Pershing Square Activist Presentation Deck

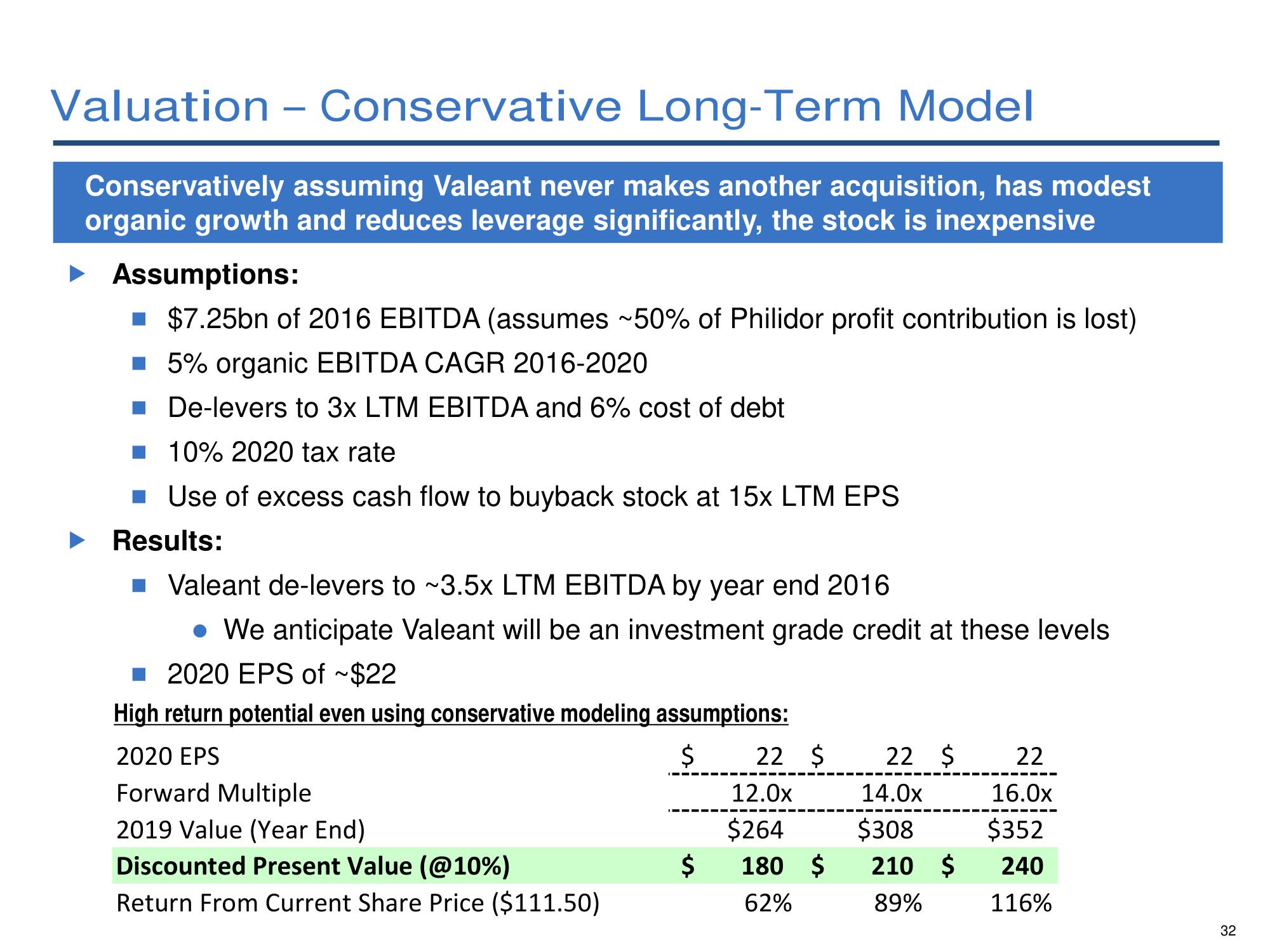

Valuation - Conservative Long-Term Model

Conservatively assuming Valeant never makes another acquisition, has modest

organic growth and reduces leverage significantly, the stock is inexpensive

▸ Assumptions:

■ $7.25bn of 2016 EBITDA (assumes ~50% of Philidor profit contribution is lost)

■ 5% organic EBITDA CAGR 2016-2020

De-levers to 3x LTM EBITDA and 6% cost of debt

■ 10% 2020 tax rate

■ Use of excess cash flow to buyback stock at 15x LTM EPS

Results:

■ Valeant de-levers to ~3.5x LTM EBITDA by year end 2016

• We anticipate Valeant will be an investment grade credit at these levels

■2020 EPS of ~$22

High return potential even using conservative modeling assumptions:

2020 EPS

$

Forward Multiple

2019 Value (Year End)

Discounted Present Value (@10%)

Return From Current Share Price ($111.50)

$

22 $

12.0x

$264

180 $

62%

22 $ 22

16.0x

$352

240

116%

14.0x

$308

210 $

89%

32View entire presentation