Meyer Burger Investor Presentation

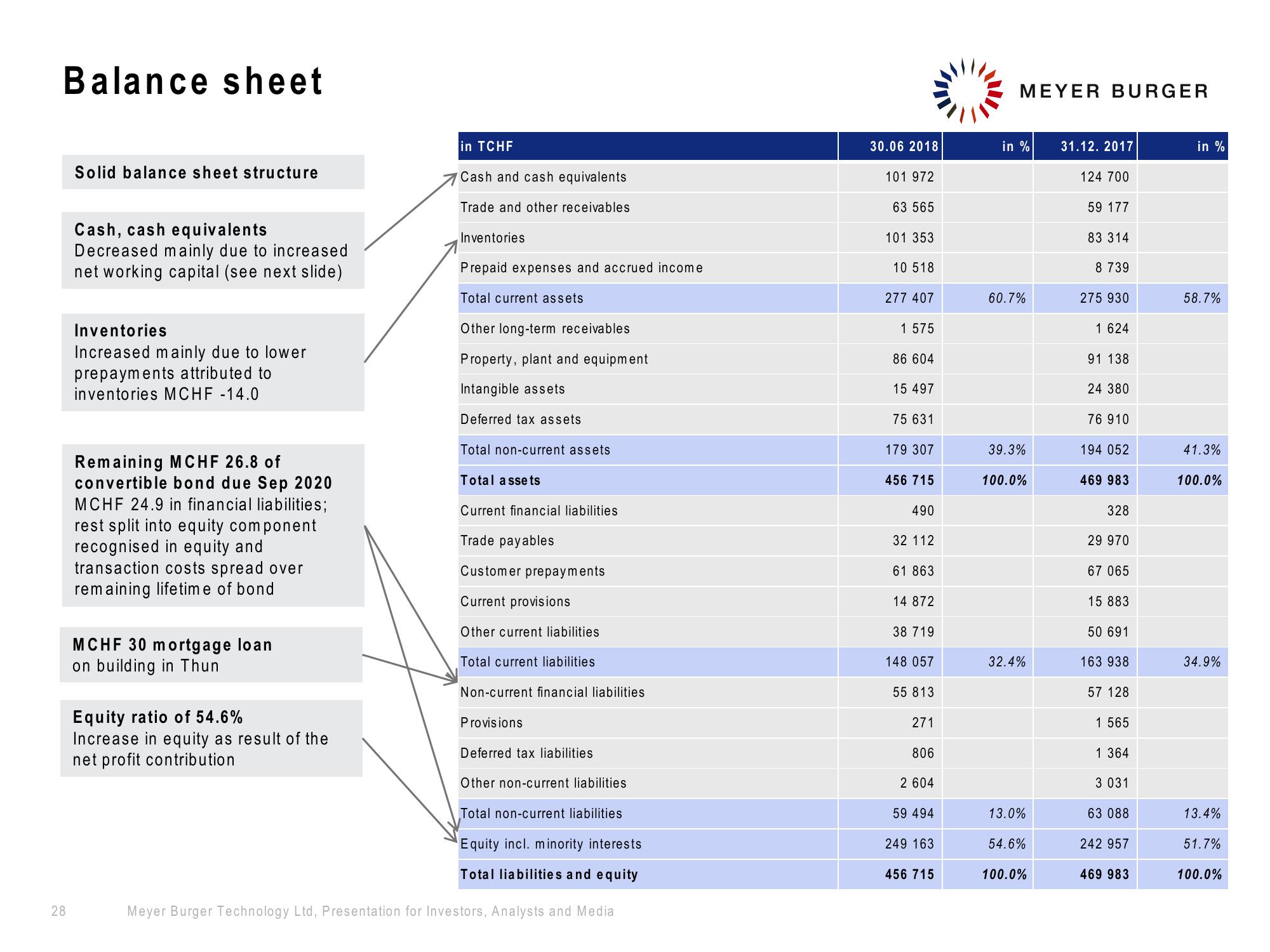

Balance sheet

MEYER BURGER

Solid balance sheet structure

in TCHF

Cash and cash equivalents

30.06 2018

in %

31.12. 2017

in %

101 972

124 700

Trade and other receivables

63 565

59 177

Cash, cash equivalents

Decreased mainly due to increased

net working capital (see next slide)

Inventories

101 353

83 314

Prepaid expenses and accrued income

10 518

8 739

Total current assets

277 407

60.7%

275 930

58.7%

Inventories

Increased mainly due to lower

prepayments attributed to

inventories MCHF -14.0

Other long-term receivables

1 575

1 624

Property, plant and equipment

86 604

91 138

Intangible assets

15 497

24 380

Deferred tax assets

75 631

76 910

Total non-current assets

179 307

39.3%

194 052

41.3%

Remaining MCHF 26.8 of

convertible bond due Sep 2020

MCHF 24.9 in financial liabilities;

rest split into equity component

recognised in equity and

transaction costs spread over

remaining lifetime of bond

MCHF 30 mortgage loan

on building in Thun

Equity ratio of 54.6%

Increase in equity as result of the

net profit contribution

Current provisions

Other current liabilities

Total assets

456 715

100.0%

469 983

100.0%

Current financial liabilities

490

328

Trade payables

32 112

29 970

Customer prepayments

61 863

67 065

14 872

15 883

38 719

50 691

Total current liabilities

148 057

32.4%

163 938

34.9%

Non-current financial liabilities

55 813

57 128

Provisions

271

1 565

Deferred tax liabilities

806

1 364

Other non-current liabilities

2 604

3 031

Total non-current liabilities

59 494

13.0%

63 088

13.4%

Equity incl. minority interests

249 163

54.6%

242 957

51.7%

Total liabilities and equity

456 715

100.0%

469 983

100.0%

28

Meyer Burger Technology Ltd, Presentation for Investors, Analysts and MediaView entire presentation