Shopify Results Presentation Deck

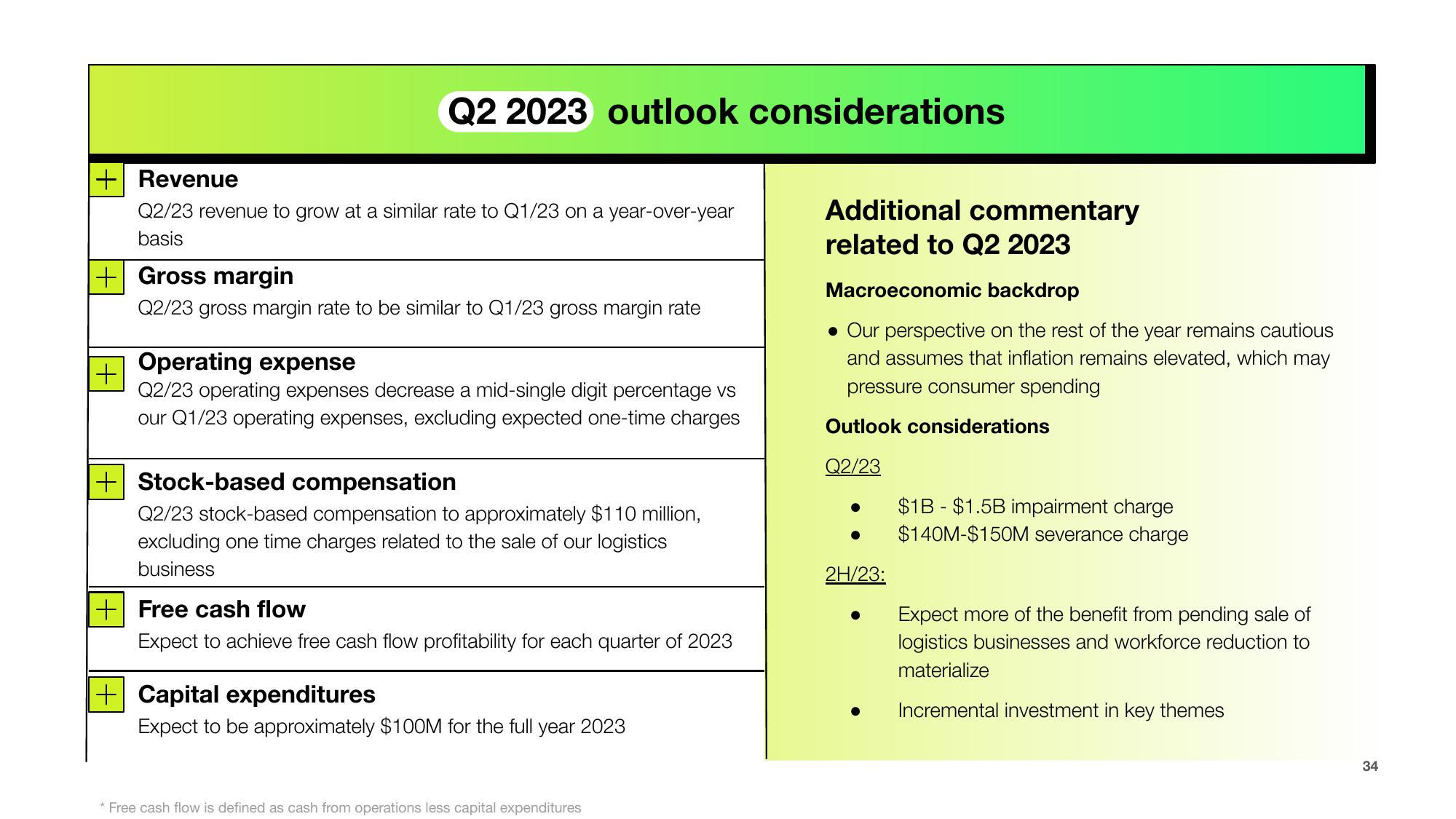

Q2 2023 outlook considerations

Revenue

Q2/23 revenue to grow at a similar rate to Q1/23 on a year-over-year

basis

+ Gross margin

Q2/23 gross margin rate to be similar to Q1/23 gross margin rate

Operating expense

Q2/23 operating expenses decrease a mid-single digit percentage vs

our Q1/23 operating expenses, excluding expected one-time charges

+ Stock-based compensation

Q2/23 stock-based compensation to approximately $110 million,

excluding one time charges related to the sale of our logistics

business

+ Free cash flow

Expect to achieve free cash flow profitability for each quarter of 2023

+ Capital expenditures

Expect to be approximately $100M for the full year 2023

* Free cash flow is defined as cash from operations less capital expenditures

Additional commentary

related to Q2 2023

Macroeconomic backdrop

• Our perspective on the rest of the year remains cautious

and assumes that inflation remains elevated, which may

pressure consumer spending

Outlook considerations

Q2/23

2H/23:

$1B $1.5B impairment charge

$140M-$150M severance charge

Expect more of the benefit from pending sale of

logistics businesses and workforce reduction to

materialize

Incremental investment in key themes

34View entire presentation