OpenText Investor Presentation Deck

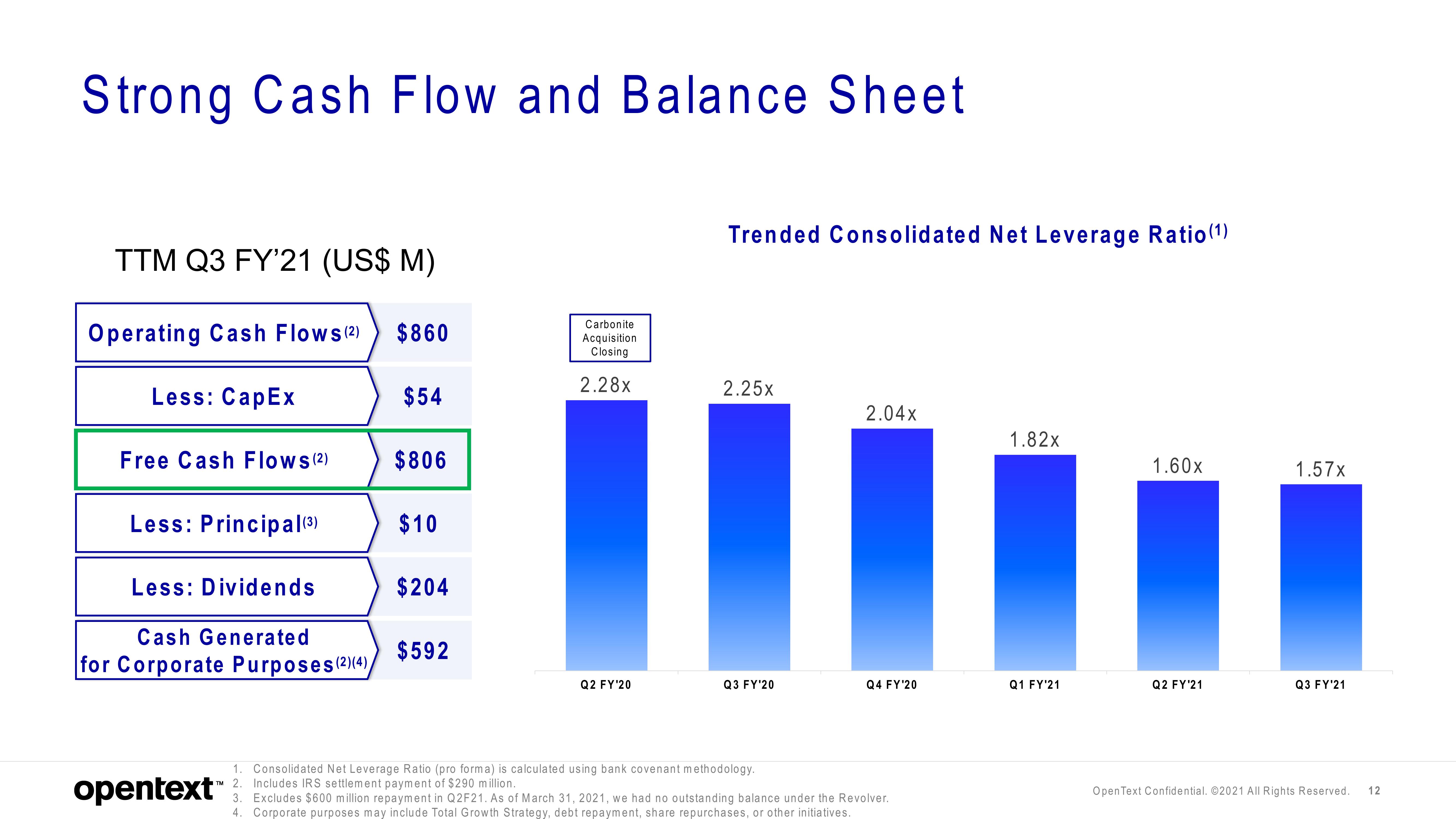

Strong Cash Flow and Balance Sheet

TTM Q3 FY'21 (US$ M)

Operating Cash Flows (2) $860

$54

Less: CapEx

Free Cash Flows (²)

Less: Principal (³)

Less: Dividends

Cash Gener ted

for Corporate Purposes (2)(4)

opentext

$806

$10

$204

$592

Carbonite

Acquisition.

Closing

2.28x

Q2 FY'20

Trended Consolidated Net Leverage Ratio (¹)

2.25X

Q3 FY'20

2.04x

Q4 FY'20

1. Consolidated Net Leverage Ratio (pro forma) is calculated using bank covenant methodology.

TM 2 Includes IRS settlement payment of $290 million.

3. Excludes $600 million repayment in Q2F21. As of March 31, 2021, we had no outstanding balance under the Revolver.

4. Corporate purposes may include Total Growth Strategy, debt repayment, share repurchases, or other initiatives.

1.82x

Q1 FY'21

1.60x

Q2 FY'21

1.57x

Q3 FY'21

Open Text Confidential. ©2021 All Rights Reserved. 12View entire presentation