BlackRock Global Long/Short Credit Absolute Return Credit

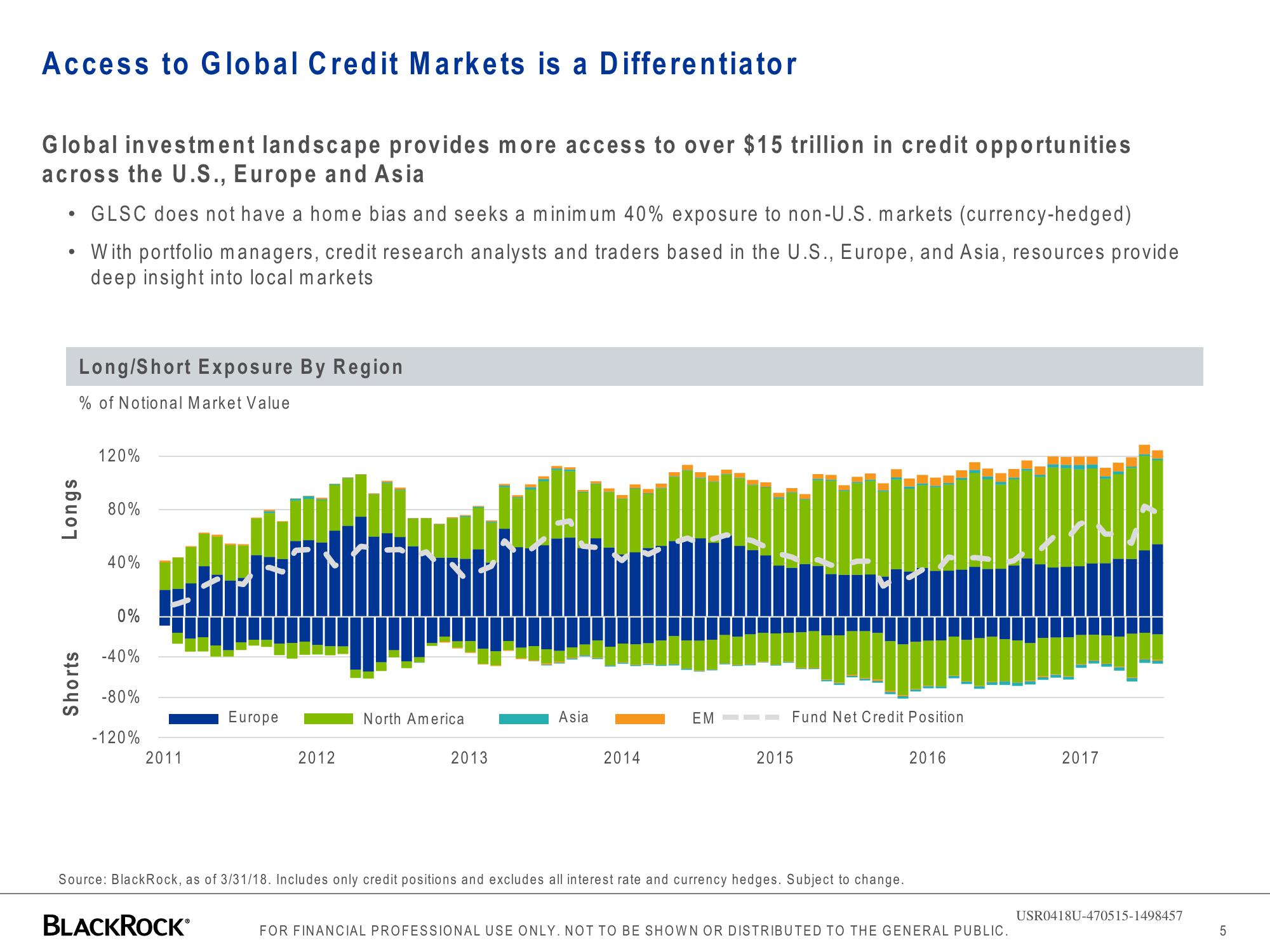

Access to Global Credit Markets is a Differentiator

Global investment landscape provides more access to over $15 trillion in credit opportunities

across the U.S., Europe and Asia

• GLSC does not have a home bias and seeks a minimum 40% exposure to non-U.S. markets (currency-hedged)

With portfolio managers, credit research analysts and traders based in the U.S., Europe, and Asia, resources provide

deep insight into local markets

Long/Short Exposure By Region

% of Notional Market Value

Longs

Shorts

120%

80%

40%

0%

-40%

-80%

-120%

2011

Europe

BLACKROCK

2012

North America

2013

Asia

2014

EM

Fund Net Credit Position

2015

Source: BlackRock, as of 3/31/18. Includes only credit positions and excludes all interest rate and currency hedges. Subject to change.

2016

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

2017

USR0418U-470515-1498457

5View entire presentation