Pershing Square Activist Presentation Deck

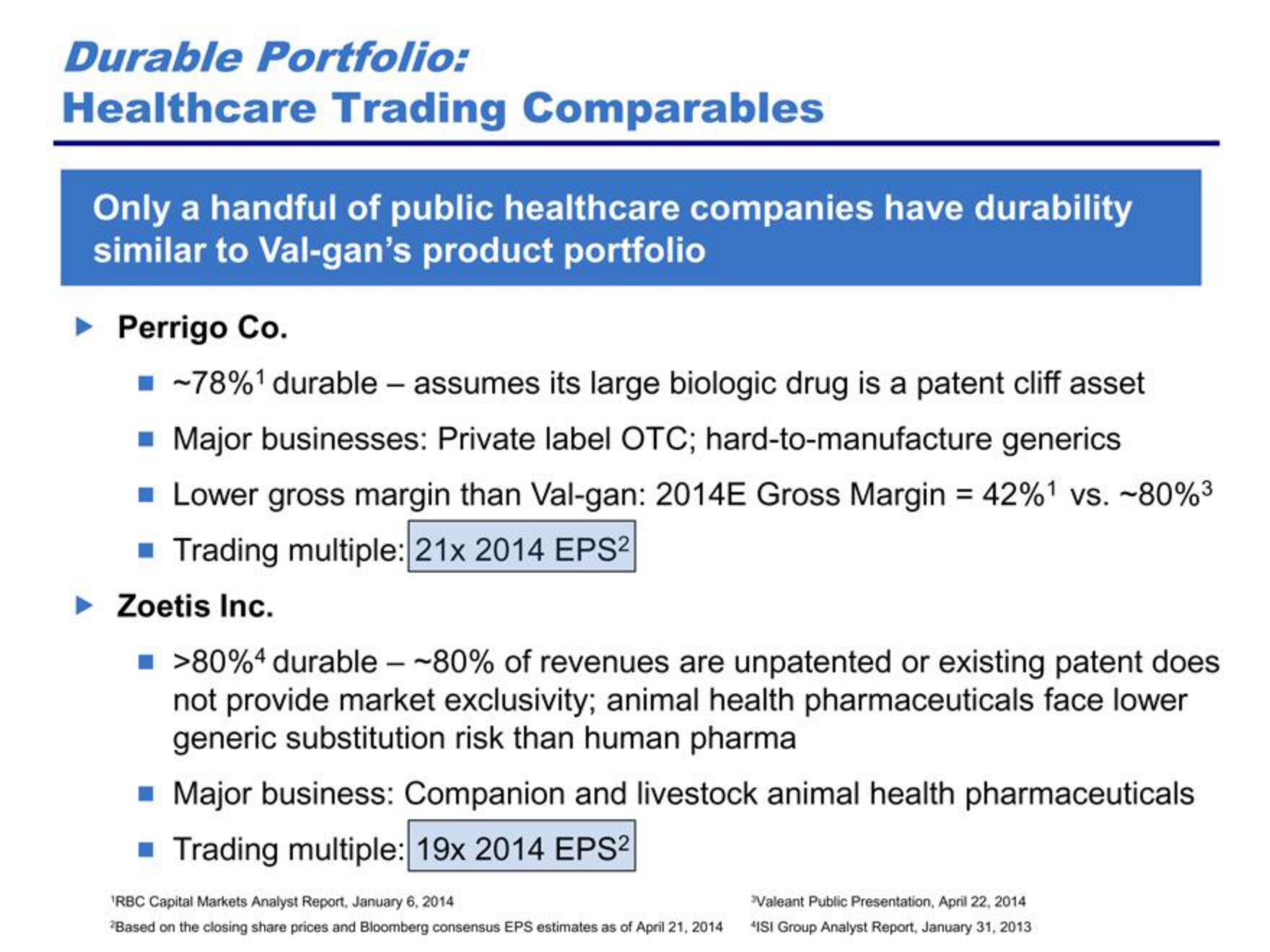

Durable Portfolio:

Healthcare Trading Comparables

Only a handful of public healthcare companies have durability

similar to Val-gan's product portfolio

► Perrigo Co.

■ -78%¹ durable - assumes its large biologic drug is a patent cliff asset

■ Major businesses: Private label OTC; hard-to-manufacture generics

■ Lower gross margin than Val-gan: 2014E Gross Margin = 42% ¹ vs. ~80%³

■ Trading multiple: 21x 2014 EPS²

► Zoetis Inc.

■ >80%4 durable ~80% of revenues are unpatented or existing patent does

not provide market exclusivity; animal health pharmaceuticals face lower

generic substitution risk than human pharma

■ Major business: Companion and livestock animal health pharmaceuticals

■ Trading multiple: 19x 2014 EPS²

¹RBC Capital Markets Analyst Report, January 6, 2014

*Based on the closing share prices and Bloomberg consensus EPS estimates as of April 21, 2014

*Valeant Public Presentation, April 22, 2014

"ISI Group Analyst Report, January 31, 2013View entire presentation