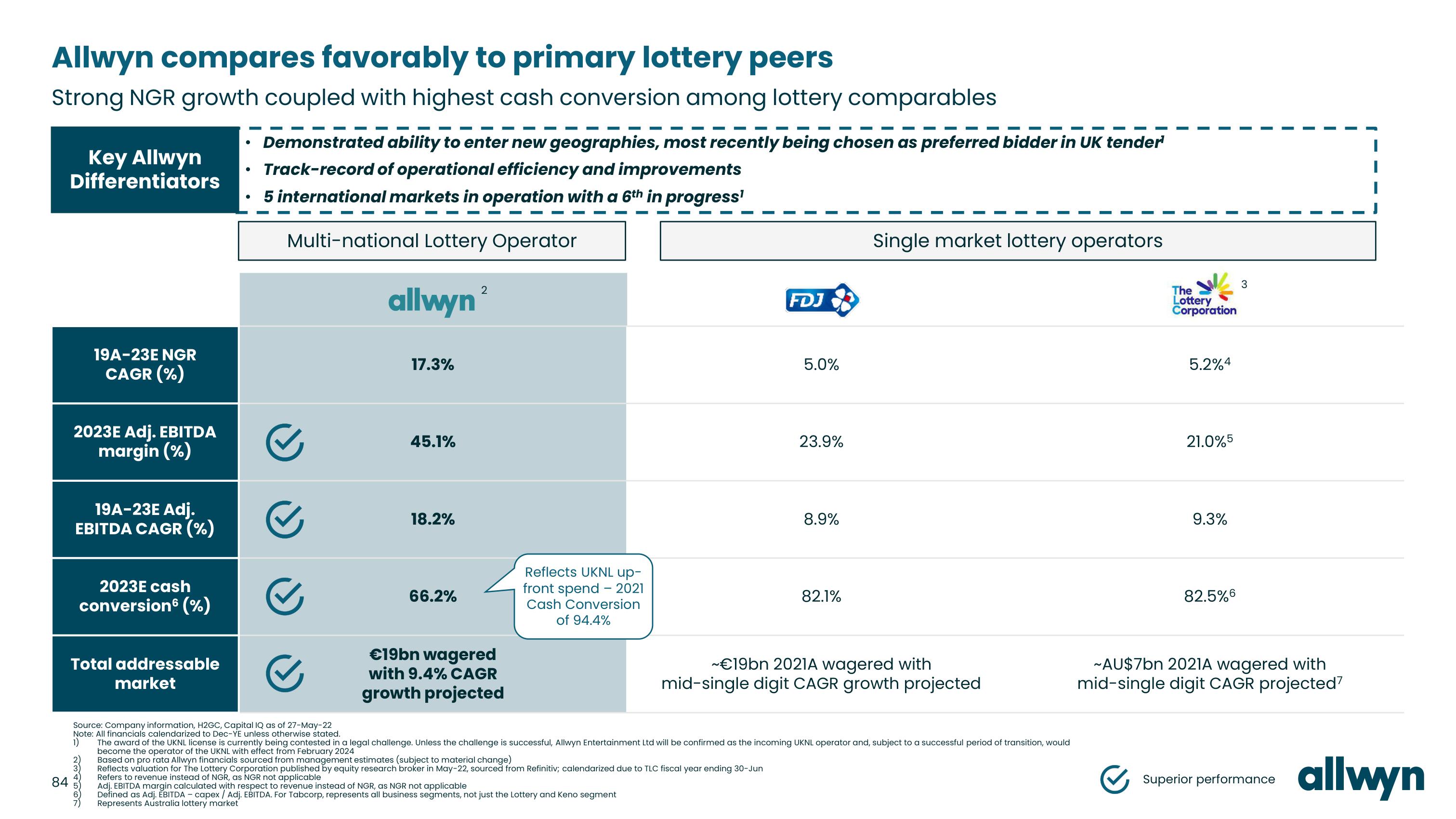

Allwyn compares favorably to primary lottery peers

Strong NGR growth coupled with highest cash conversion among lottery comparables

84

Key Allwyn

Differentiators

2023E Adj. EBITDA

margin (%)

19A-23E NGR

CAGR (%)

19A-23E Adj.

EBITDA CAGR (%)

2023E cash

conversion (%)

Total addressable

market

2)

3)

233667

Demonstrated ability to enter new geographies, most recently being chosen as preferred bidder in UK tender¹

• Track-record of operational efficiency and improvements

●

5 international markets in operation with a 6th in progress¹

Multi-national Lottery Operator

●

✔

✔

✔

✔

allwyn

17.3%

45.1%

18.2%

66.2%

2

€19bn wagered

with 9.4% CAGR

growth projected

Reflects UKNL up-

front spend - 2021

Cash Conversion

of 94.4%

FDJ

Adj. EBITDA margin calculated with respect to revenue instead of NGR, as NGR not applicable

Defined as Adj. EBITDA - capex / Adj. EBITDA.For Tabcorp, represents all business segments, not just the Lottery and Keno segment

Represents Australia lottery market

5.0%

23.9%

8.9%

82.1%

Source: Company information, H2GC, Capital IQ as of 27-May-22

Note: All financials calendarized to Dec-YE unless otherwise stated.

1)

The award of the UKNL license is currently being contested in a legal challenge. Unless the challenge is successful, Allwyn Entertainment Ltd will be confirmed as the incoming UKNL operator and, subject to a successful period of transition, would

become the operator of the UKNL with effect from February 2024

Based on pro rata Allwyn financials sourced from management estimates (subject to material change)

Reflects valuation for The Lottery Corporation published by equity research broker in May-22, sourced from Refinitiv; calendarized due to TLC fiscal year ending 30-Jun

Refers to revenue instead of NGR, as NGR not applicable

Single market lottery operators

~€19bn 2021A wagered with

mid-single digit CAGR growth projected

The

Lottery

Corporation

5.2%4

21.0%5

9.3%

82.5%6

3

~AU$7bn 2021A wagered with

mid-single digit CAGR projected7

✔Superior performance allwynView entire presentation