OpenText Investor Presentation Deck

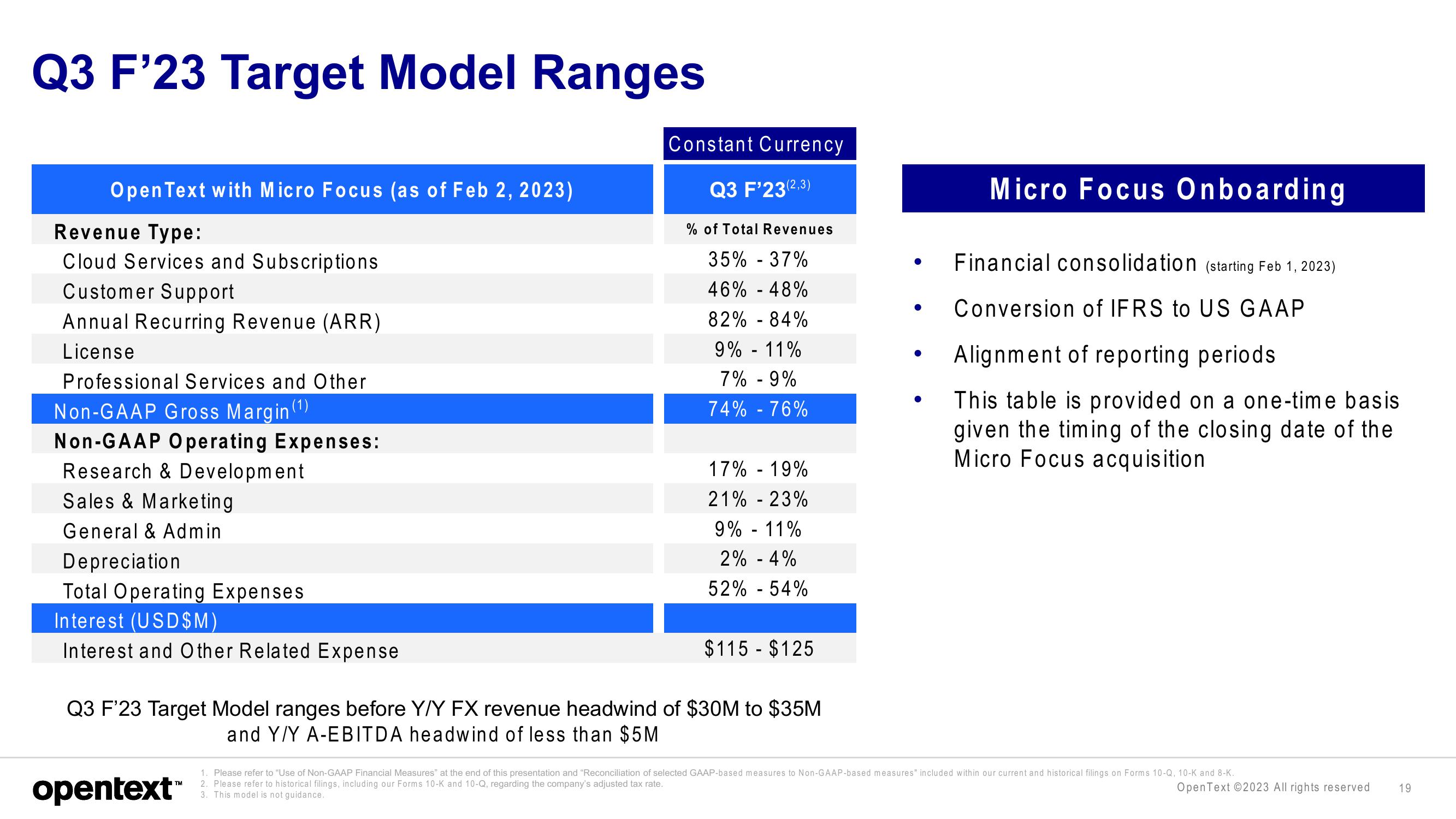

Q3 F'23 Target Model Ranges

Open Text with Micro Focus (as of Feb 2, 2023)

Revenue Type:

Cloud Services and Subscriptions

Customer Support

Annual Recurring Revenue (ARR)

License

Professional Services and Other

Non-GAAP Gross Margin(¹)

Non-GAAP Operating Expenses:

Research & Development

Sales & Marketing

General & Admin

Depreciation

Total Operating Expenses

Interest (USD$M)

Interest and Other Related Expense

Constant Currency

Q3 F'23(2,3)

% of Total Revenues

35% -37%

46% -48%

82% - 84%

9% -11%

7% -9%

74% -76%

opentext™

17% -19%

21% -23%

9% -11%

2% -4%

52% -54%

$115 - $125

Q3 F'23 Target Model ranges before Y/Y FX revenue headwind of $30M to $35M

and Y/Y A-EBITDA headwind of less than $5M

Micro Focus Onboarding

Financial consolidation (starting Feb 1, 2023)

Conversion of IFRS to US GAAP

Alignment of reporting periods

This table is provided on a one-time basis

given the timing of the closing date of the

Micro Focus acquisition

1. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

2. Please refer to historical filings, including our Forms 10-K and 10-Q, regarding the company's adjusted tax rate.

3. This model is not guidance.

OpenText ©2023 All rights reserved

19View entire presentation