Grab Results Presentation Deck

Business Update

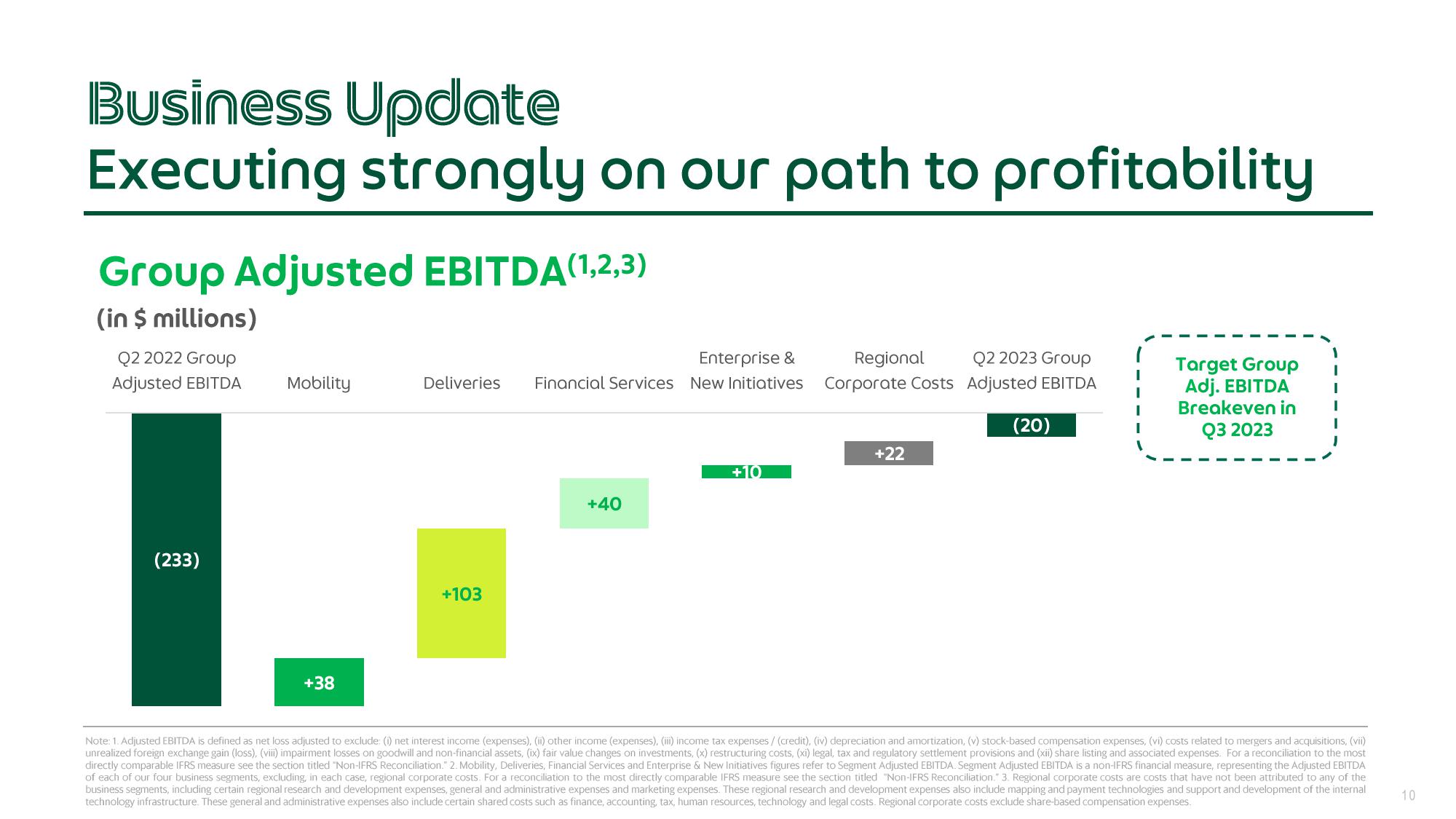

Executing strongly on our path to profitability

Group Adjusted EBITDA(1,2,3)

(in $ millions)

Q2 2022 Group

Adjusted EBITDA

(233)

Mobility

+38

Enterprise &

Regional

Q2 2023 Group

Deliveries Financial Services New Initiatives Corporate Costs Adjusted EBITDA

+103

+40

+10

+22

(20)

Target Group

Adj. EBITDA

Breakeven in

Q3 2023

Note: 1. Adjusted EBITDA is defined as net loss adjusted to exclude: (1) net interest income (expenses), (ii) other income (expenses), (iii) income tax expenses/ (credit), (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii)

unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses. For a reconciliation to the most

directly comparable IFRS measure see the section titled "Non-IFRS Reconciliation." 2. Mobility, Deliveries, Financial Services and Enterprise & New Initiatives figures refer to Segment Adjusted EBITDA. Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA

of each of our four business segments, excluding, in each case, regional corporate costs. For a reconciliation to the most directly comparable IFRS measure see the section titled "Non-IFRS Reconciliation." 3. Regional corporate costs are costs that have not been attributed to any of the

business segments, including certain regional research and development expenses, general and administrative expenses and marketing expenses. These regional research and development expenses also include mapping and payment technologies and support and development of the internal

technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses.

10View entire presentation