Mondee Investor Update

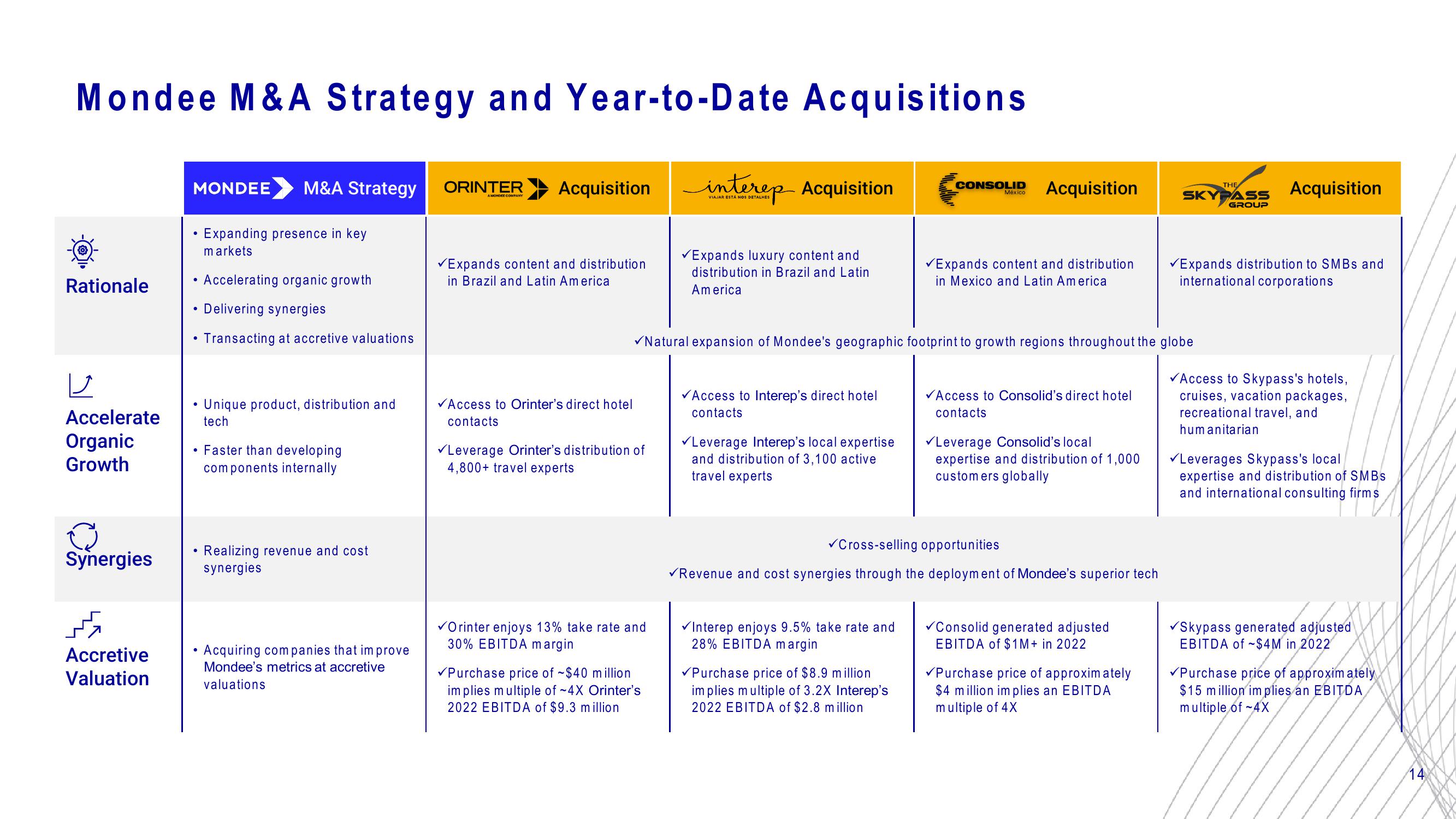

Mondee M&A Strategy and Year-to-Date Acquisitions

Rationale

U

Accelerate

Organic

Growth

Synergies

کر

Accretive

Valuation

MONDEE M&A Strategy

• Expanding presence in key

markets

• Accelerating organic growth

• Delivering synergies

• Transacting at accretive valuations

●

Unique product, distribution and

tech

Faster than developing

components internally

Realizing revenue and cost

synergies

Acquiring companies that improve

Mondee's metrics at accretive

valuations

ORINTER

AMONDEE COMPANY

Acquisition interep Acquisition

✓Expands content and distribution

in Brazil and Latin America

✓Access to Orinter's direct hotel

contacts

✓Leverage Orinter's distribution of

4,800+ travel experts

✓Orinter enjoys 13% take rate and

30% EBITDA margin

VIAJAR

✓Purchase price of ~$40 million

implies multiple of ~4X Orinter's

2022 EBITDA of $9.3 million

✓Expands luxury content and

distribution in Brazil and Latin

America

✓Access to Interep's direct hotel

contacts

✓Leverage Interep's local expertise

and distribution of 3,100 active

travel experts

✓Natural expansion of Mondee's geographic footprint to growth regions throughout the globe

CONSOLID

✔Interep enjoys 9.5% take rate and

28% EBITDA margin

México

✓Purchase price of $8.9 million

implies multiple of 3.2X Interep's

2022 EBITDA of $2.8 million

Acquisition

✓Expands content and distribution

in Mexico and Latin America

Access to Consolid's direct hotel

contacts

✓Cross-selling opportunities

✔Revenue and cost synergies through the deployment of Mondee's superior tech

✓Leverage Consolid's local

expertise and distribution of 1,000

customers globally

✓Consolid generated adjusted

EBITDA of $1M+ in 2022

THE

SKYPASS

✓Purchase price of approximately

$4 million implies an EBITDA

multiple of 4X

GROUP

Acquisition

✓Expands distribution to SMBs and

international corporations

✓Access to Skypass's hotels,

cruises, vacation packages,

recreational travel, and

humanitarian

✓Leverages Skypass's local

expertise and distribution of SMBs

and international consulting firms

✔Skypass generated adjusted

EBITDA of $4M in 2022

✓Purchase price of approximately

$15 million implies an EBITDA

multiple of ~4X

14View entire presentation