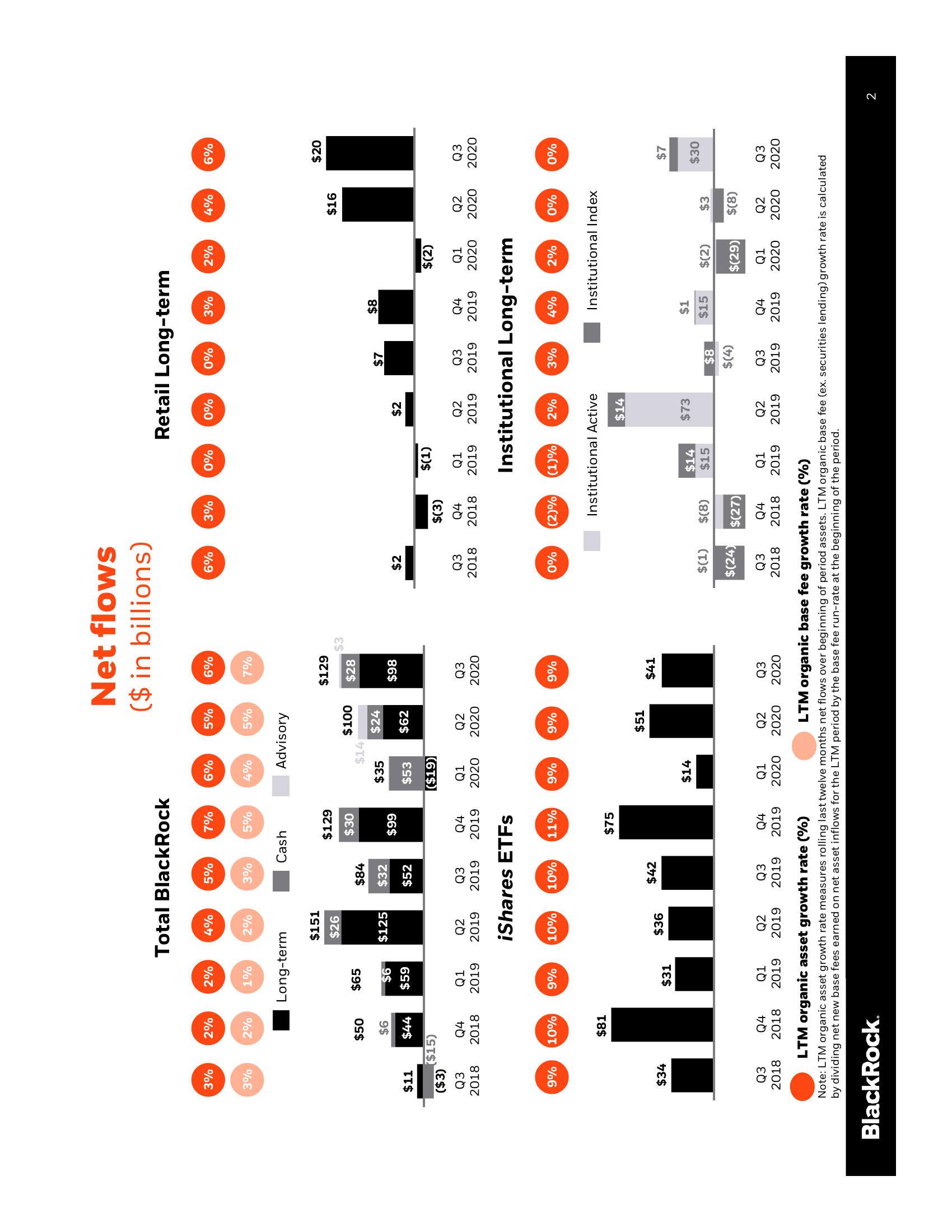

BlackRock Results Presentation Deck

3%

3%

$11

($3)

Q3

2018

9%

2%

$34

2%

($15)

$50

$6

$44

Q4

2018

10%

$81

2%

1%

$65

$6

$59

Long-term

Q1

2019

9%

Total BlackRock

$31

4%

2%

$151

$26

$125

10%

5%

$36

3%

$84

$32

$52

10%

7%

Cash

5%

Q2 Q3 Q4

2019 2019 2019

iShares ETFs

$42

$129

$30

$99

11%

$75

Q3

Q1

Q2

Q3

Q4

Q4

2018 2018 2019 2019 2019 2019

6%

4%

$141

$35

$53

($19)

Advisory

Q1

2020

9%

$14

Q1

2020

Net flows

($ in billions)

5%

5%

$100

$24

$62

Q2

2020

9%

$51

Q2

2020

6%

7%

$129

$28

$98

Q3

2020

9%

$41

Q3

2020

$3

6%

$2

Q3

2018

0%

$(1)

$(24)

Q3

2018

3%

$(3)

Q4

2018

(2)%

0%

$(8)

$(1)

Retail Long-term

0%

$2

$14

$15

(1)% 2%

Institutional Active

$14

0%

$73

$7

Q1

Q2

Q3

Q4

Q1

2019 2019 2019 2019 2020

$(27)

Q4 Q1 Q2

2018 2019 2019

Institutional Long-term

3%

3%

$8

$(4)

$8

Q3

2019

2%

4%

$(2)

$1

$15

2%

4%

$16

0%

Institutional Index

Q2

Q3

2020 2020

6%

$20

$3

0%

$7

$30

$(2)

$(29) $(8)

Q4 Q1 Q2 Q3

2019 2020 2020 2020

LTM organic base fee growth rate (%)

LTM organic asset growth rate (%)

Note: LTM organic asset growth rate measures rolling last twelve months net flows over beginning of period assets. LTM organic base fee (ex. securities lending) growth rate is calculated

by dividing net new base fees earned on net asset inflows for the LTM period by the base fee run-rate at the beginning of the period.

BlackRock.

2View entire presentation