FY 2018 Fourth Quarter Earnings Call

Factors impacting ADNT's Q4 GAAP results

ADIENT

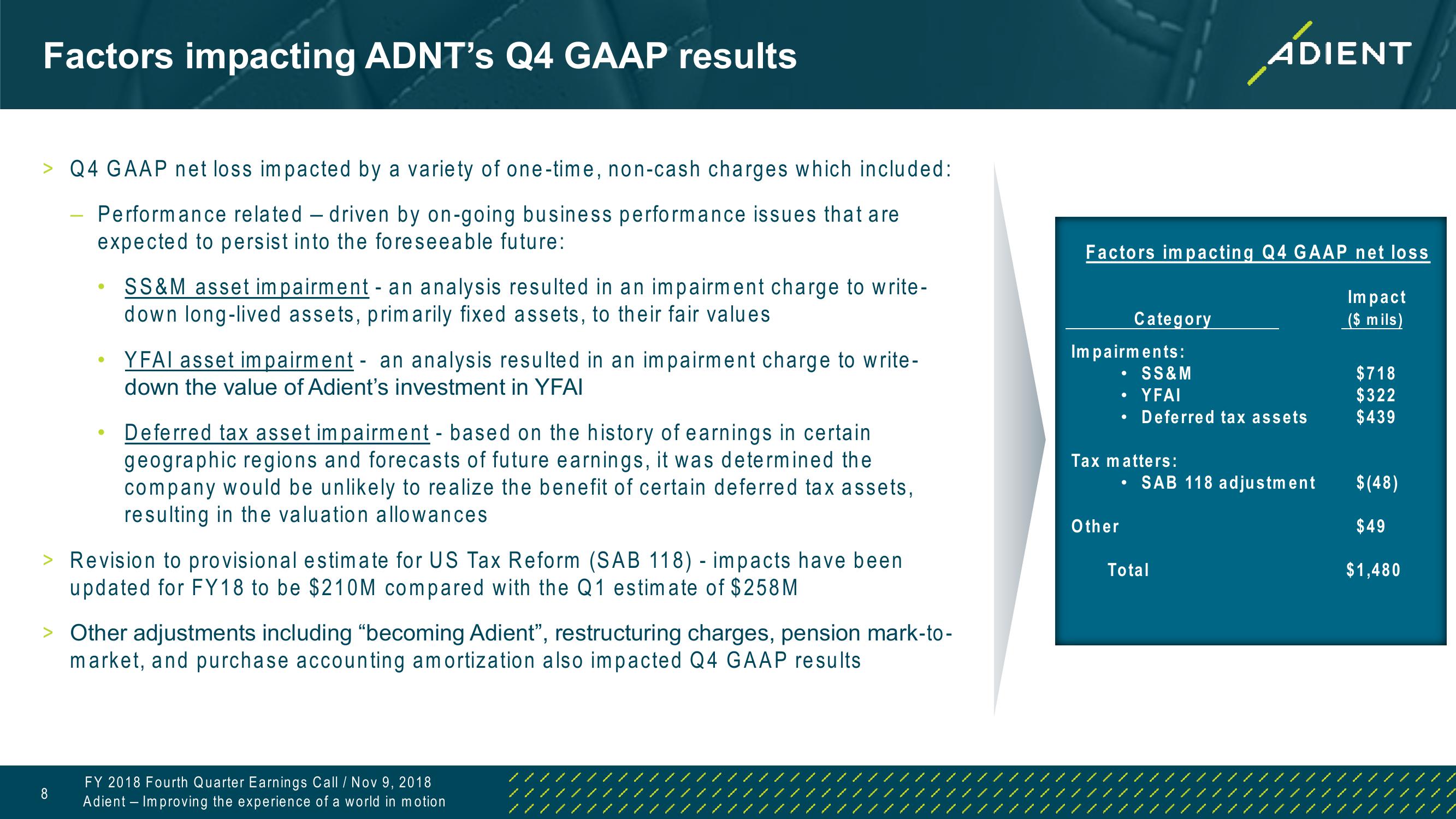

> Q4 GAAP net loss impacted by a variety of one-time, non-cash charges which included:

Performance related driven by on-going business performance issues that are

expected to persist into the foreseeable future:

SS&M asset impairment - an analysis resulted in an impairment charge to write-

down long-lived assets, primarily fixed assets, to their fair values

YFAI asset impairment - an analysis resulted in an impairment charge to write-

down the value of Adient's investment in YFAI

Deferred tax asset impairment - based on the history of earnings in certain

geographic regions and forecasts of future earnings, it was determined the

company would be unlikely to realize the benefit of certain deferred tax assets,

resulting in the valuation allowances

> Revision to provisional estimate for US Tax Reform (SAB 118) - impacts have been

updated for FY18 to be $210M compared with the Q1 estimate of $258M

> Other adjustments including "becoming Adient", restructuring charges, pension mark-to-

market, and purchase accounting amortization also impacted Q4 GAAP results

Factors impacting Q4 GAAP net loss

Category

Impairments:

Impact

($ mils)

•

•

SS&M

YFAI

$718

$322

Deferred tax assets

$439

Tax matters:

SAB 118 adjustment

$(48)

$49

$1,480

Other

•

Total

FY 2018 Fourth Quarter Earnings Call / Nov 9, 2018

8

Adient - Improving the experience of a world in motionView entire presentation