Grab Investor Day Presentation Deck

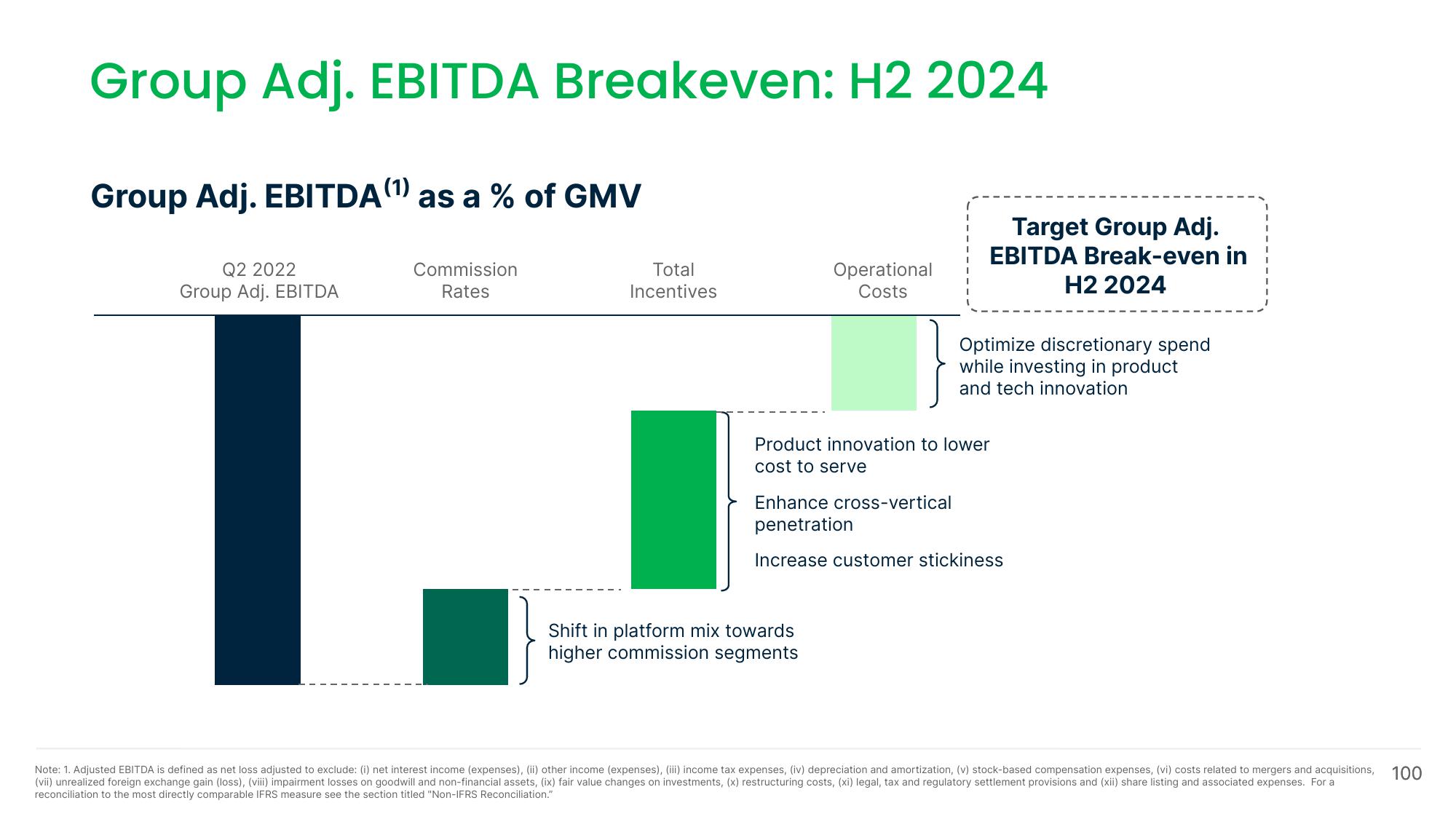

Group Adj. EBITDA Breakeven: H2 2024

Group Adj. EBITDA(1) as a % of GMV

Q2 2022

Group Adj. EBITDA

Commission

Rates

Total

Incentives

Operational

Costs

Target Group Adj.

EBITDA Break-even in

H2 2024

Shift in platform mix towards

higher commission segments

Optimize discretionary spend

while investing in product

and tech innovation

Product innovation to lower

cost to serve

Enhance cross-vertical

penetration

Increase customer stickiness

Note: 1. Adjusted EBITDA is defined as net loss adjusted to exclude: (i) net interest income (expenses), (ii) other income (expenses), (iii) income tax expenses, (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, 100

(vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses. For a

reconciliation to the most directly comparable IFRS measure see the section titled "Non-IFRS Reconciliation."View entire presentation