Second Quarter 2017 Conference Call

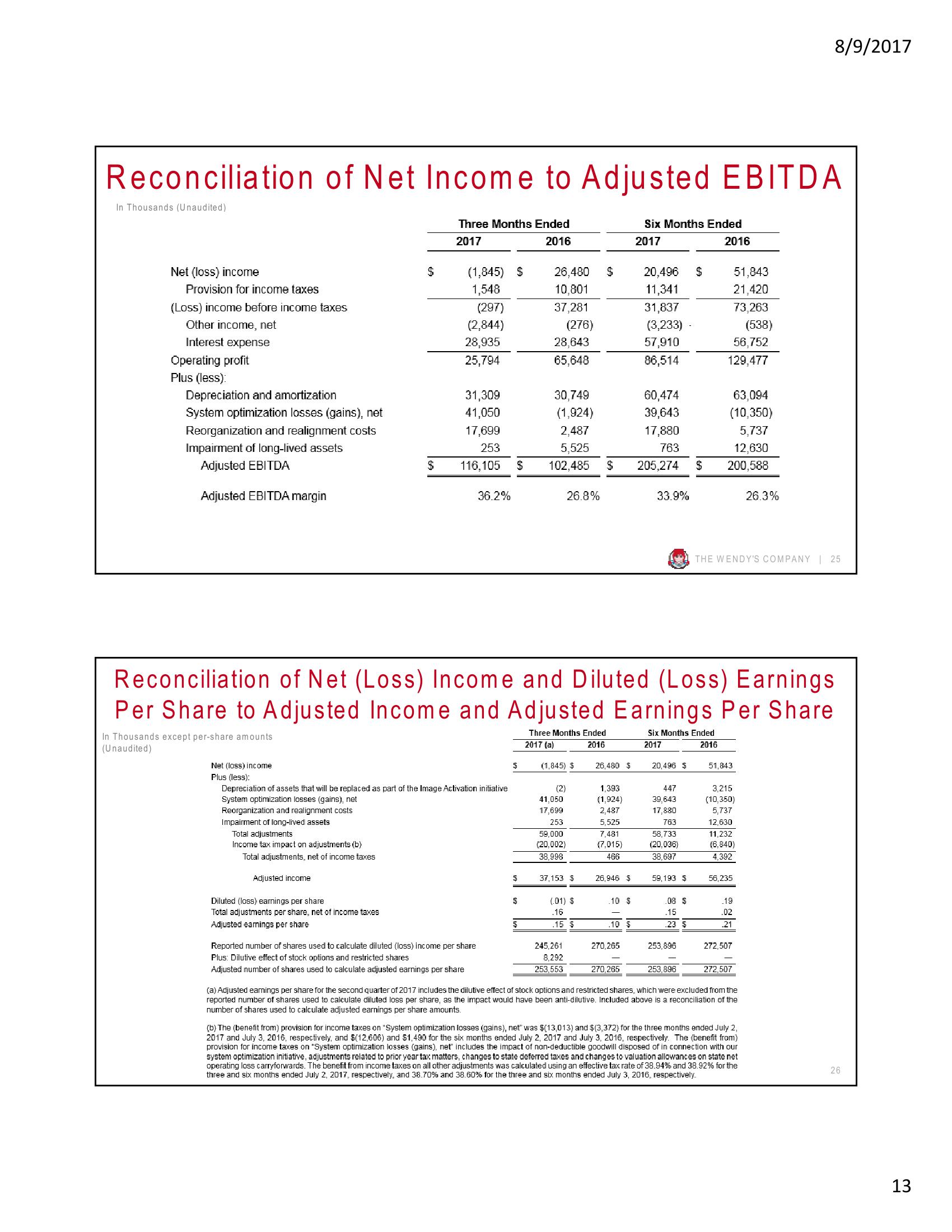

Reconciliation of Net Income to Adjusted EBITDA

In Thousands (Unaudited)

Net (loss) income

Provision for income taxes

(Loss) income before income taxes

Other income, net

Interest expense

Operating profit

Plus (less):

Depreciation and amortization

System optimization losses (gains), net

Reorganization and realignment costs

Impairment of long-lived assets

Adjusted EBITDA

Adjusted EBITDA margin

In Thousands except per-share amounts

(Unaudited)

Reorganization and realignment costs

Impairment of long-lived assets

Total adjustments

Income tax impact on adjustments (b)

Total adjustments, net of income taxes

$

Adjusted income

$

Diluted (loss) earnings per share

Total adjustments per share, net of income taxes

Adjusted earnings per share

Three Months Ended

2017

2016

(1,845) $

1,548

(297)

(2,844)

28,935

25,794

31,309

41,050

17,699

253

116,105

Net (loss) income

Plus (less):

Depreciation of assets that will be replaced as part of the Image Activation initiative

System optimization losses (gains), net

36.2%

Reported number of shares used to calculate diluted (loss) income per share

Plus: Dilutive effect of stock options and restricted shares

Adjusted number of shares used to calculate adjusted earnings per share

$

$

$

26,480

10,801

37,281

$

(276)

28,643

65,648

26.8%

(1,845) $

(2)

41,050

17,699

253

59,000

(20,002)

38,998

30,749

(1,924)

2,487

5,525

102,485 $ 205,274 $

Reconciliation of Net (Loss) Income and Diluted (Loss) Earnings

Per Share to Adjusted Income and Adjusted Earnings Per Share

Three Months Ended

2017 (a)

2016

Six Months Ended

2017

2016

37.153 $

245,261

8,292

253,553

$

(01) $

.16

.15 $

26,480 $

1.393

(1,924)

2,487

5,525

7,481

(7,015)

466

26,946 $

10 $

.10 $

Six Months Ended

2017

2016

270,265

20,496 $

11,341

31,837

(3,233)

57,910

86,514

270,265

60,474

39,643

17,880

763

33.9%

20,496 $

447

39,643

17,880

763

58,733

(20,036)

38,697

59,193 $

.08 $

.15

.23 $

253,896

253,896

56,752

129,477

51,843

21,420

73,263

63,094

(10,350)

5,737

12,630

200,588

51,843

THE WENDY'S COMPANY | 25

3,215

(10,350)

5,737

12,630

11,232

(6,840)

4,392

56,235

.19

.02

.21

(538)

272,507

272,507

(a) Adjusted earnings per share for the second quarter of 2017 includes the dilutive effect of stock options and restricted shares, which were excluded from the

reported number of shares used to calculate diluted loss per share, as the impact would have been anti-dilutive. Included above is a reconciliation of the

number of shares used to calculate adjusted earnings per share amounts.

8/9/2017

26.3%

(b) The (benefit from) provision for income taxes on "System optimization losses (gains), net was $(13,013) and $(3,372) for the three months ended July 2,

2017 and July 3, 2016, respectively, and $(12,606) and $1,490 for the six months ended July 2, 2017 and July 3, 2016, respectively. The (benefit from)

provision for income taxes on "System optimization losses (gains), net includes the impact of non-deductible goodwill disposed of in connection with our

system optimization initiative, adjustments related to prior year tax matters, changes to state deferred taxes and changes to valuation allowances on state net

operating loss carryforwards. The benefit from income taxes on all other adjustments was calculated using an effective tax rate of 38.94% and 38.92% for the

three and six months ended July 2, 2017, respectively, and 38.70% and 38.60% for the three and six months ended July 3, 2016, respectively.

26

13View entire presentation