Barclays Investment Banking Pitch Book

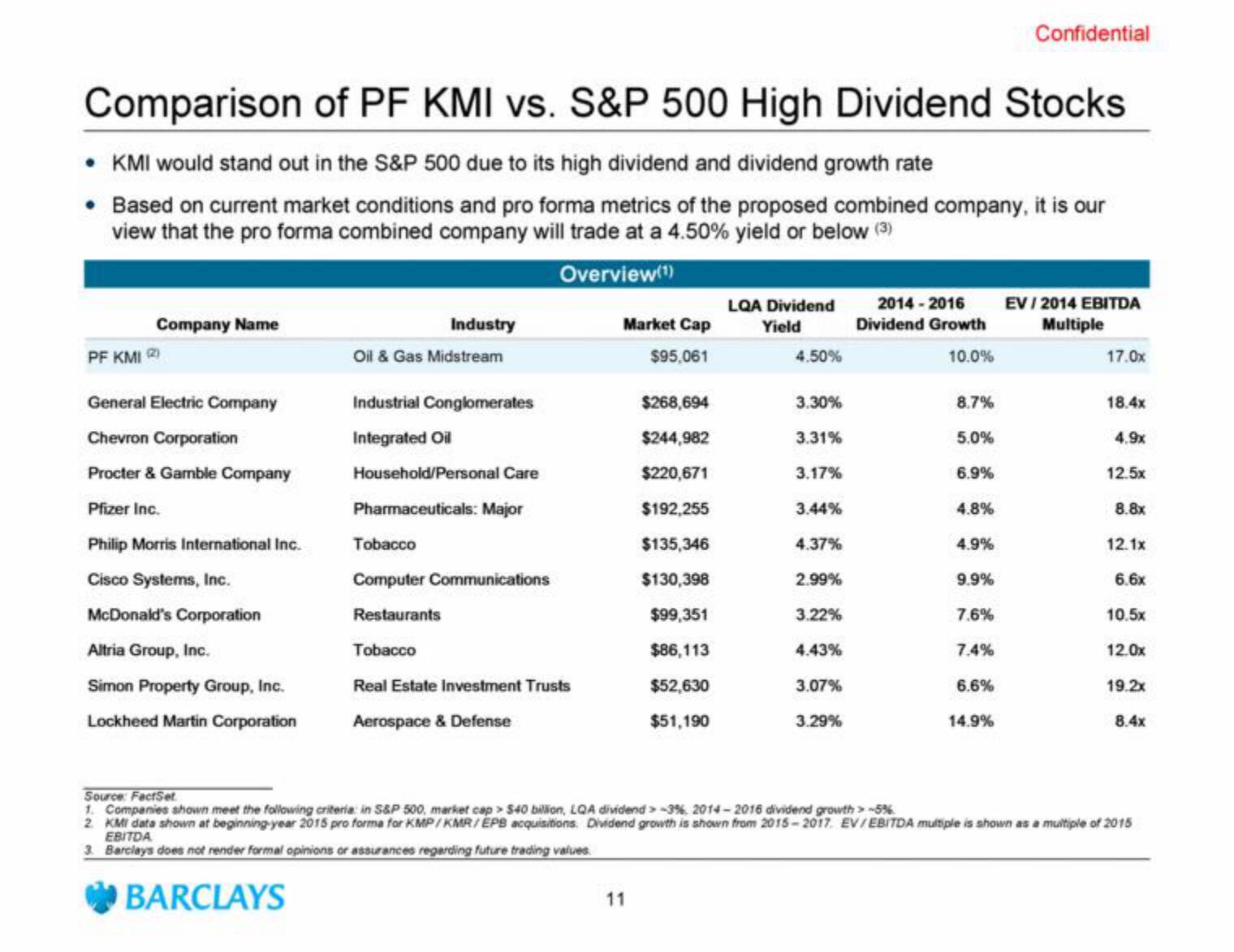

Comparison of PF KMI vs. S&P 500 High Dividend Stocks

• KMI would stand out in the S&P 500 due to its high dividend and dividend growth rate

• Based on current market conditions and pro forma metrics of the proposed combined company, it is our

view that the pro forma combined company will trade at a 4.50% yield or below (3)

Overview(¹)

Company Name

PF KMI 2

General Electric Company

Chevron Corporation

Procter & Gamble Company

Pfizer Inc.

Philip Morris International Inc.

Cisco Systems, Inc.

McDonald's Corporation

Altria Group, Inc.

Simon Property Group, Inc.

Lockheed Martin Corporation

Industry

Oil & Gas Midstream

Industrial Conglomerates

Integrated Oil

Household/Personal Care

Pharmaceuticals: Major

Tobacco

Computer Communications

Restaurants

Tobacco

Real Estate Investment Trusts

Aerospace & Defense

Market Cap

$95,061

$268,694

$244,982

$220,671

$192,255

$135,346

$130,398

$99,351

$86,113

$52,630

$51,190

11

LQA Dividend

Yield

4.50%

3.30%

3.31%

3.17%

3.44%

4.37%

2.99%

3.22%

4.43%

3.07%

3.29%

2014-2016

Dividend Growth

10.0%

8.7%

5.0%

6.9%

4.8%

4.9%

9.9%

7.6%

7.4%

6.6%

Confidential

14.9%

EV / 2014 EBITDA

Multiple

17.0x

18.4x

4.9x

12.5x

8.8x

12.1x

6.6x

10.5×

12.0x

19.2x

8.4x

Source: FactSet

1. Companies shown meet the following criteria in S&P 500, market cap> $40 billion, LQA dividend -3%, 2014-2016 dividend growth > -5%

2 KMI data shown at beginning year 2015 pro forma for KMP/KMR/EPS acquisitions. Dividend growth is shown from 2015-2017 EV/EBITDA multiple is shown as a multiple of 2015

EBITDA

3. Barclays does not render formal opinions or assurances regarding future trading values.

BARCLAYSView entire presentation