Despegar Results Presentation Deck

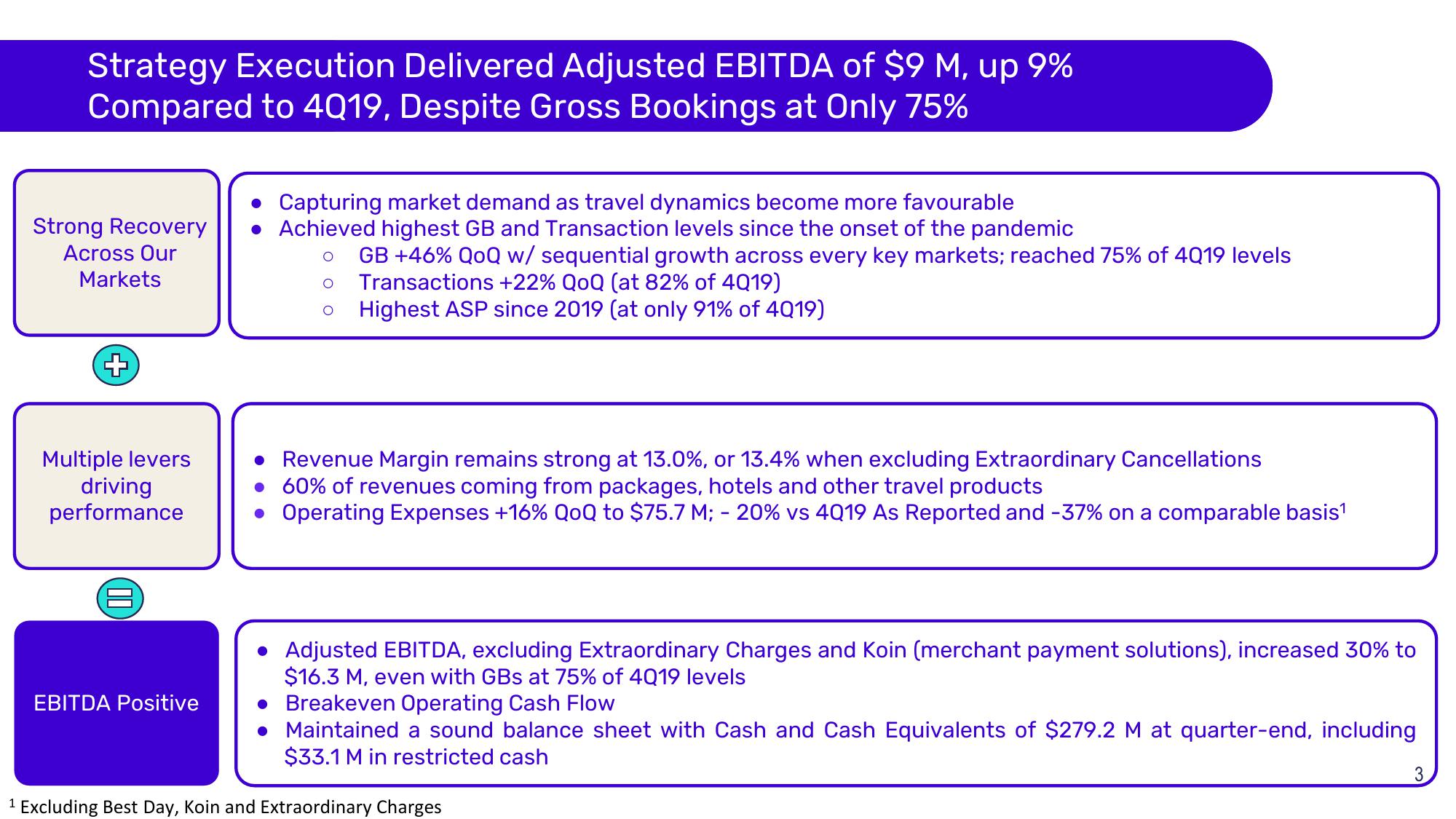

Strategy Execution Delivered Adjusted EBITDA of $9 M, up 9%

Compared to 4Q19, Despite Gross Bookings at Only 75%

Strong Recovery

Across Our

Markets

+

Multiple levers

driving

performance

EBITDA Positive

• Capturing market demand as travel dynamics become more favourable

Achieved highest GB and Transaction levels since the onset of the pandemic

O

GB +46% QOQ w/ sequential growth across every key markets; reached 75% of 4Q19 levels

O Transactions +22% QOQ (at 82% of 4Q19)

O Highest ASP since 2019 (at only 91% of 4019)

Revenue Margin remains strong at 13.0%, or 13.4% when excluding Extraordinary Cancellations

• 60% of revenues coming from packages, hotels and other travel products

• Operating Expenses +16% QoQ to $75.7 M; - 20% vs 4019 As Reported and -37% on a comparable basis¹

Adjusted EBITDA, excluding Extraordinary Charges and Koin (merchant payment solutions), increased 30% to

$16.3 M, even with GBs at 75% of 4019 levels

• Breakeven Operating Cash Flow

•

Maintained a sound balance sheet with Cash and Cash Equivalents of $279.2 M at quarter-end, including

$33.1 M in restricted cash

1 Excluding Best Day, Koin and Extraordinary Charges

3View entire presentation