TPG Results Presentation Deck

Other Operating Metrics

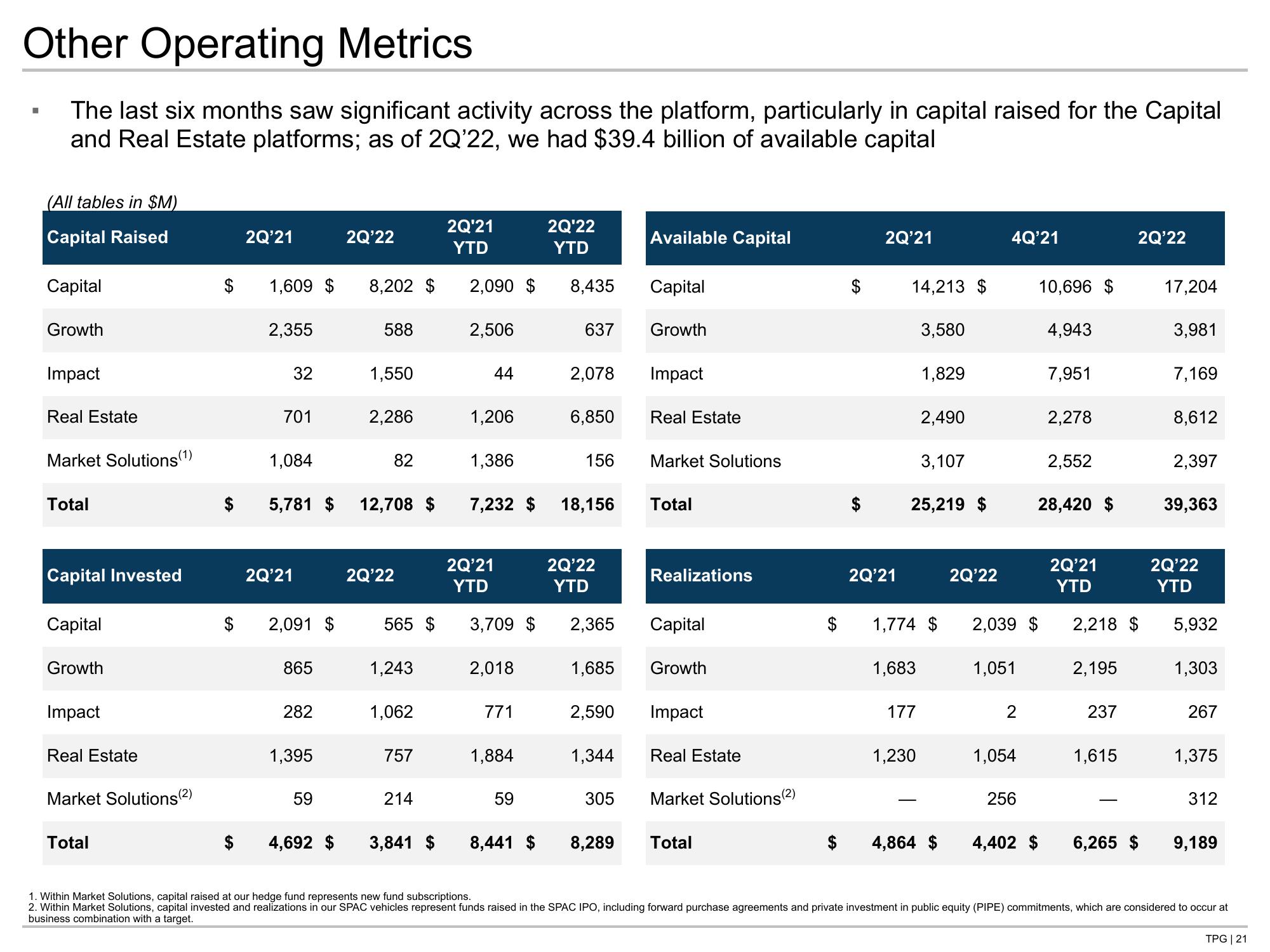

The last six months saw significant activity across the platform, particularly in capital raised for the Capital

and Real Estate platforms; as of 2Q'22, we had $39.4 billion of available capital

(All tables in $M)

Capital Raised

Capital

Growth

Impact

Real Estate

Market Solutions (1)

Total

Capital Invested

Capital

Growth

Impact

Real Estate

Market Solutions (²)

Total

2Q'21

1,609 $ 8,202 $

2,355

32

701

1,084

2Q'21

2,091 $

865

5,781 $ 12,708 $

282

2Q'22

1,395

59

588

1,550

2,286

82

2Q'22

565 $

1,243

1,062

757

214

4,692 $ 3,841 $

2Q'21

YTD

2,090 $

2,506

44

1,206

1,386

7,232 $

2Q'21

YTD

3,709 $

2,018

771

1,884

59

8,441 $

2Q'22

YTD

8,435

637

2,078

6,850

156

18,156

2Q'22

YTD

2,365

1,685

1,344

305

Available Capital

8,289

Capital

Growth

Impact

Real Estate

Market Solutions

Total

Realizations

2,590 Impact

Capital

Growth

Real Estate

Market Solutions (2)

Total

2Q'21

2Q'21

14,213 $

1,683

3,580

177

1,829

25,219 $

1,230

2,490

3,107

$ 1,774 $ 2,039 $

2Q'22

4,864 $

4Q'21

1,051

1,054

256

10,696 $

4,943

7,951

2,278

2,552

28,420 $

2Q'21

YTD

2,218 $

2,195

237

2Q'22

1,615

4,402 $ 6,265 $

17,204

3,981

7,169

8,612

2,397

39,363

2Q'22

YTD

5,932

1,303

267

1,375

312

9,189

1. Within Market Solutions, capital raised at our hedge fund represents new fund subscriptions.

2. Within Market Solutions, capital invested and realizations in our SPAC vehicles represent funds raised in the SPAC IPO, including forward purchase agreements and private investment in public equity (PIPE) commitments, which are considered to occur at

business combination with a target.

TPG | 21View entire presentation