Pershing Square Activist Presentation Deck

Starbucks ("SBUX")

TM

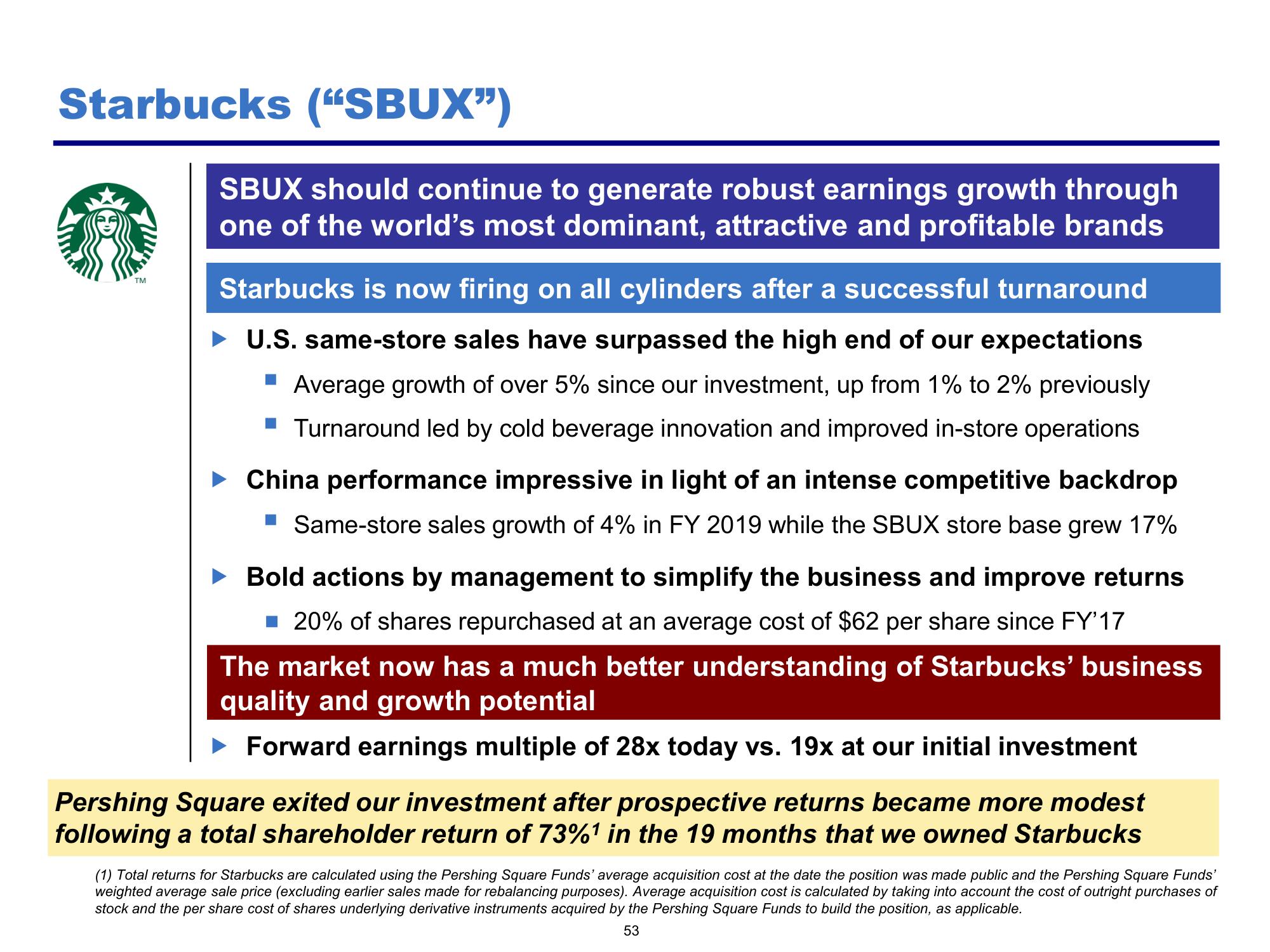

SBUX should continue to generate robust earnings growth through

one of the world's most dominant, attractive and profitable brands

Starbucks is now firing on all cylinders after a successful turnaround

► U.S. same-store sales have surpassed the high end of our expectations

Average growth of over 5% since our investment, up from 1% to 2% previously

Turnaround led by cold beverage innovation and improved in-store operations

► China performance impressive in light of an intense competitive backdrop

▪ Same-store sales growth of 4% in FY 2019 while the SBUX store base grew 17%

Bold actions by management to simplify the business and improve returns

20% of shares repurchased at an average cost of $62 per share since FY'17

The market now has a much better understanding of Starbucks' business

quality and growth potential

Forward earnings multiple of 28x today vs. 19x at our initial investment

Pershing Square exited our investment after prospective returns became more modest

following a total shareholder return of 73%¹ in the 19 months that we owned Starbucks

(1) Total returns for Starbucks are calculated using the Pershing Square Funds' average acquisition cost at the date the position was made public and the Pershing Square Funds'

weighted average sale price (excluding earlier sales made for rebalancing purposes). Average acquisition cost is calculated by taking into account the cost of outright purchases of

stock and the per share cost of shares underlying derivative instruments acquired by the Pershing Square Funds to build the position, as applicable.

53View entire presentation