Pershing Square Activist Presentation Deck

Exceptional Returns on New Unit Capex

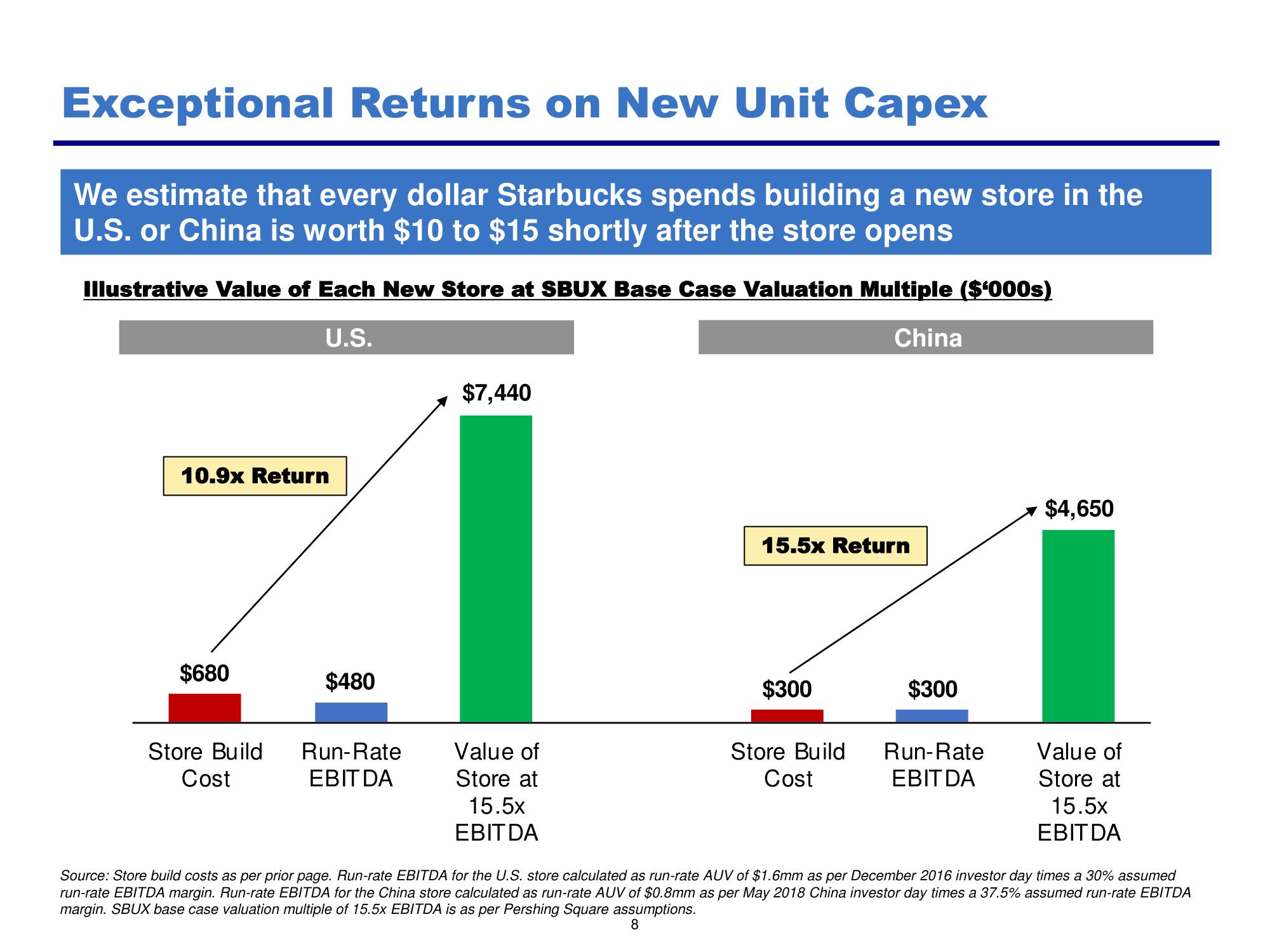

We estimate that every dollar Starbucks spends building a new store in the

U.S. or China is worth $10 to $15 shortly after the store opens

Illustrative Value of Each New Store at SBUX Base Case Valuation Multiple ($¹000s)

U.S.

China

10.9x Return

$680

Store Build

Cost

$480

Run-Rate

EBIT DA

$7,440

Value of

Store at

15.5x

EBITDA

15.5x Return

$300

Store Build

Cost

$300

Run-Rate

EBITDA

$4,650

Value of

Store at

15.5x

EBITDA

Source: Store build costs as per prior page. Run-rate EBITDA for the U.S. store calculated as run-rate AUV of $1.6mm as per December 2016 investor day times a 30% assumed

run-rate EBITDA margin. Run-rate EBITDA for the China store calculated as run-rate AUV of $0.8mm as per May 2018 China investor day times a 37.5% assumed run-rate EBITDA

margin. SBUX base case valuation multiple of 15.5x EBITDA is as per Pershing Square assumptions.

8View entire presentation