Bed Bath & Beyond Results Presentation Deck

I

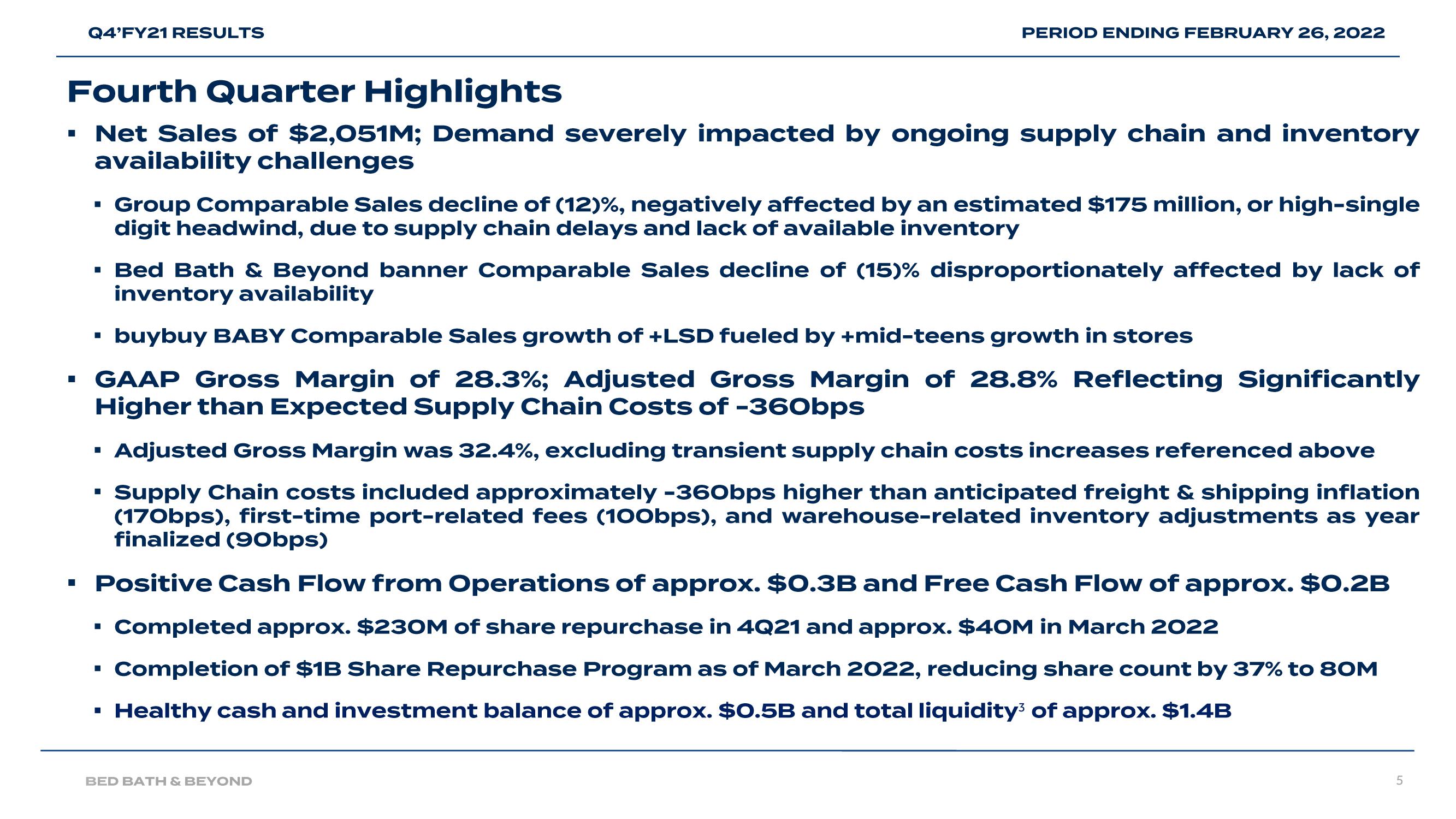

Fourth Quarter Highlights

Net Sales of $2,051M; Demand severely impacted by ongoing supply chain and inventory

availability challenges

■

Q4'FY21 RESULTS

■

I

▪ Group Comparable Sales decline of (12)%, negatively affected by an estimated $175 million, or high-single

digit headwind, due to supply chain delays and lack of available inventory

▪ Bed Bath & Beyond banner Comparable Sales decline of (15)% disproportionately affected by lack of

inventory availability

buybuy BABY Comparable Sales growth of +LSD fueled by +mid-teens growth in stores

GAAP Gross Margin of 28.3%; Adjusted Gross Margin of 28.8% Reflecting Significantly

Higher than Expected Supply Chain Costs of -360bps

■

PERIOD ENDING FEBRUARY 26, 2022

■

Adjusted Gross Margin was 32.4%, excluding transient supply chain costs increases referenced above

I

▪ Supply Chain costs included approximately -360bps higher than anticipated freight & shipping inflation

(170bps), first-time port-related fees (100bps), and warehouse-related inventory adjustments as year

finalized (90bps)

Positive Cash Flow from Operations of approx. $0.3B and Free Cash Flow of approx. $0.2B

Completed approx. $230M of share repurchase in 4Q21 and approx. $40M in March 2022

Completion of $1B Share Repurchase Program as of March 2022, reducing share count by 37% to 80M

Healthy cash and investment balance of approx. $0.5B and total liquidity of approx. $1.4B

I

I

BED BATH & BEYOND

5View entire presentation