Pershing Square Activist Presentation Deck

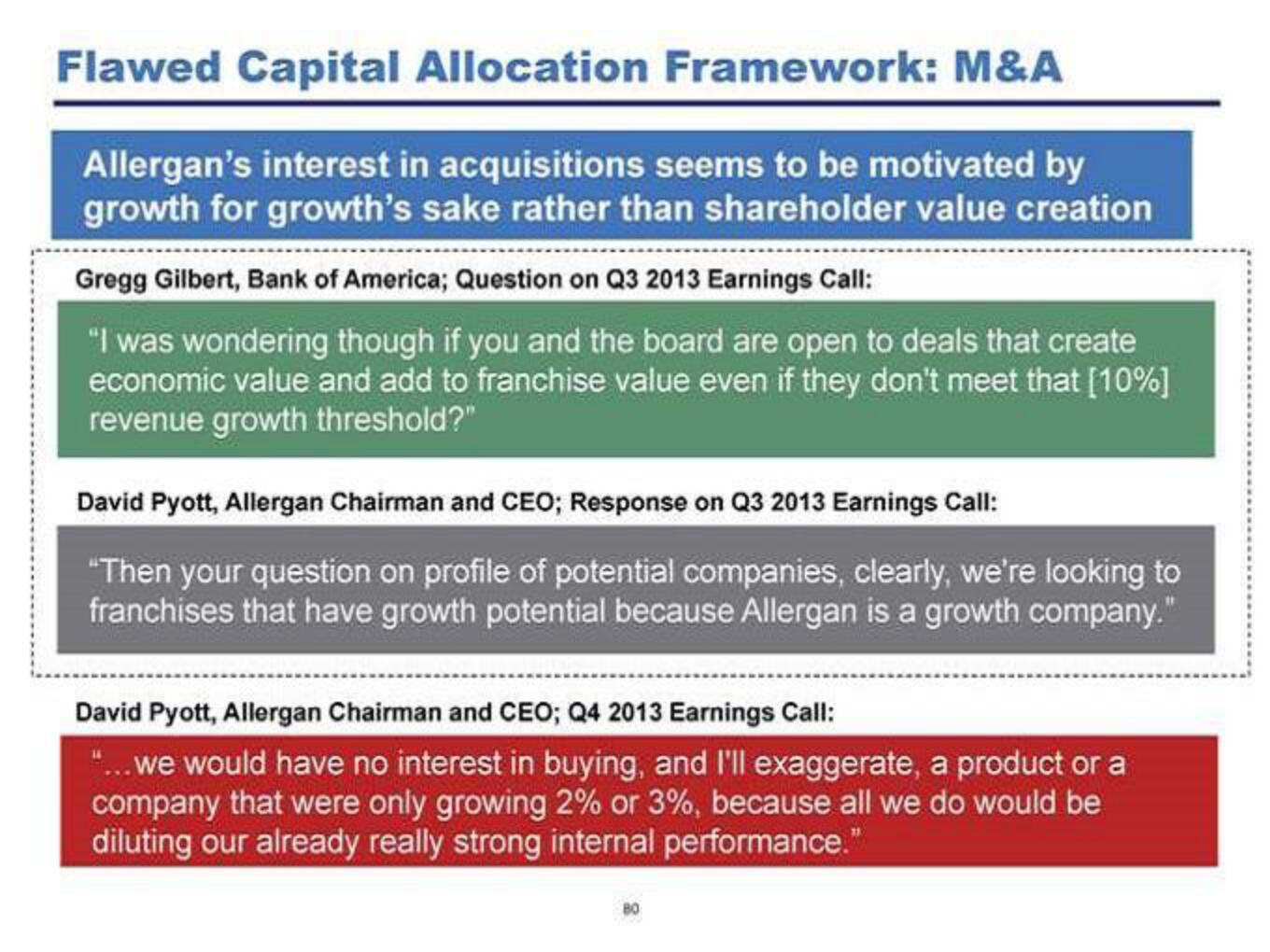

Flawed Capital Allocation Framework: M&A

Allergan's interest in acquisitions seems to be motivated by

growth for growth's sake rather than shareholder value creation

Gregg Gilbert, Bank of America; Question on Q3 2013 Earnings Call:

"I was wondering though if you and the board are open to deals that create

economic value and add to franchise value even if they don't meet that [10%]

revenue growth threshold?"

David Pyott, Allergan Chairman and CEO; Response on Q3 2013 Earnings Call:

"Then your question on profile of potential companies, clearly, we're looking to

franchises that have growth potential because Allergan is a growth company."

David Pyott, Allergan Chairman and CEO; Q4 2013 Earnings Call:

"... we would have no interest in buying, and I'll exaggerate, a product or a

company that were only growing 2% or 3%, because all we do would be

diluting our already really strong internal performance."View entire presentation