Barclays Investment Banking Pitch Book

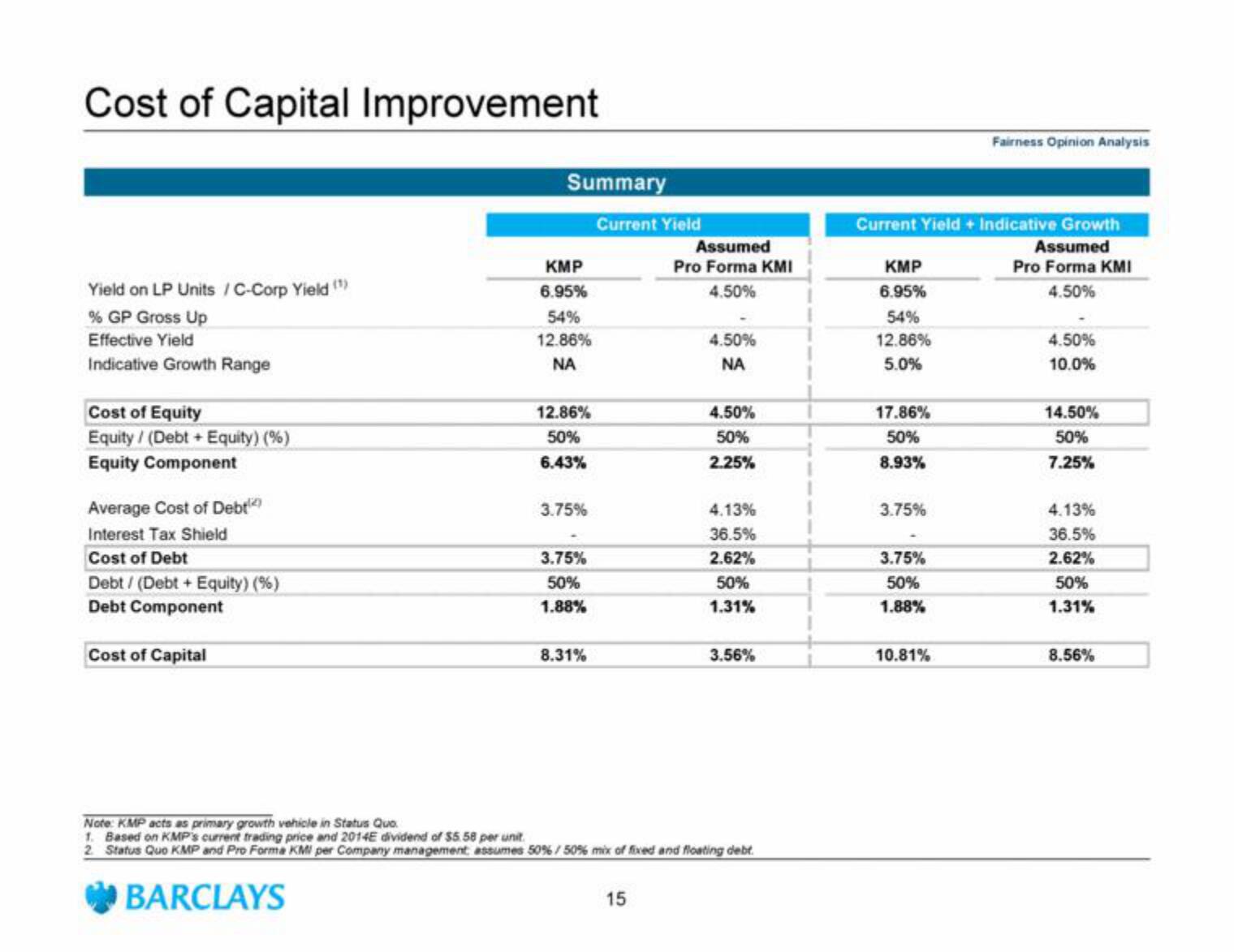

Cost of Capital Improvement

Yield on LP Units / C-Corp Yield (¹)

% GP Gross Up

Effective Yield

Indicative Growth Range

Cost of Equity

Equity / (Debt+ Equity) (%)

Equity Component

Average Cost of Debt

Interest Tax Shield

Cost of Debt

Debt / (Debt +Equity) (%)

Debt Component

Cost of Capital

Summary

BARCLAYS

KMP

6.95%

54%

12.86%

ΝΑ

12.86%

50%

6.43%

3.75%

3.75%

50%

1.88%

8.31%

Current Yield

Assumed

Pro Forma KMI

4.50%

15

4.50%

ΝΑ

4.50%

50%

2.25%

4.13%

36.5%

2.62%

50%

1.31%

Note: KMP acts as primary growth vehicle in Status Quo

1. Based on KMP's current trading price and 2014E dividend of $5.58 per unit.

2. Status Quo KMP and Pro Forma KMI per Company management assumes 50% / 50% mix of fixed and floating debt.

3.56%

Current Yield + Indicative Growth

Assumed

Pro Forma KMI

4.50%

KMP

6.95%

54%

12.86%

5.0%

17.86%

50%

8.93%

3.75%

3.75%

50%

1.88%

Fairness Opinion Analysis

10.81%

4.50%

10.0%

14.50%

50%

7.25%

4.13%

36.5%

2.62%

50%

1.31%

8.56%View entire presentation