Pershing Square Activist Presentation Deck

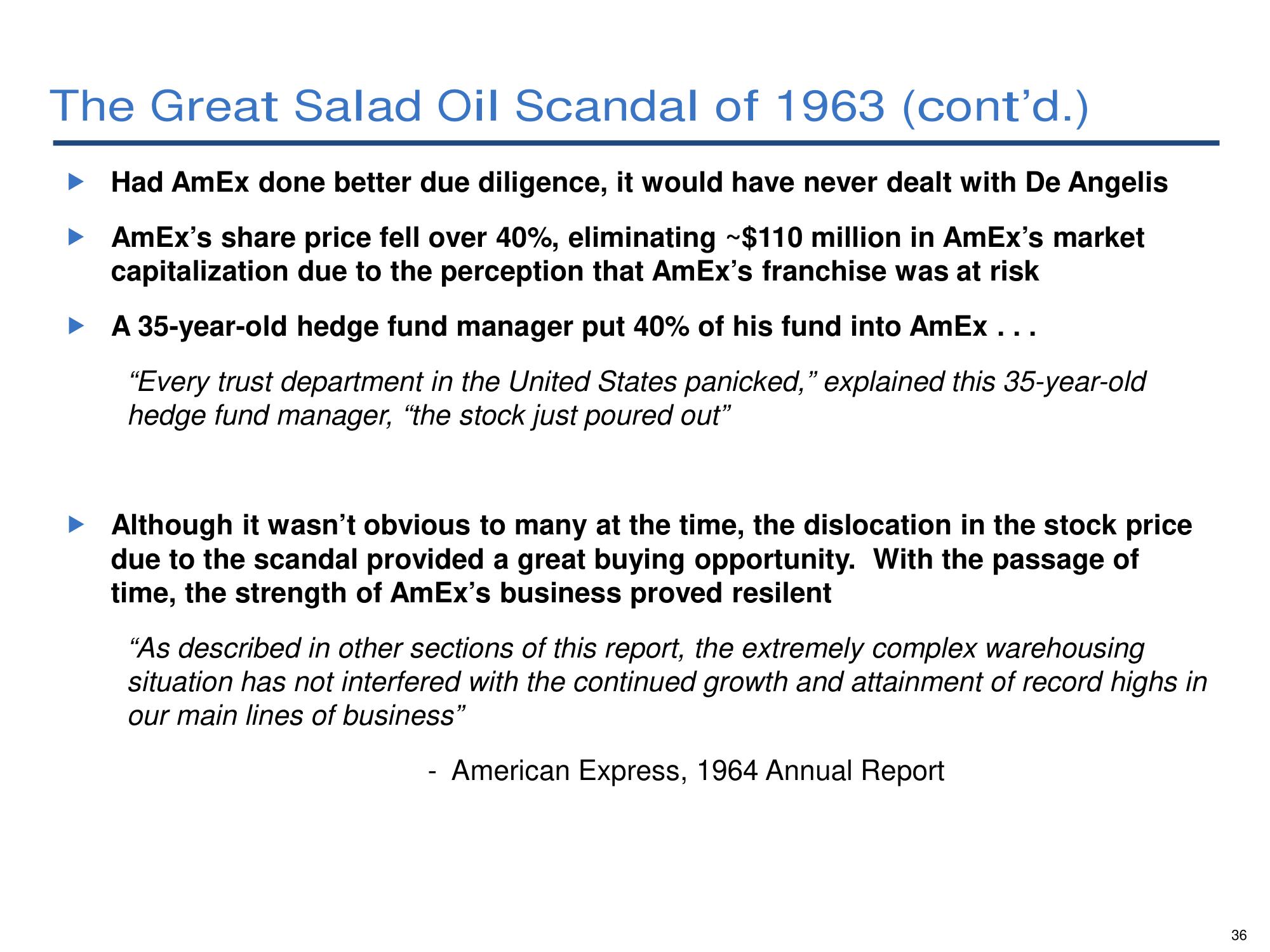

The Great Salad Oil Scandal of 1963 (cont'd.)

Had AmEx done better due diligence, it would have never dealt with De Angelis

AmEx's share price fell over 40%, eliminating ~$110 million in AmEx's market

capitalization due to the perception that AmEx's franchise was at risk

▸ A 35-year-old hedge fund manager put 40% of his fund into AmEx...

"Every trust department in the United States panicked," explained this 35-year-old

hedge fund manager, "the stock just poured out"

► Although it wasn't obvious to many at the time, the dislocation in the stock price

due to the scandal provided a great buying opportunity. With the passage of

time, the strength of AmEx's business proved resilent

"As described in other sections of this report, the extremely complex warehousing

situation has not interfered with the continued growth and attainment of record highs in

our main lines of business"

- American Express, 1964 Annual Report

36View entire presentation