LegalZoom.com Results Presentation Deck

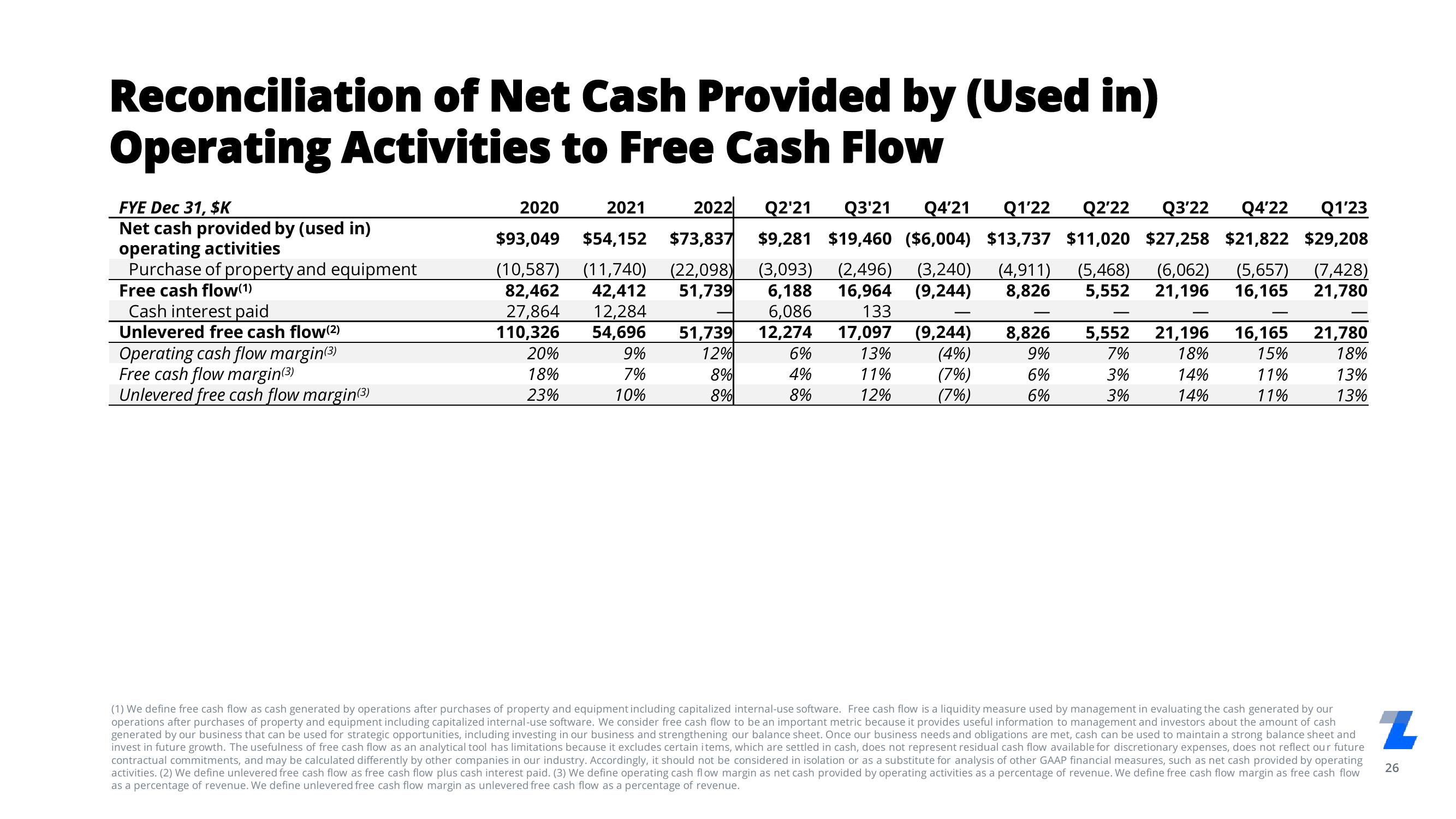

Reconciliation of Net Cash Provided by (Used in)

Operating Activities to Free Cash Flow

FYE Dec 31, $K

Net cash provided by (used in)

operating activities

Purchase of property and equipment

Free cash flow(1)

Cash interest paid

Unlevered free cash flow(²2)

Operating cash flow margin(3)

Free cash flow margin(³)

Unlevered free cash flow margin(3)

2020

2021 2022 Q2¹21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23

$93,049 $54,152 $73,837 $9,281 $19,460 ($6,004) $13,737 $11,020 $27,258 $21,822 $29,208

(10,587) (11,740) (22,098) (3,093) (2,496) (3,240) (4,911) (5,468) (6,062) (5,657)

82,462 42,412 51,739 6,188 16,964 (9,244) 8,826 5,552 21,196 16,165

27,864 12,284

6,086

133

110,326 54,696 51,739 12,274 17,097

20%

12%

6% 13%

9%

18%

7%

8%

4%

11%

23%

10%

8%

8%

12%

(9,244)

(4%)

(7%)

(7%)

8,826

9%

6%

6%

5,552 21,196

7%

18%

3%

14%

3%

14%

16,165

15%

11%

11%

(7,428)

21,780

21,780

18%

13%

13%

(1) We define free cash flow as cash generated by operations after purchases of property and equipment including capitalized internal-use software. Free cash flow is a liquidity measure used by management in evaluating the cash generated by our

operations after purchases of property and equipment including capitalized internal-use software. We consider free cash flow to be an important metric because it provides useful information to management and investors about the amount of cash

generated by our business that can be used for strategic opportunities, including investing in our business and strengthening our balance sheet. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and

invest in future growth. The usefulness of free cash flow as an analytical tool has limitations because it excludes certain items, which are settled in cash, does not represent residual cash flow available for discretionary expenses, does not reflect our future

contractual commitments, and may be calculated differently by other companies in our industry. Accordingly, it should not be considered in isolation or as a substitute for analysis of other GAAP financial measures, such as net cash provided by operating

activities. (2) We define unlevered free cash flow as free cash flow plus cash interest paid. (3) We define operating cash flow margin as net cash provided by operating activities as a percentage of revenue. We define free cash flow margin as free cash flow

as a percentage of revenue. We define unlevered free cash flow margin as unlevered free cash flow as a percentage of revenue.

Z

26View entire presentation