Hydrafacial Investor Presentation Deck

NET SALES

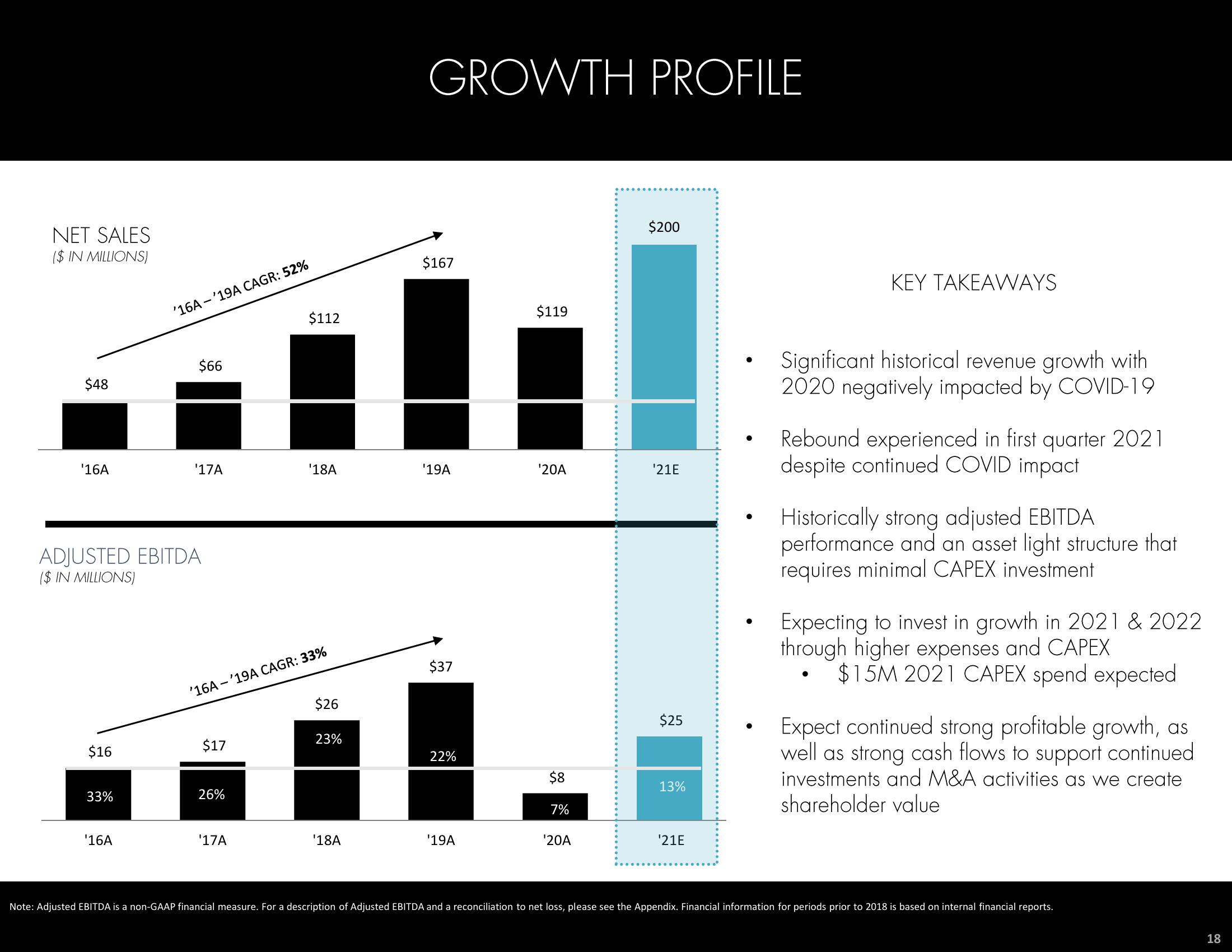

($ IN MILLIONS)

$48

'16A

$16

33%

'16A-'19A CAGR: 52%

ADJUSTED EBITDA

($ IN MILLIONS)

'16A

$66

'17A

$17

'16A-'19A CAGR: 33%

26%

$112

'17A

'18A

$26

23%

'18A

GROWTH PROFILE

$167

'19A

$37

22%

'19A

$119

¹20A

$8

7%

'20A

$200

'21E

13%

¹21E

●

●

●

●

KEY TAKEAWAYS

Significant historical revenue growth with

2020 negatively impacted by COVID-19

Rebound experienced in first quarter 2021

despite continued COVID impact

Historically strong adjusted EBITDA

performance and an asset light structure that

requires minimal CAPEX investment

Expecting to invest in growth in 2021 & 2022

through higher expenses and CAPEX

$15M 2021 CAPEX spend expected

Expect continued strong profitable growth, as

well as strong cash flows to support continued

investments and M&A activities as we create

shareholder value

Note: Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA and a reconciliation to net loss, please see the Appendix. Financial information for periods prior to 2018 is based on internal financial reports.

18View entire presentation